The Markets Have Just Issued a Major Warning

Stock-Markets / Cycles Analysis Jan 20, 2015 - 02:40 PM GMTBy: Submissions

Michael Campbell writes:

Michael Campbell writes:

- The Swiss franc rose over 30% in a hour vs the Euro on Friday.

- Copper dropped 11% in three days last week

- Oil is down 56% since June

- Russian Ruble is down 70% in 3 weeks

- 7 European Countries have negative interest rates (i.e. buy a government bond and be guaranteed to get less money back)

Hi ,

For most of us the rate of change is pretty overwhelming, but over 38 years experience tells me that none of us can afford to ignore what’s going on. The good news is that Martin Armstrong is the best person I know to make sense of it all.

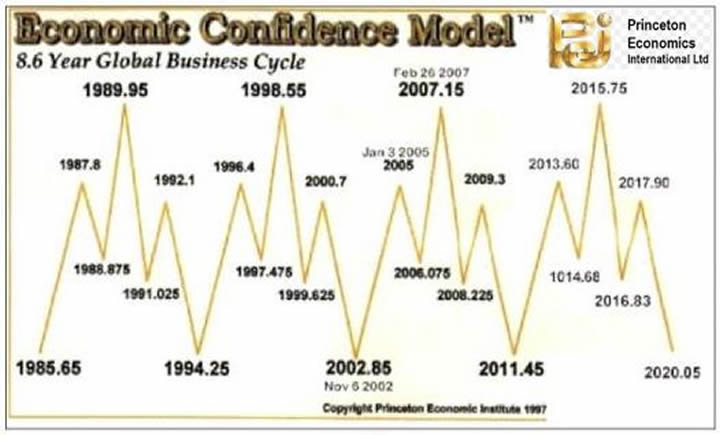

Think about this. Last week I was looking through some old notes when I came across this slide from Martin Armstrong’s World Outlook Conference presentation in early February 1998. Despite the fact that I am extremely familiar with his work I was still blown away by his model’s accuracy.

Just read the list: the tech collapse – the sovereign debt crisis – the subprime real estate bubble - and now the euro’s decline and the Japanese economic problems, which the most recent stats confirm. Think about it – 16 years ago his model was accurately predicting these events.

1998 Collapse of Russia

1999 Low in oil and gold

2000 Tech Bubble (like railroads in 1907)

2002 Bottom US share market

2007 Real Estate Bubble – Oil hits $100

2009 Start of Sovereign Debt Crisis

2011 – 2015 Japan Economic Decline and Euro begins to crack

2015.75 – Sovereign Debt Big Bang

For nearly four decades I’ve been saying that if there was only one analyst I could read and talk to it would be Martin Armstrong. If you attended the World Outlook Conference in 2013 you heard Marty predict that Russia would invade Ukraine in the last week of February 2014. He didn’t just make the right call, he also told us it would push both the US dollar and US share market higher.

He also clearly stated that the euro was doomed and there would be a lot of money to make playing it to return to par.

He reiterated that call last year. Clearly NATO, the EU or the US government didn’t predict that event but Marty’s model did.

But Here’s The Most Important Date To Note

Look at the last date on the slide – 2015.75 – that’s September 30th of this year. Marty has been noting that as a pivotal date for two decades and I can hardly wait to hear him talk about it at this year’s conference.

He calls it the start of the Big Bang. But what will it mean for gold – will it mark the low? Will it mark the top in stocks? Will it mark the beginning of the next phase of the Sovereign Debt Crisis, which will ultimately force interest rates higher thereby putting a top in the bond market?

At the World Outlook I’m going to feature Marty on Friday night and then again on Saturday afternoon. Friday I will ask him specifically about the Big Bang and what it could mean for Sovereign debt, interest rates and gold. On Saturday I’ll ask him about stocks, the loonie, the US dollar and oil.

One Final Thought

Marty is in high demand. His consulting fee for reviewing the holdings of major pools of capital starts at $5 million per year. (That’s not a misprint.)

He joins us at the World Outlook for two reasons. We’ve been friends for over 30 years and he has a major commitment to helping individuals and especially our children who are inheriting this financial mess get through these increasingly volatile and chaotic times.

I urge you to take advantage of the opportunity. The road map he will provide will prove invaluable to navigate the coming chaos.

Sincerely,

Mike

PS At the conference we will preview part of the new documentary film on Martin Armstrong called The Forecaster. It has opened in Europe to rave reviews.

- Where: Westin Bayshore Hotel, Downtown Vancouver

- When: Friday January 30th 1:00pm to 8:00pm and Saturday January 31st 9:00am to 4:00pm

- To Order: www.moneytalks.net/events/world-outlook-financial-conference.html

- Cost: General Admission = $129 for a two day pass

© 2015 Copyright Michael Campbell - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.