The Great "inflated" Expectations for Gold, Oil, Commodities -- and Now Stocks

Commodities / Gold and Silver 2015 Jan 28, 2015 - 11:02 AM GMTBy: EWI

What's Bigger Than a $1.4 Billion Mortgage Ratings Scandal?

Last chance to get prepared for the major moves in U.S. stocks, commodities, gold, USD and more for 2015 and beyond -- Elliott Wave International's free State of the U.S. Markets online conference ends Wednesday!

Register now and get instant access to a free video presentation from market legend Robert Prechter plus all of the great insights from our most recent publications and presentations from our key analysts.

Last chance to get prepared for the major moves in U.S. stocks, commodities, gold, USD and more for 2015 and beyond -- Elliott Wave International's free State of the U.S. Markets online conference ends Wednesday!

Register now and get instant access to a free video presentation from market legend Robert Prechter plus all of the great insights from our most recent publications and presentations from our key analysts.

Editor's note: You'll find the text version of the story below the video.

Get insights on the economy and investing for 2015 and beyond.

Last chance to join our free, online State of the U.S. Markets Conference.

On January 21, one of the biggest financial lawsuits in recent history came to a costly end. The accused, ratings behemoth Standard & Poor's, agreed to a $1.4 billion settlement for "inflating credit ratings on toxic assets," thus accelerating and exacerbating the 2008 subprime mortgage crisis.

Settlement aside, there is a far bigger issue here than business ethics or conflicts of interests, which is not likely to get a hearing in the court of mainstream finance.

Which is: The professionals who are supposed to assess investment risks are no better at it than you or I.

Case in point: Think back to November 30, 2001. The world's largest seller of natural gas and electricity has gone from cash cow to dry bone. Its share price had plummeted 99%, from $90 to just under $1. YET-- the company continued to enjoy an "INVESTMENT GRADE" rating.

The company's name: Enron. Four days later, it filed for the largest bankruptcy in U.S. history.

Enron seems like a distant memory, but what about the subprime mortgage debacle? Moody's rating service slashed the ratings of 131 subprime bonds due to higher than expected defaults, in July 2007 -- two years after the market for non-traditional mortgages had already turned.

Spot a trend here? The "experts" failure to anticipate huge trend changes in companies, and in the overall economy. In the first edition of his business best-seller Conquer the Crash, EWI president Bob Prechter wrote:

"The most widely utilized ratings services are almost always woefully late in warning of problems within financial institutions. They often seem to get news about a company around the time everyone else does... In several cases, a company can collapse before the standard ratings services know what hit it."

So here's the question: What are the experts not seeing now that you and I need to prepare for?

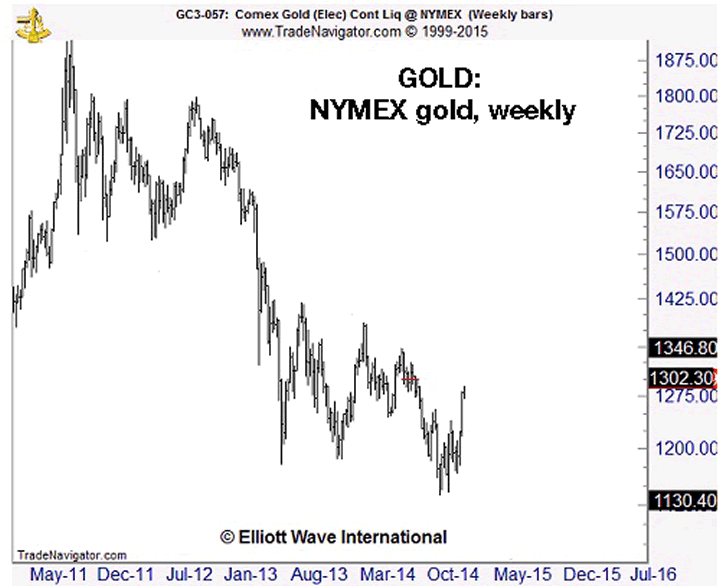

What about gold? In 2012, with prices nearly reclaiming all-time high territory, the Federal Reserve's quantitative easing campaign was supposed to keep the wind at gold's back.

"Ben Bernanke has just offered gold investors a... gilded invitation to participate in the greatest secular bull market of our time." (April 14, 2012, Motley Fool)

Then this happened:

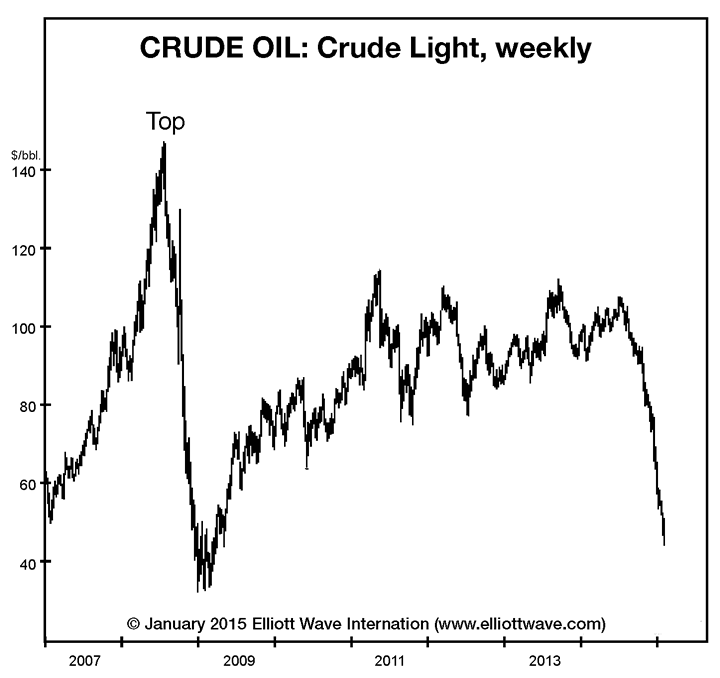

The same goes for the 2008 peaks in oil and commodities -- two more "safe-havens" that were supposed to benefit from the Fed's money-printing campaign, but instead prices fell to lows not seen since the 2007 financial crisis.

So, that leaves the remaining outlier -- equities, which have climbed to record highs. And, according to the experts, the path of least resistance remains up. A December 14, 2014 article in the New York Times:

"We don't see a lot on the horizon that could derail the U.S stock market in particular."

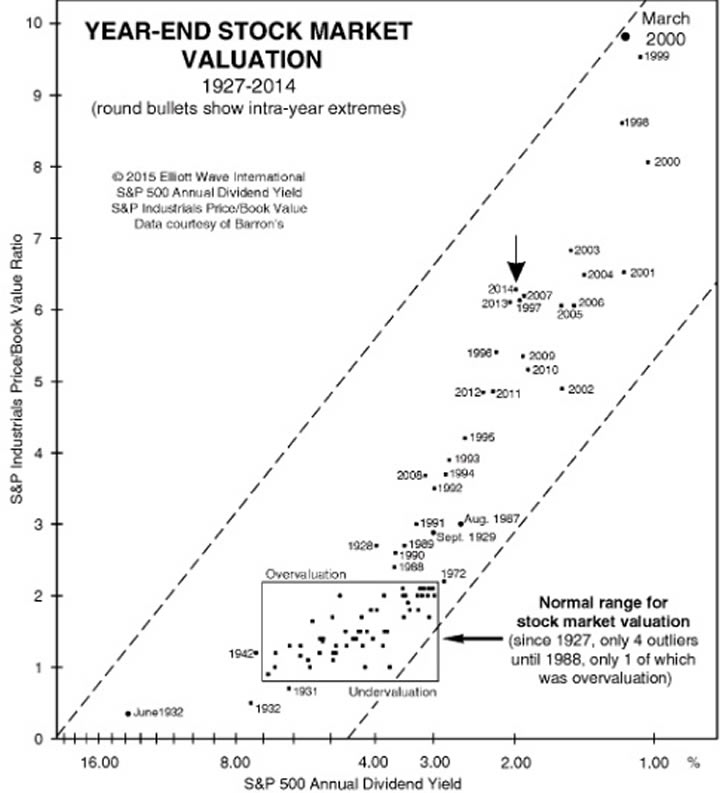

Our January 2015 Elliott Wave Theorist urges caution with this single chart of the S&P 500's year-end valuations since 1927. Every major peak of the last 90 years landed well outside the normal range: 1929, 1987, 2000, and 2007.

We believe the precarious placement of 2014 sends a similar message: "The stock market and the economy are not in a new multi-decade recovery as economists believe, but very late in a transition phase from boom to bust."

LAST CHANCE to Join Elliott Wave International's free State of the U.S. Markets online conference -- Ends Wednesday, January 28.Get prepared for the major moves in U.S. stocks, commodities, gold, USD and more for 2015 and beyond. Register now and you can still get instant access to a free video presentation from market legend Robert Prechter plus all of the great insights from our most recent publications and presentations from our key analysts. Hurry - Ends Wednesday, January 28. |

This article was syndicated by Elliott Wave International and was originally published under the headline What's Bigger Than a $1.4 Billion Mortgage Ratings Scandal?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.