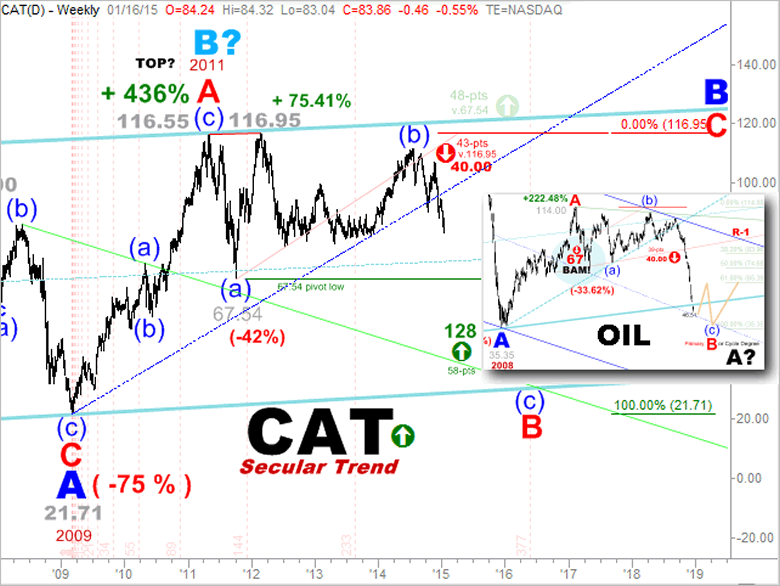

CAT to Follow Crude Oil Price to $40.00?

Companies / Company Chart Analysis Jan 17, 2015 - 06:47 PM GMTBy: Joseph_Russo

Is it reasonable to assume that so goes Crude Oil, so goes Caterpillar? Perhaps it is, or perhaps not, but the price charts of these two economic giants do show a fair degree of correlation.

Some Motley Fools I know think there may be some fundamental correlations as well.

Interestingly, both properties share downside price targets of $40.00 dollars. The major difference is that Crude is very much leading the way with a recent print low of $44.78 per barrel, which is not too far from our technical target.

In striking contrast, CAT’s recent print low of $83.04 still harbors the potential for enduring another 50% of downside to meet a similar fate.

The historic record of rises and chops from their respective 2008-2009 print lows is rather stunning but not too surprising considering the effect that massive interventions tend to have in lifting all boats in general tandem.

That both instruments project downside price targets of $40.00 dollars, is rather eerie to that the least.

In closing, only time will tell whether the crash in Crude Oil foresaw a similar crash in Caterpillar from which astute traders and investors capitalized on handsomely.

Until Next Time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2015 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.