Bitcoin Price Could Move Down

Currencies / Bitcoin Dec 30, 2014 - 04:24 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Looking back at Bitcoin in 2014, we see that this was not a kind year for the currency, at least not in terms of the price. Bitcoin has gone down some 50% (!) since the beginning of the year or some 70% (!) since December 2013. Not particularly encouraging results, and even Bitcoin-focused websites make mention of them. On CoinDesk, we read:

If the story of bitcoin in 2013 was its meteoric rise in price, which saw it hit a peak of over $1,100 in November, then the tale of bitcoin's price this year is one of plummeting from those heights.

The price of bitcoin opened the year at $770, according to the CoinDesk Price Index. By mid-December, it was trading in the mid-$300 range. This represents a drop of more than 50% from the start of the year.

However, it's worth noting that bitcoin is still trading comfortably above its price for much of last year. Indeed, it is changing hands for more than three times the amount it was trading at during the highs of April 2013, before its historic bull run.

Over the past 12 months, the price has been buffeted by a diverse array of factors, ranging from adoption by payments giant PayPal and technology goliath Microsoft to the massive sell-order from the 'BearWhale' and rumoured clampdowns by the Chinese authorities.

This is yet another article in which we see the currency discussed from the perspective of its terrible returns in 2014. But the investors should be more concerned about what lies ahead than what has just happened. And it might be the case that all the negative comments on Bitcoin are a sign of a bottom to come.

Of course, calling out a bottom is a hard thing to do. Going in long might be painful since the currency might lose more altitude, an event described as “catching a falling knife.” Bitcoin might depreciate further. If it were to follow its long-term trend, this would be the natural direction.

Is the rise in the number of negative news on Bitcoin a sign that a rebound is not far away? The tone of the articles doesn’t seem extreme just now, so it would suggest that this is still not the point where the currency is “hated.”

For now, let’s focus on the charts.

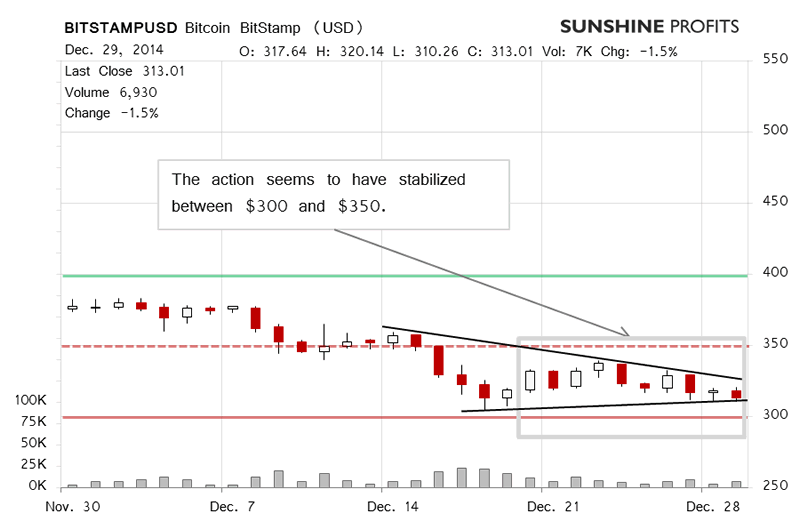

On BitStamp, there was no conclusive action yesterday. Bitcoin went down on increased volume but neither the price action nor the volume was significant enough to suggest a possible change in the short-term outlook. Yesterday, we wrote:

Even though six days have passed, not that much has changed. Today we’ve seen some depreciation (…) but neither the price nor the volume is representative of a strong move. As such, it seems that Bitcoin might continue to move along its recent trend which is down.

What we’ve seen today is a confirmation of that point. Bitcoin has gone up slightly (this is written around 11:45 a.m. ET) but this move seems pretty much negligible in terms of the price and the volume hasn’t actually been really strong either. As such, the action today is more of a sideway move. This in itself doesn’t seem to establish a new trend but might point to the possibility of a move in line with the recent trend in the future. This would mean a move down.

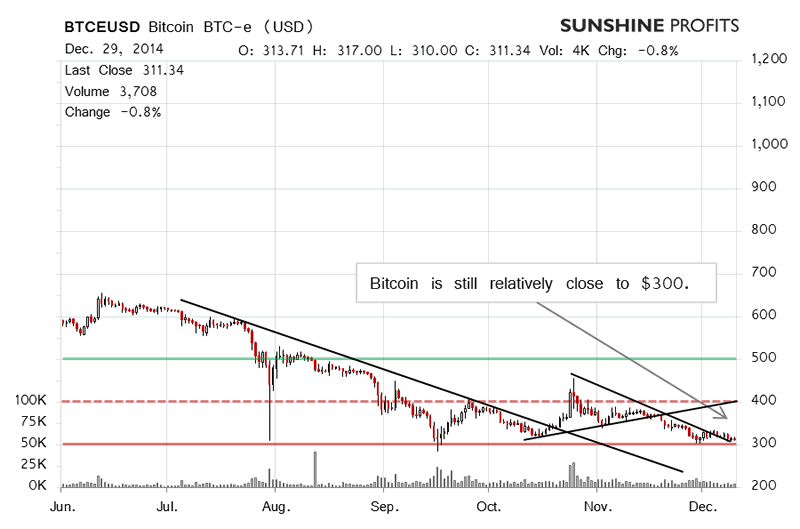

On the long-term BTC-e chart, the price is at one possible trend line and still above $300. Yesterday, we commented:

(…) the current picture is becoming more bearish by the day. It is not bearish enough to go short just yet, in our opinion. To suggest hypothetical short position we would have to see a slip below $300 and an uptick in volume.

Even though Bitcoin hasn’t really gone down on BTC-e today (it’s been relatively flat as of the moment of writing), this might actually be a bearish development. The volume has been relatively weak so it doesn’t seem that the next big move has already started. But the currency hit a low of $307 earlier today (only slightly above the Sunday low). This might be an indication of more downward pressure in the market.

At the moment of writing, it seems that the best bet is on Bitcoin moving down. In our opinion, however, it might be best to wait for a confirmation in the form of a move below $300, which could be the signal for the start of the next downswing, possibly to around $275.

Summing up, we don’t support any short-term positions in the Bitcoin market at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.