Crude Oil Price Forecasts

Commodities / Crude Oil Jan 10, 2015 - 04:52 PM GMTBy: Investment_U

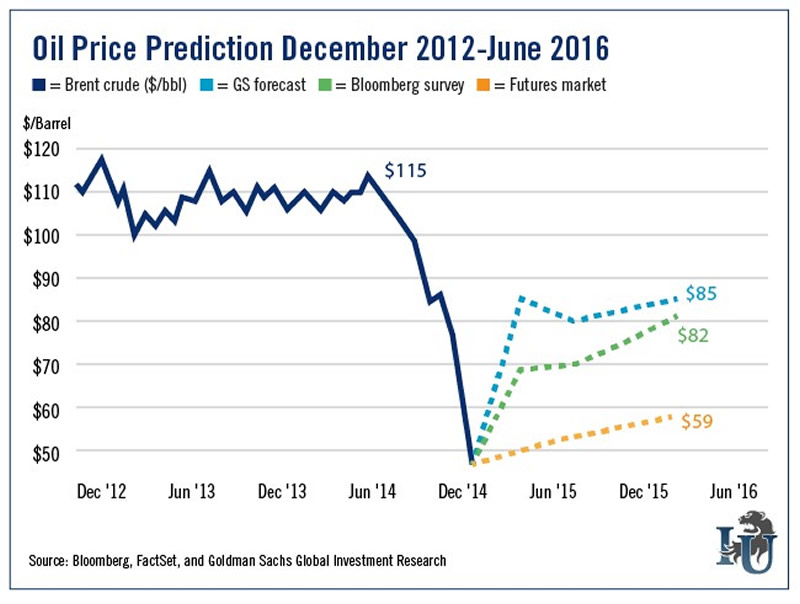

Rachel Gearhart writes: This week’s chart looks at oil prices from December 2012 through the end of 2014. It also does something quite interesting. It shows predictions out to June 2016. To create the chart, we looked at forecasts from Goldman Sachs, analysts surveyed by Bloomberg and the futures market.

Rachel Gearhart writes: This week’s chart looks at oil prices from December 2012 through the end of 2014. It also does something quite interesting. It shows predictions out to June 2016. To create the chart, we looked at forecasts from Goldman Sachs, analysts surveyed by Bloomberg and the futures market.

As you can see in the chart, analysts and Goldman Sachs forecast a strong rebound in oil prices.

Though no one predicts that oil will rebound to anywhere near its circa $110 a barrel price from pre-June 2014 drop, plenty of folks on Wall Street expect to see prices similar to those from September 2014. That’s good news for the sector.

The futures curve, though, is not as positive.

Remember, a futures contract is an agreement that allows a party to purchase oil at a predetermined price on a predetermined date in the future. The relatively slow price growth predicted by the futures market tells us that the folks actually buying crude oil or hedging its movements don’t see a significant move higher anytime soon.

Of course, after the week we just saw on the crude market, analysts may be anxious to revise their forecasts lower as the year progresses. In fact, earlier this week, Citigroup cut its average Brent forecast for 2015 from $80 a barrel to $63 a barrel. For 2016, it cut its forecast from $85 a barrel to $70 a barrel.

With so much movement in oil prices, it can be hard to make smart investment decisions. In a recent article, Dave Fessler said that the best way to hedge the volatility in oil prices is with a pipeline master limited partnership.

As the “tollbooth operators of the oil and natural gas transportation highways,” pipeline MLPs provide stability and had a strong showing at the end of 2014. Individual MLPs and funds that hold pipeline MLPs beat the S&P 500 every month in 2014. And with oil prices certain to stay volatile, they’ll likely do the same in 2015. This makes for an excellent investing opportunity as oil forecasts change.

Editorial Note: If you are looking for an energy play with huge upside potential, Resource Strategist Sean Brodrick also has one of his own bold predictions for oil in 2015. And it’s straight out of science fiction. As strange as the technology sounds, it could fuel more than 10 million automobiles in the United States. To learn more, click here.

Source: http://www.investmentu.com/article/detail/42568/invest-oil-2015-forecast#.VLFz8k1ya0k

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.