Stock Market George Lindsay 22year Cycle Overlay

Stock-Markets / Cycles Analysis Dec 10, 2014 - 10:51 AM GMTBy: Ed_Carlson

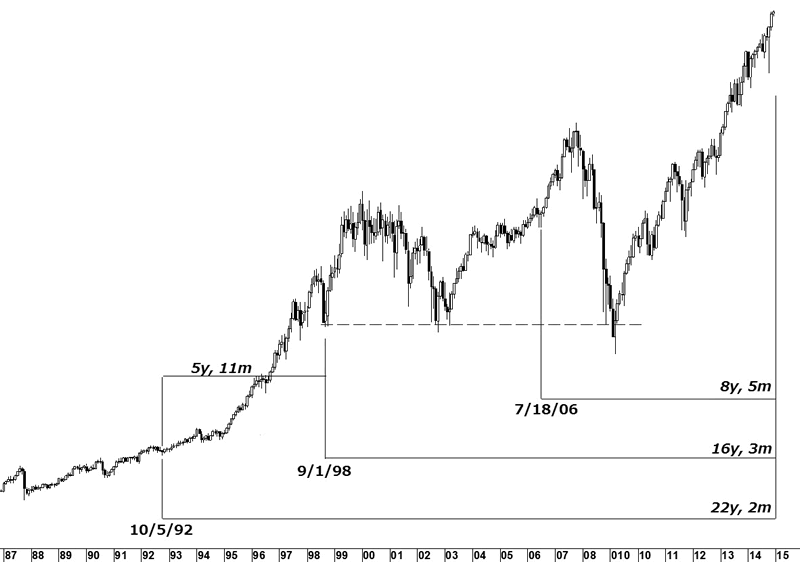

George Lindsay described his 22y overlay in a two part installment of his newsletter in 1964. In it he showed 18 examples of how the model had helped to time highs in the Dow. In the 22y overlay we are searching for three important intervals ending at a high 22y, 15y, and 8y later. Lows appear every ~7y followed by a high 8y after the final low.

Some of the highs he showed were significant and some were not. The significance of the forecast can predetermined by the significance of the 22y and 15y interval lows. The significance of the 8y interval does not affect the expected decline.

In the current set-up the origin of the 22y interval in 1992 can be seen on the chart at left but doesn't look like an important low. I believe that is the wrong interpretation. This low was point G of Lindsay's long cycle (See An Aid to Timing, SeattleTA Press 2012) defining it as an important low. More important to determining the importance of the forecast high is the significance of origin of the 15y interval. The low in 1998 was the low of the separating decline of a three peaks/domed house pattern. Lows of separating declines have proven to be very important in forecasting 15y highs throughout Lindsay's work.

Normally, one bear market holds above the nadir of the previous one. There have been only a limited number of exceptions to this rule. On these few occasions, the length of the 15y interval has come closer to 16y than 15y. The low in 2009 breached the previous two lows in 1998 and 2002. Last week's high in the Dow is 16y, 3m from the low in 1998.

Lindsay wrote that when the 15y interval is increased to 16y that the distance between the 22y and 16y lows comes closer to 6y than the prescribed 7y. As expected, the distance between the lows in 1992 and 1998 is almost exactly 6 years.

Try a "sneak-peek" at Lindsay research (and more) at Seattle Technical Advisors.

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2014 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.