Investor Profits from China 2,000-Year Unstoppable Trends

Companies / China Stocks Feb 25, 2015 - 12:05 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: What if I told you that a two-millennia old economic pattern is about to reassert itself – and you can profit from not one but two Unstoppable Trends by getting in today?

Keith Fitz-Gerald writes: What if I told you that a two-millennia old economic pattern is about to reassert itself – and you can profit from not one but two Unstoppable Trends by getting in today?

Better yet, what if pundits were almost universally writing off what I am about to share with you, further clearing the way for savvy investors to enjoy the earliest windfalls and potentially the biggest gains, too?

Much of the media and many of the mainstream investment houses are ignoring this country. The IMF and Morgan Stanley are both forecasting dismal GDP growth in the next few years. Just last month, Bloomberg labeled its markets as being in an “amateur hour” phase.

So why is it that the elite are piling in?

For the same reason I’m telling you that it’ll be a winner – because they know like we do that the hoy-paloi is overlooking some key numbers – not to mention basic history. For 18 of the last 20 centuries, this juggernaut has been the world’s largest economy. And with more than 7% growth last year, it’s outpacing the U.S. to reclaim the title. Again.

What we’re seeing is a seismic shift not just of global power but capital – and that will mean enormous profits for people who see it ahead of time.

Analysts are getting it wrong. Now you can profit before they have time to wake up.

Here’s what’s really going on in the world’s fastest-growing economy.

What Analysts Don’t Get About China

Most analysts are absolutely convinced that China’s a nation on the verge of collapse.

Chances are you’ve checked out the ghost city videos on YouTube and heard well-known professional short trader Jim Chanos (among others) going on about what a wreck the country is. If not, go take a look. They’re great entertainment.

Lately the China-bashers have focused on a trifecta of data – rapid business growth, stagnating prices, and rising manufacturing wages that have tripled since 2006 – all of which imply that China’s production costs are going up. The thinking is that profits must go down as a result.

Unfortunately, the logic is based on nothing more than the idea that “if it’s happening in Europe, Japan, and the United States, it must be happening in China, too.” They’re making the most fundamental of all mistakes – applying western economic metrics to an economy that is fundamentally different.

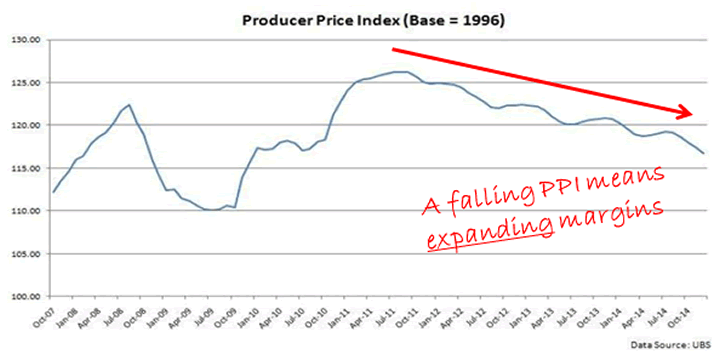

In reality, China’s Producer Price Index – they have a PPI just like we do – has gone down every year since 2011 and may drop another 3%-5% by 2016.

This means that margins and, yes, profits are expanding, not contracting. I’ll get to why in a minute.

When I point out this inconvenient truth and other data like it, critics default to the longer term, noting that the PPI is going up over time. But that observation is meaningless without some context.

China’s PPI has gone up a mere 16.4% since 1996. That’s a drop in the bucket compared to the PPI in the United States, which has increased by 10% since 2010 alone, according to tradingeconomics.com

The key takeaway here is that China is doing a better job of maintaining its cost advantage, especially when you compare it to the United States, as so many analysts seem determined to do.

If China’s rising costs were really impacting production, you’d see China’s share of global market exports dropping. In reality, China’s export growth became the world’s top exporter in 2009 a mere eight years after it was admitted to the World Trade Organization. In 2013, it accounted for nearly 12% of all global exports and more than $200 billion of services a month by 2014. It may hit 15% by 2016.

At the same time, China is becoming increasingly efficient and profitable because of automation – just like every other developed country has over time. The improvement is so vast that it’s rendering labor price increases moot. Factor in a hungry workforce drawn from 1.3 billion people, and you’ve got the answer. That’s what makes its outlook for growth very different from those of the U.S., Europe, and Japan.

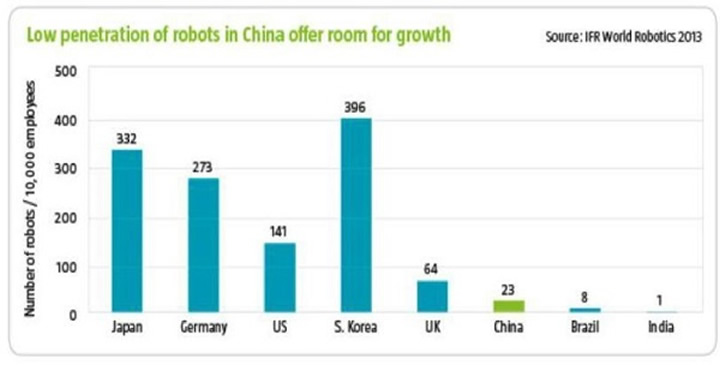

We’ve talked extensively about that as part of two Unstoppable Trends – Demographics and Technology - so I won’t repeat the discussion at length here. But I will highlight the key takeaway… a robot making something or performing a repetitive task costs 10 times less today than it did 10 years ago. Even in China, where labor cost have been unthinkably low by Western standards for years and even though they are rising now.

That’s really important because China has one of the lowest penetration rates of robotics of any nation on the planet. Yet, as Nicolas Musy of China Integrated, a Chinese business consultancy, points out, China is the world’s biggest robotic market and accounts for nearly 20% of global robotics sales.

Ergo, China can continue to automate for years and still not see margins trapped the way margins in western countries are by rising labor costs.

So how do you invest knowing what you now know?

First, you line up with our Unstoppable Trends – in this case, Technology and Demographics.

The rising middle class that’s some 600 million strong and the rapid introduction of automated manufacturing technology is a potent combination.

Second, you carefully pick your trade.

I recommended Navios Maritime Holdings Inc. (NYSE:NM) and Yingli Green Energy Holding Co Ltd. (NYSE:YGE) to my Strike Force subscribers as a way to capitalize on China’s demand for raw materials and clean energy needs. Anybody who followed along as directed captured gains on 400% and 200%, respectively.

Now I think we want to shift our focus away from energy and materials to technology.

I think you can capture the best of both with a choice like ABB Ltd. (NYSE:ABB) and Apple Inc. (NasdaqGS:AAPL). The former is a global leader in industrial-scale electricity infrastructure and automation systems while the latter is self-evident.

Or, if an ETF is more your style, try the Guggenheim China Technology ETF (NYSEArca:CQQQ) which emphasizes Chinese tech companies, including more than a few with high manufacturing input.

And, third, you control your risk.

Despite the fact that China remains the world’s last true bastion of growth, it’s not a place where you can just pile in, set it, and forget it when it comes to your money. So take a good look at this article on position sizing that I shared with you a few weeks ago, and make your move.

![]() (See you next time.)

(See you next time.)

Best regards,

Keith

Source :http://totalwealthresearch.com/2015/02/profit-2000-year-pattern-two-unstoppable-trends/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.