Gold Prices After The End of QE

Commodities / Gold and Silver 2014 Dec 22, 2014 - 01:05 PM GMTBy: Arkadiusz_Sieron

The performance of gold obviously depends on the U.S. economic condition and the Fed's future actions. In the short run, the end of QE3 will most likely not change anything and gold will most likely decline on a dollar rally. It is likely to last as long the U.S. central bank credibility is at all-time heights. This is because gold can be seen as the reciprocal of central bank credibility. Thus, when central bank credibility is at a peak, gold is in the dumps. The end of QE3 could even strengthen the belief about the strength of the U.S. economy. After all, Fed would not halt the quantitative easing if the economy was not strong, right? Just look at the economic numbers, say the pundits. Unemployment went down, while GDP grew faster than expected in the third quarter, and oil is historically cheap, which will additionally boost the U.S. economy.

The performance of gold obviously depends on the U.S. economic condition and the Fed's future actions. In the short run, the end of QE3 will most likely not change anything and gold will most likely decline on a dollar rally. It is likely to last as long the U.S. central bank credibility is at all-time heights. This is because gold can be seen as the reciprocal of central bank credibility. Thus, when central bank credibility is at a peak, gold is in the dumps. The end of QE3 could even strengthen the belief about the strength of the U.S. economy. After all, Fed would not halt the quantitative easing if the economy was not strong, right? Just look at the economic numbers, say the pundits. Unemployment went down, while GDP grew faster than expected in the third quarter, and oil is historically cheap, which will additionally boost the U.S. economy.

Moreover, in contrast to the Fed, the Bank of Japan announced on October 31, 2014 a new round of QE in Japan. It implies more quantitative and qualitative easing, because the BoJ will purchase not only bonds, but also real estate investment trusts and exchange-traded trust tracking the Japanese stock market. The European central bank also stated that it will start to purchase asset-backed securities to increase its balance sheet to 1 trillion euro by 2016. Therefore, despite still expansionary monetary policy, the U.S. dollar will likely be gaining compared to other main currencies, depressing the gold price (in terms of the USD).

However, the end of QE3 could mean a market bust. Most likely not today, nor tomorrow. The effects of changes in monetary policy come with a significant delay. Perhaps, the money supply is not yet decelerating at a rate comparable to the rates we saw in the latter stages of the previous two boom-bust cycles, but today's economy is much more fragile than earlier. Every confidence-shaking event can unsettle markets. Remember how the markets reacted when Bernanke suggested tapering? The same panic attack was observed in October, because of the expected halt of QE3. The correction was on the way, but then James Bullard, the president of the Federal Reserve Bank of St. Louis, said that the Fed could be back with QE4, if needed. He was supported by Eric Rosengren, the president of the Federal Reserve Bank of Boston, who later said that he could easily imagine not raising rates until 2016.

The message is clear: do not take the end of QE too seriously. It is not the permanent abandon of quantitative easing, which may be restored at any time depending on the economic situation. The hike of interest rates is also an open case. Gold is not lost. On the contrary, all the fuss about the future of the Fed's action can only increase the nervousness in the financial markets, supporting the gold price.

But even if the Fed increases interest rates, the result will not necessarily be negative for the yellow metal. Generally, as we have explained in one of the previous editions of Market Overview, the gold price is inversely related to the real interest rates. Although true, our explanation omitted the impact of the interest rates hike on the asset market. In equilibrium the price of the asset is equal to the present value of the discounted stream of payments.

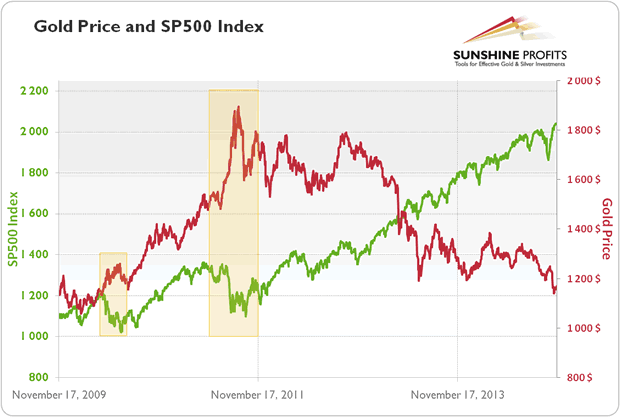

Therefore, the rise of interest rates will be detrimental to asset prices and, consequently, positive for the gold price. The reason is simple: gold tends to perform relatively well during the busts and relatively poorly during the booms (at least if we take the last 3 years into account). This relationship does not always hold because of the influence of changes in the U.S. dollar value and many secondary issues, but the inverse correlation between gold and U.S. stocks is well established in the case of the last 3 years, so we can expect it to be present in the case of the next medium-term trend. We can justify this negative relationship in the following way: in case of panic in the stock market, investors shift their capital into the ultimate safe haven - gold. Just recall 2011 when U.S. stocks went through a sharp sell-off and the gold price reached its record high.

Graph 1: Gold price (red line, right scale) and SP500 Index (green line, left scale) from 2009 to 2014

The bottom line is that the end of QE3 is not the abandonment of the quantitative easing concept and expansionary monetary policy with extremely low interest rates. An interest rates hike could be detrimental for the asset markets and accelerate the bursting of the stock bubble. However, the halt of QE3 and all this talk about the normalization of monetary policy could increase Fed's credibility. Therefore, as data on the U.S. economy looks positive, at least compared to Japan and Europe, the greenback will be gaining, which could easily translate into lower prices of the yellow metal. However, the seeds of the next bust have been already sown, so investors should wait and watch for downside risks, especially the slow global economic growth (look at data on China) and the decelerating pace of money supply expansion in many countries. Both factors have actually busted the oil boom. The stock market may be next, which would increase gold prices.

Stay updated on the latest developments in the Fed's policy, gold market and US economy by signing up for our Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe now, we still encourage you to join our gold newsletter. It's free and you can unsubscribe in just a few clicks.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.