Gold and the Euro Tragedy, Iraq 3.0, Ukraine Conflict Three Ring Circus

Commodities / Gold and Silver 2015 Feb 27, 2015 - 03:39 PM GMTBy: DeviantInvestor

A three ring circus is performing – to entertain and impoverish the western world.

A three ring circus is performing – to entertain and impoverish the western world.

Ring # 1: The Euro tragedy is “extending and pretending” into a Greek drama.

Ring # 2: Iraq 3.0 is in beta test mode based on weapons of mass propaganda.

Ring # 3: The conflict in Ukraine is performing flips followed by flops.

Aiding and abetting the circus acts are the global fiat currencies – the dollars, euros, yen, rubles, and what-have-you currencies that central banks print in excess to create the illusion of wealth and solvency. We have our devaluing fiat currencies or we can invest in a safety net – gold. It should be an easy choice!

Devaluing fiat currencies:

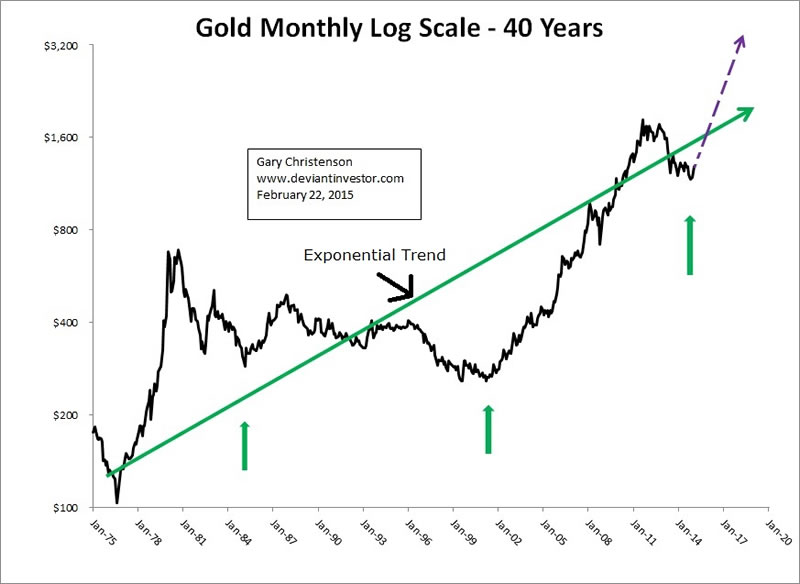

Choose real money:

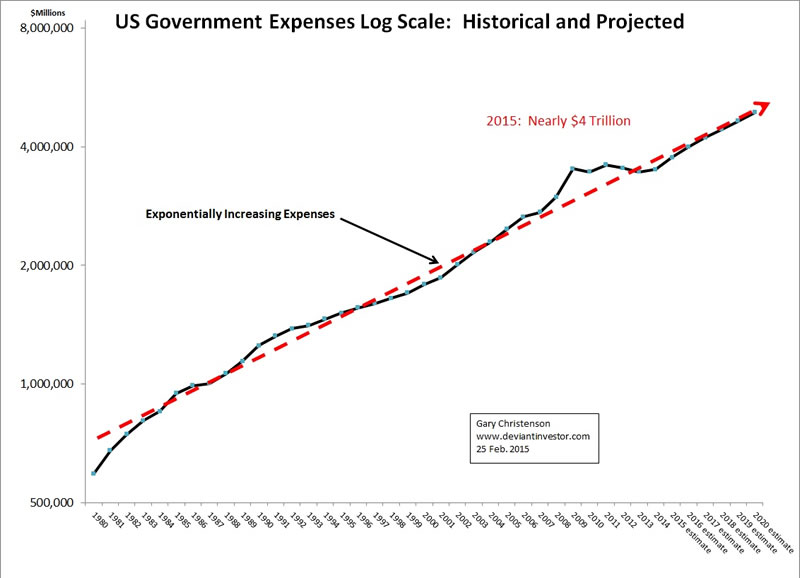

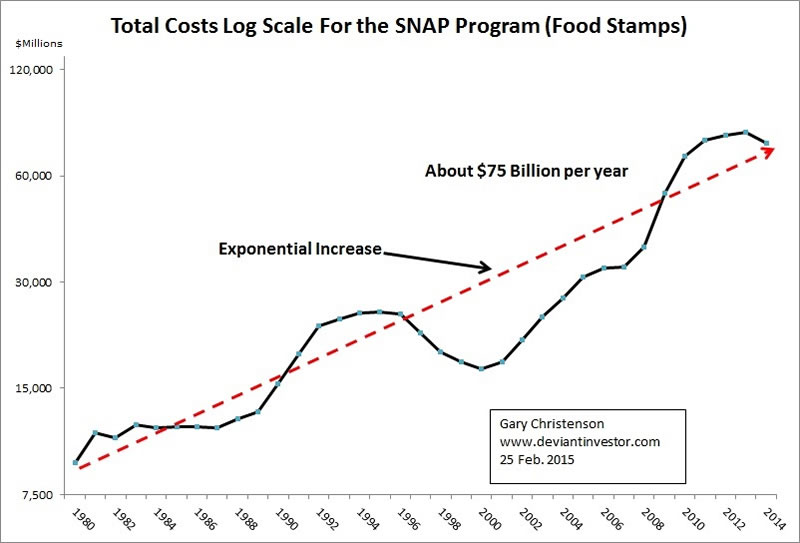

To help choose between devaluing currencies and real money, examine these log scale graphs and find their common elements.

All three graphs show:

- Long-term well established trends

- Exponential increases over 30+ years

- The likely future.

The official US gold hoard is supposedly 260,000,000 ounces which represents about $300 billion dollars in current value. The SNAP program spends that much in about four years. The US government spends that much in less than 30 days. I fully expect US government expenses will increase and I fully expect China, Russia and India will accumulate as much gold bullion as possible at these inexpensive prices.

- How can gold prices remain low when US government expenses and debt increase exponentially, thereby causing the dollar to devalue?

- Will the next recession and war decrease expenses and debt?

- Will Asia dump their gold in return for fiat dollars, euros, or yen?

CONCLUSIONS:

- The US government has consistently increased its expenses from 1980 as shown and since 1913, not shown.

- SNAP (food stamp) program costs increased erratically and inevitably. This program alone consumes the entire official US gold hoard every four years. Really?

- Gold prices have increased erratically and exponentially since 1971. Given the exponentially increasing government debt and ongoing military adventures, gold prices will inevitably reflect the declining value of fiat currencies and rally much higher.

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.