Crude Oil Price Sinking Or Rebounding

Commodities / Crude Oil Dec 09, 2014 - 10:34 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 1.65% as a stronger U.S. dollar and news that Saudi Arabia lowered the price of oil for buyers in the U.S. and Asia continued to weight. As a result, light crude moved lower for the fourth time in a row and closed the week at its lowest level since mid-Jul 2009.

On Friday, the Labor Department showed that the U.S. economy added 321,000 jobs in the previous month, beating analysts' expectations for jobs growth of 225,000. Additionally, the U.S. unemployment rate remained unchanged at 5.8% last month. These stronger-than-expected numbers pushed the USD Index to a fresh multi-year high of 89.49, making crude oil less attractive in dollar-denominated exchanges, especially among investors holding other currencies. On top of that, news that Saudi Arabia lowered the price of oil for buyers in the U.S. and Asia continued to weight, which helped soften the price of crude oil. In this environment, light crude dropped once again, approaching the support zone. Time for rebound or new lows? (charts courtesy of http://stockcharts.com).

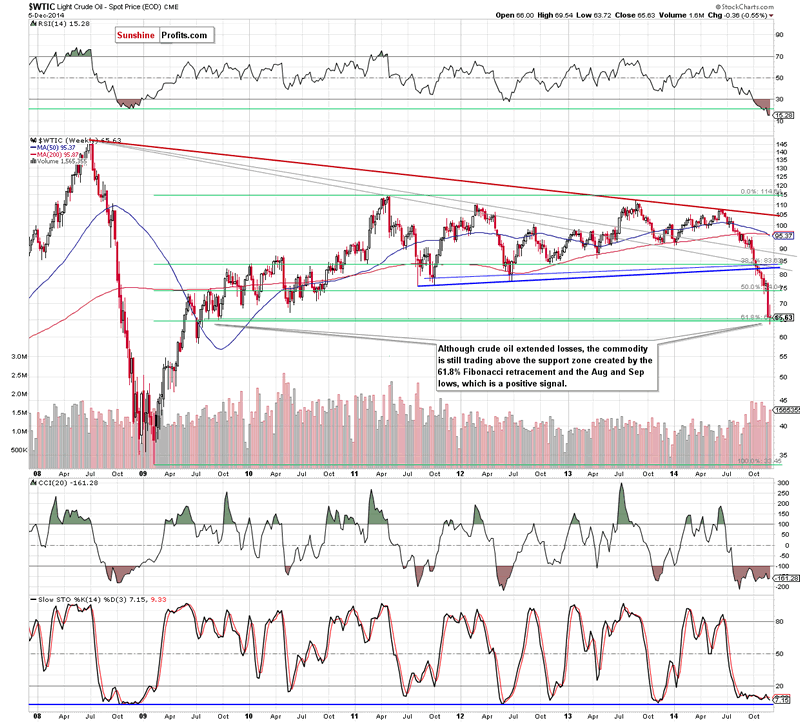

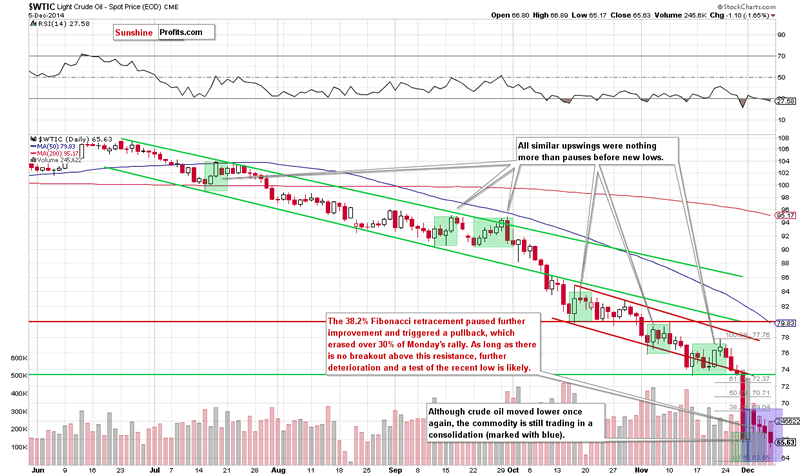

Looking at the above charts, we see that crude oil moved lower for the fourth time in a row and closed the week at its lowest level since mid-Jul 2009. In our opinion, this suggests that we'll see further deterioration in the coming day and a test of the strength of the recent low and the solid support zone (created by the 61.8% Fibonacci retracement and the Aug and Sep 2009 lows). If this area holds, we could see a post double-bottom rally. In this case, crude oil would increase to at least to the last Monday's high of $69.54. What could happen if oil bears win and push the commodity lower? If crude oil extends losses and broke below the above-mentioned support zone, we could see a drop even to around $58.32-$60, where the Jul 2009 lows (in terms of intraday and weekly closing prices) are.

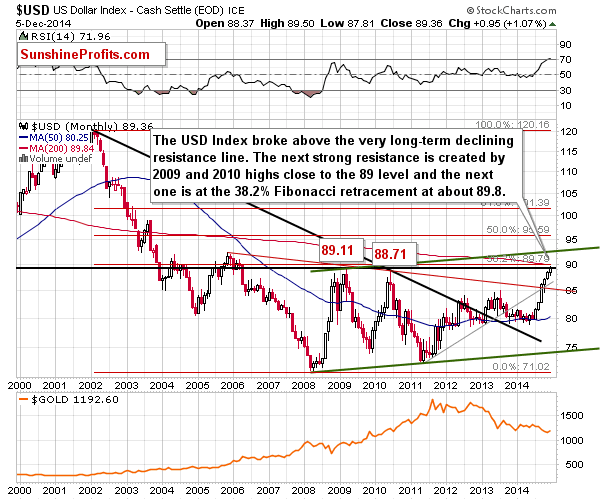

Nevertheless, before we see a realization of any of these scenarios, we would like to take a closer look at the current situation in the USD Index as the U.S. dollar was one of the major forces, which affected the price of the commodity in recent weeks.

On the above chart, we see that the USD Index moved higher earlier this month and reached the strong resistance area created by the 2009 and 2010 highs. On Friday, we saw a breakout above these levels, which is a strong bullish signal that suggests further increase to the next upside target - the 38.2% Fibonacci retracement level based on the entire 2002 - 2008 decline (around 89.80). What does it mean for crude oil? Based on a negative correlation between the commodity and the U.S. currency that we noticed in recent weeks, it seems that light crude could move lower once again in the near future. Nevertheless, we should keep in mind that despite the greenback's new high, crude oil didn't hit a fresh multi-year low on Friday, which is positive sign for the commodity.

Taking the above into account, and combining it with the fact that the space for further growth in the USD Index seems limited, we think that even if the USD Index moves little higher, crude oil could show strength - similarly to what we saw in May, the first part of Jun and also in Sep. Additionally, if the index reverses and moves lower in the coming days, we'll see a rebound in crude oil as a weaker U.S. dollar makes the commodity less expensive for buyers in other currencies.

Summing up, the overall situation is still too unclear to open any positions as crude oil is still trading in a narrow range between the support and resistance areas. However, taking into account the current situation in the USD Index and a negative correlation between the commodity and the U.S. currency, it seems to us that trend reversals in both cases are just around the corner. Nevertheless, until the uncertainty about future movements is in play, we believe that waiting on the sidelines for the confirmation that the final bottom is in is the best choice at the moment.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, however, if last week's upward move won't be followed by a fresh multi-year low and we'll see a breakout above the 38.2% Fibonacci retracement (based on the recent downward move), we'll consider opening long positions. Until this time, waiting on the sidelines for the confirmation that the final bottom is in is the best choice.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.