Housing Market Boom and Bust Cycles Driven by Real House Price Values

Housing-Market / UK Housing Jun 03, 2008 - 01:52 AM GMTBy: Nadeem_Walayat

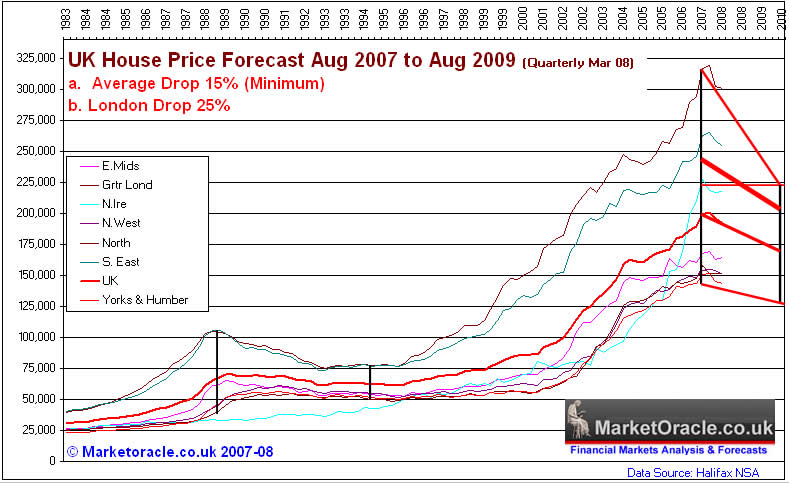

The UK housing bear market is now into its 9th month as of the peak in August 2007. This article analyses the real value of UK houses prices based on average earnings as part of ongoing preliminary analysis towards the extension of the existing 2 year housing market forecast for a 15% drop from August 2007 to August 2009.

The UK housing bear market is now into its 9th month as of the peak in August 2007. This article analyses the real value of UK houses prices based on average earnings as part of ongoing preliminary analysis towards the extension of the existing 2 year housing market forecast for a 15% drop from August 2007 to August 2009.

The above graph illustrates the current average UK house prices as per the Halifax data; real house price trend based on average earnings X 3.5; and the spread between the two which indicates the overbought or oversold state of the housing market in terms of the long-term trend of rising house prices.

The key observations are -

1. That house prices were under valued from 1993 right up until 2002.

2. That the current peak in house prices was at a value of nearly £80,000 (41%) above the long-tem sustainable trend, and significantly higher than the last peak in 1989 which was at £19,000 (27%) above the long-term trend.

3. That the market tends to move between extremes of boom and busts, and therefore is expected to overcorrect to the downside before a sustainable bottom can be expected in terms of real housing market value.

4. That the real rate of house price growth is approximately 4.5% per annum .Therefore over the next 3 years real house prices are expected to rise to £143,000 against current average UK house prices of £191,852 (March 2008).

Conclusion:

The long-term housing market real valuation trend implies a decline in house prices over the next 3 years to below £143,000. This would represent a fall in house prices of 29% from the August 2007 peak, and in inflation adjusted terms would represent a decline of between 50% and 60%. The fall of approximately 5% to date is nothing compared to what is increasingly likely to follow over many years, both in terms of nominal house price falls and in terms of inflation adjusted loss of value.

Therefore home owners wanting to sell and waiting for a rebound before selling, or holding out for higher offers may need to rethink their market price expectations and bite the bullet before they are forced into a decision at much lower prices..

Current Housing Market Forecast

The UK remains on track to fulfill the current 2 year forecast for a 15% drop from August 2007 to August 2009. The growing expectations are for a sustained drop in nominal house prices of as much as 25% by mid 2011.

More Analysis of the UK Housing Market:

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 150 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Attention Editors and Publishers! - You have permission to republish THIS article if published in its entirety, including attribution to the author and links back to the http://www.marketoracle.co.uk . Please send an email to republish@marketoracle.co.uk, to include a link to the published article.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.