The U.S. Dollar Has Peaked

Currencies / US Dollar Jan 22, 2015 - 12:41 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: "Today may be the very top in the U.S. dollar," I told Liz Claman on Fox Business' "Countdown to the Closing Bell" last Friday.

Dr. Steve Sjuggerud writes: "Today may be the very top in the U.S. dollar," I told Liz Claman on Fox Business' "Countdown to the Closing Bell" last Friday.

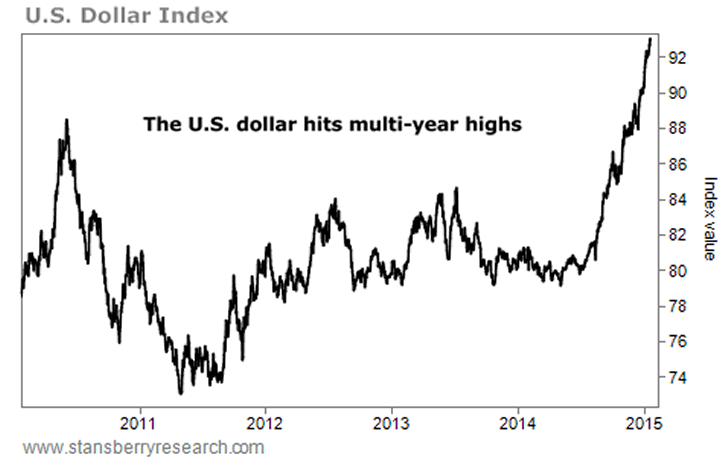

The U.S. dollar has soared over the last several months. And it has now become a crowded trade. I told Liz that no one expects the dollar to fall today... but that's what I'm betting on.

I'm betting the long-term bull market in the U.S. dollar is ending right now.

Let me explain...

The absurdity of the U.S. dollar story is showing up all over. I laughed out loud when I read this headline on Bloomberg last week...

"UBS's Richest Clients Seen Flocking to Dollars After Swiss Franc Shock"

The headline is just one of those classic "signs of a top" in the markets. Today, investors are flocking toward the dollar to an extreme degree.

It's not just rich guys with their money in Switzerland. Investors all over the world LOVE the dollar right now. And that's a problem...

When an asset becomes this loved, this quickly, it usually can't go up much more... And at that point, it's ripe for a fall.

That perfectly describes the situation in the U.S. dollar right now.

You see, right now, large speculators have more chips bet on the U.S. dollar than any time, ever (yes, ever), based on the latest Commitment of Traders report from the U.S. Commodity Futures Trading Commission.

And U.S. dollar sentiment is at its highest reading ever (yes, ever), according to Jason Goepfert. (Jason runs the excellent SentimenTrader.com.)

Jason wrote about it last week...

It's not just the fact that these [U.S. dollar] positions have moved to a record [in sentiment] that should raise concern for those long the dollar... It is the fact that the rate of change has increased so much in the past two to three weeks. When we see an increased rate of change at the same time that positons are moving to records, it suggests an urgency that is most often the hallmark of a last-ditch exhaustion...

In short, the U.S. dollar is extremely close to a peak, if we are not already there. The dollar has been moving higher for the last three and a half years… But the long-term trend is ending right now.

I believe the fall started last Friday. But it may start as late as a couple weeks from today.

Even if I'm wrong on timing, the dollar decline WILL start. And that means now is the time to prepare your portfolio.

Good investing,

Steve

P.S. In the latest issue of True Wealth, I share exactly what to buy to take advantage of a weaker dollar. And if you sign up for a risk-free trial subscription today (less than $5), you'll also get a FREE copy of Jim Rickards' excellent book, The Death of Money. Jim even included a special bonus chapter exclusively for our readers. To learn more about this special offer and how to claim your free copy of The Death of Money, go here.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.