Government Spending Does Not Help the Economy

Economics / Government Spending Dec 31, 2014 - 04:13 PM GMTBy: Frank_Shostak

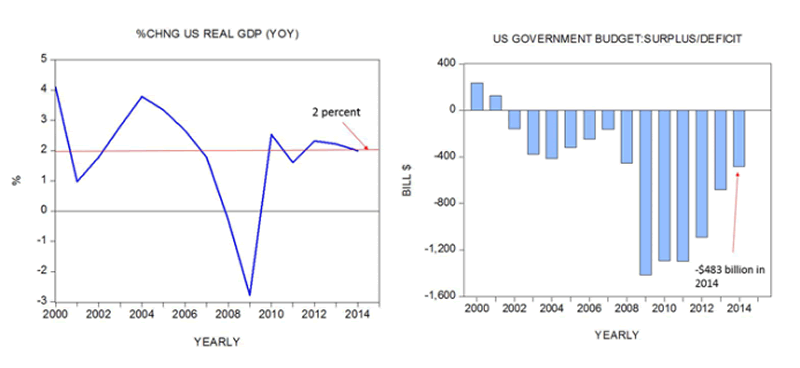

Some economists such as Nobel Laureate Paul Krugman hold that during an economic slump it is the duty of the government to run large budget deficits in order to keep the economy going. On this score — given that from 2011 to 2014 the rate of growth of real gross domestic product (GDP) hovered at around 2 percent — many experts are of the view that the budget deficit, which stood at $483 billion in 2014, wasn’t large enough.

Some economists such as Nobel Laureate Paul Krugman hold that during an economic slump it is the duty of the government to run large budget deficits in order to keep the economy going. On this score — given that from 2011 to 2014 the rate of growth of real gross domestic product (GDP) hovered at around 2 percent — many experts are of the view that the budget deficit, which stood at $483 billion in 2014, wasn’t large enough.

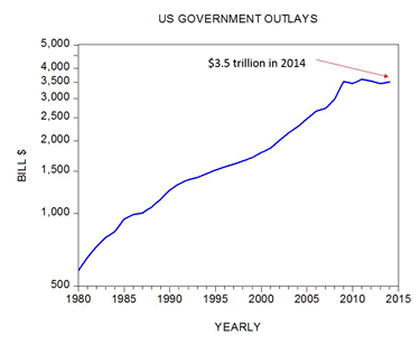

According to this way of thinking, if overall demand in the economy weakens on account of a weakening in consumer outlays, then the government must step in and boost its spending in order to prevent overall demand from declining. Note that government outlays in 2014 stood at $3.5 trillion against $1.788 trillion in 2000 — an increase of 96 percent.

Is Government Spending Good for the Economy?

Paul Krugman and other commentators are of the view that a widening of the budget deficit in response to larger government outlays can be great news for the economy.

Furthermore, they hold that there is very little empirical evidence that budget deficits are stifling economic growth as such. If anything, they hold it can only benefit an economy once it falls below its average growth path.

In contrast, the opponents of this view hold that a widening in the budget deficit tends to be monetized and subsequently leads to a higher inflation.

Also, a widening in the budget deficit tends to crowd out the private sector and this stifles economic growth, so it is held. So from this perspective a government must avoid as much as possible a widening in the budget deficit. In fact the focus should always be on achieving a balanced budget.

Why More Spending Is Bad News

We suggest that the goal of fixing the budget deficit as such, whether to keep it large or trying to eliminate it altogether, could be an erroneous policy. Ultimately what matters for the economy is not the size of the budget deficit but the size of government outlays — the amount of resources that government diverts to its own activities. Note that contrary to Krugman we hold that an increase in government outlays is bad news for the economy.

Observe that a government is not a wealth generating entity — the more it spends the more resources it has to take from wealth generators. This in turn undermines the wealth generating process of the economy. This means that the effective level of tax is the size of the government and nothing else. For instance, if the government plans to spend $3 trillion and funds these outlays by means of $2 trillion in taxes there is going to be a shortfall, labeled as a deficit, of $1 trillion. Since government outlays have to be funded it means that in addition to taxes the government has to secure some other means of funding, such as borrowing or printing money, or new forms of taxes.

The government is going to employ all sorts of means to obtain resources from wealth generators to support its activities. Hence what matters here is that government outlays are $3 trillion, and not the deficit of $1 trillion.

For instance, if the government would have lifted taxes to $3 trillion and as a result would have a balanced budget, would this alter the fact that it still takes $3 trillion of resources from wealth generators? In fact, an increase in government outlays sets in motion an increase in the diversion of wealth from wealth generating activities to non-wealth generating activities. It leads to economic impoverishment. So in this sense an increase in government outlays to boost the overall economy’s demand should be regarded as bad news for the wealth generating process and hence to the economy.

Contrary to commentators such as Krugman, the IMF, and various Fed officials, we suggest that a cut in government outlays should be seen as great news for wealth generators. It is of course bad news for various artificial forms of life that emerged on the back of increases in government outlays.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See Frank Shostak's article archives. Comment on the blog.![]()

© 2014 Copyright Frank Shostak - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.