Bitcoin Price Volatility

Currencies / Bitcoin Nov 07, 2014 - 05:47 PM GMTBy: Mike_McAra

In short: speculative short positions, stop-loss at $377, take-profit at $307.

In short: speculative short positions, stop-loss at $377, take-profit at $307.

Mark Wetjen, a member of the Commodity Futures Trading Commission (CFTC), wrote an opinion piece for The Wall Street Journal in which he highlighted the potential of Bitcoin:

With a market capitalization of around $4.4 billion, Bitcoin represents a tiny fraction of the U.S. financial system. But as Jerry Brito, director of the think tank Coin Center, said at our public meeting, Bitcoin has the potential to provide tremendous benefits to the under-banked and un-banked, particularly in emerging markets where traditional financial services often are not available. Bitcoin is likely to be an especially powerful resource for people who rely on mobile-payment systems on their smartphones.

Bitcoin or similar technologies can be used as platforms for financial innovation in the digital transfer of currency, securities, contracts and sensitive information. Such innovation could play a fascinating role in the derivatives markets as well as financial services more broadly (...).

(...).

Regulators should work quickly to understand how these technologies work and how they affect specific regulatory jurisdictions, with the ultimate goal of creating a regulatory framework should the public begin adopting or using these technologies in greater numbers. Creating a flexible and rational regulatory framework also is the best way for regulators to respond to previous incidents such as Mt. Gox, Liberty Reserve or Silk Road--serious innovators will choose to work within such a regime in the U.S. rather than avoid it, which in turn will build more confidence in consumers currently leery of embracing the new technology, or something like it. That will lay the groundwork for future innovation in virtual currencies.

This is yet another sign that government agencies are not necessarily inclined to stifle Bitcoin but they would rather come up with rules that would prevent blow ups such as Mt. Gox. The problem here is that these agencies are not necessarily versed in technological innovations such as Bitcoin. But it also turns out that at least some members of these governmental bodies, such as Wetjen himself, are actively considering what cryptocurrencies are and how they can work in the regulatory landscape we have.

Over time, we would expect more and more research on Bitcoin done by regulatory agencies, more of them getting up to speed on what Bitcoin is and what it's not. This means that the perception of the currency will actually visibly change from something that the agencies are wary of to a known way of making payments. More regulation might prove a way to establish an environment in which companies will become interested in this way of accepting payments.

For now, let's focus on the charts.

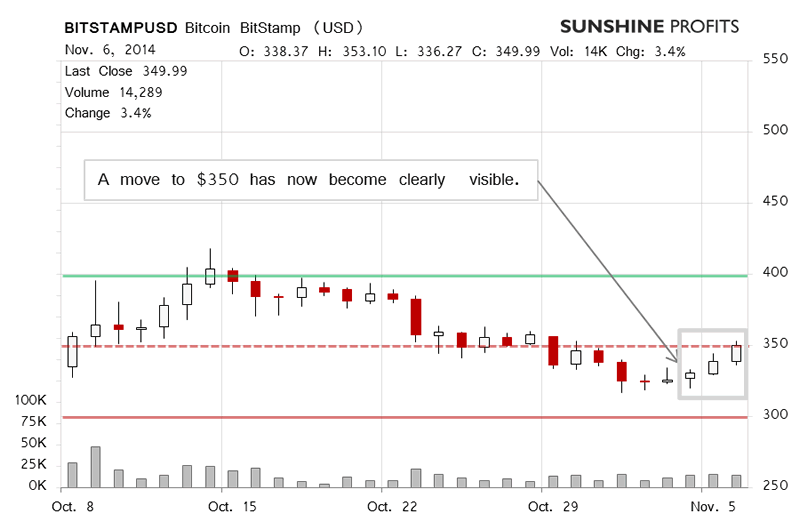

On BitStamp, yesterday looked like an important day. This was because of the move up which took up late in the day. The volume was slightly lower than on the previous day but by no means weak. This was a fourth day of relatively elevated volume and rising closing prices. Is this a beginning of a new trend up?

It might have looked like that, particularly after yesterday but today is much more in line with our baseline scenario. Bitcoin has slipped below $350 again (this is written around 10:30 a.m. ET). If we actually see a close below $350 today and, more importantly, tomorrow, this might suggest that the move up is no more than a counter-trend breather. This is how the situation looks so far.

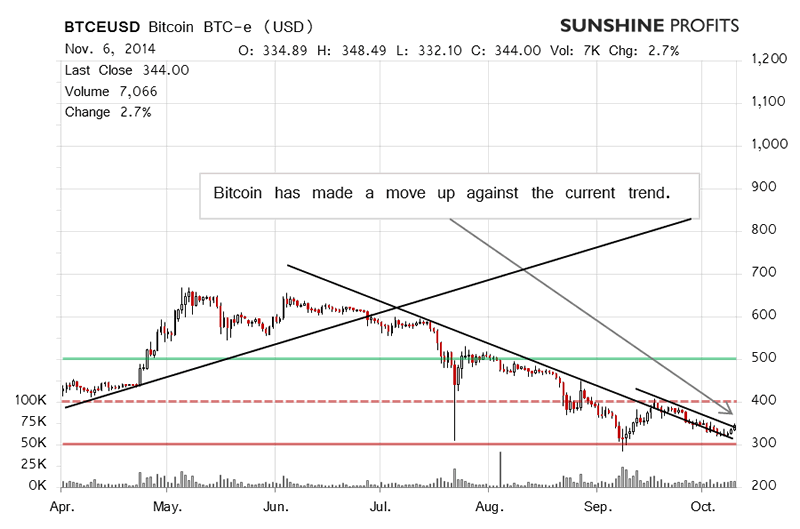

On the long-term BTC-e chart, we see that the recent move up has just gotten more pronounced. Does this mean that we'll see higher prices from now? We would like to quote our comments from two days back:

(...) we don't read too much into today's appreciation. Of course, a move up is always possible, so our stop-loss levels are there to limit any potential pain, but at the moment we simply haven't seen enough of a change in the market, even from a short-term perspective to change the speculative positions. Our best bet is on a move down.

Combining that with the fact that Bitcoin didn't even go above $350 on BTC-e yesterday and that the action today hasn't been violent, and mostly to the downside, we arrive at the conclusion that not much has actually changed.

This seems to be an important moment in the market. If we see more closes below $350, the implication might be of a move down to $300 or even lower. This move would then test the all-important bottom at around $275. Our best bet at this time is that we'll see a move down to $300.

Summing up, we support short speculative positions in the Bitcoin market.

Trading position (short-term, our opinion): short speculative positions, stop-loss at $377, take-profit at $307. Additionally, a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.