Understanding Global Monetary Policy: And How to Profit From It

Commodities / Gold and Silver 2014 Nov 04, 2014 - 12:40 PM GMTBy: Bob_Kirtley

To say that the last month as been turbulent in markets would be a drastic understatement. We saw the biggest intraday range in US bond yields in 16 years, equities nosedive then whipsaw right back to new highs, VIX hit the highest levels since 2011 whilst gold, silver and oil hit multi year lows. With such volatility around the theme of uncertainty is rife across financial markets, therefore it is important to reassess ones views of the market and properly understand the underlying drivers of market action.

To say that the last month as been turbulent in markets would be a drastic understatement. We saw the biggest intraday range in US bond yields in 16 years, equities nosedive then whipsaw right back to new highs, VIX hit the highest levels since 2011 whilst gold, silver and oil hit multi year lows. With such volatility around the theme of uncertainty is rife across financial markets, therefore it is important to reassess ones views of the market and properly understand the underlying drivers of market action.

The Importance of Central Banks

The most powerful force in financial markets is global central banks and the monetary policy they follow. Mayer Amschel Rothschild, founder of the House of Rothschild, famously said; “Give me control of a nation’s money supply, and I care not who makes it’s laws", and since the global financial crisis central banks have been more active and more critical to market direction that ever before. Therefore any macro view on global markets must start with an opinion on what path central banks are taking and how they may react to potential upcoming scenarios.

The Fed, ECB, BoE and BoJ are the titans of this world. Before we discuss their individual positions there is an overriding theme that is vital to understand first. Globalization in the later part of the 20th Century connected the global economy like never before. Therefore the trajectory of all economies are much more highly correlated, since globalization has interwoven nearly every area of commerce across all borders. Given that each country’s growth, and the principal drivers of their growth, are so interdependent, it follows that the monetary policy of various central banks also become more correlated also. Hence we have had all major central banks on a course of highly accommodative monetary policy in recent years.

As central banks look to move away from this stance and begin to tighten monetary policy over coming years, the global economy becomes ever more sensitive to their moves. One bank tightening is similar to a tightening in global monetary policy, due to the ripple effect across markets, since the global economy and financial markets are so interconnected. Likewise an easing from a major central bank makes financial conditions more accommodative across the globe. Thus is follows that if the banks are all easing or tightening, the impact is multiplied.

Translating Monetary Policy To Market Movements

Many observers have been puzzled by the market reaction to recent monetary policy changes. When the Fed began tapering some thought that equities would crash as the support for the financial system was being removed. However this is only considering that impacts of Fed policy and lacks an appreciation for the global dynamics at play.

The US Federal Reserve is currently looking at tightening monetary policy by increasing interest rates next year. They have been steadily reducing their accommodative stance by tapering QE. At the same time we had the BOJ embarking on massive increases in their quantitative easing which is supportive of asset prices. So to a degree these are offsetting in global sense and keep asset prices supported.

Similarly there were those who thought the recent program by the ECB to buy ABS would send gold prices higher, working on the simple assumption that more QE leads to higher gold prices, which we strongly disagreed with (Please see our article “Why ECB QE Is Bearish for Gold Prices” for further detail). At the same time that the ECB is moving to more QE, the Fed remains confident that it will begin increasing interest rates next year, thus keeping gold capped in USD. Once we consider the finer details that the ECBs targeted and relatively small QE is perhaps helpful for the global economy it further discredits the notion that gold prices should have every moved higher under such an scenario.

Another critical point to understand is that it is not the position of the central bank that moves markets, it is the change in that position that counts. Throughout 2013 many wondered why gold prices were falling when the Fed was still actively involved in QE. It was the fact that they were tapering purchases and changing their policy position that drove gold prices lower. The same principles are present in currency market; it is not the underlying interest rates or strength in a nation’s economy that drives the currency movements, it is the changes in the velocity of those factors that drives the price action.

Central banks are becoming ever more reactive to changing conditions; therefore any view on the trajectory of monetary policy should be subject to regular and rigorous revision. At present our view is that global monetary policy is on balance quite accommodative and thus supportive of risk assets such as equities. The massive easing by the BOJ and the clear intent from the ECB to maintain and increase their accommodative stance if necessary puts enough slack in financial conditions to allow the Fed to increase interest rates next year without sabotaging global growth.

This Will Keep Risk Assets Supported

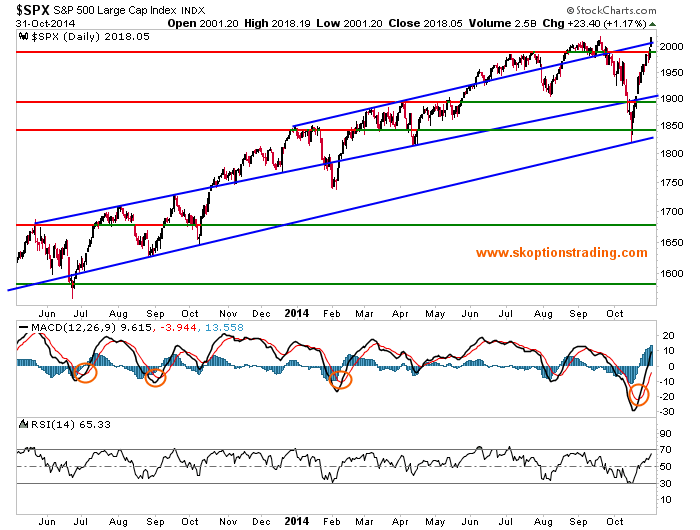

Given that the BOJ and ECB are more likely to step up their easing than reduce it, we believe risk assets such as stocks and credit will remain well supported. Naturally it follows that stocks are a buy on dips and during this last dip we executed trades that expressed that view.

Stocks remain vulnerable to sharp pullbacks as markets digest changes in policy over the coming months. Let us not understate the magnitude of the task ahead given we are coming out of the most accommodative policies markets have ever seen. Even a perfectly executed transition will not be without hiccups. Therefore we are not running a core long in equity markets; we are simply tactically trading from the long side when the risk-reward dynamics move in our favour.

Equity Volatility To Remain Contained

Concerns that a tightening of US monetary policy will lead to declines in the stock market are misplaced and whilst we acknowledge that the transition to tighter monetary policy will be a bumpy road, one must factor in how careful central bankers are going to be driving down this road. The tightening process will be slow, gradual but most critically will be highly reactive to market conditions and economic data.

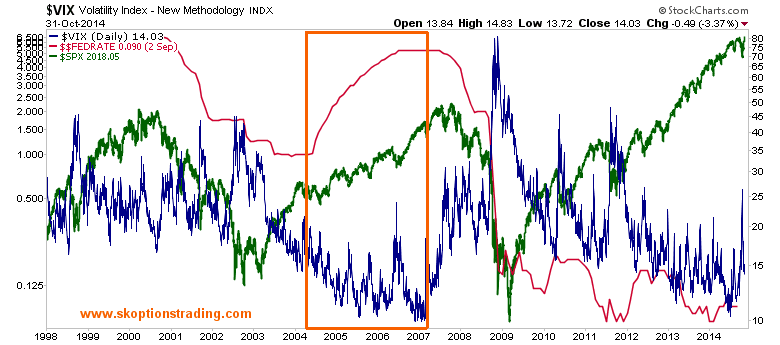

If there is even a slight cause for concern that the tightening is causing instability in financial markets or threatening global growth, the tightening bias will ease and central bankers will communicate to markets that they will only tighten further if the situation calls for it. As such we have high conviction in our view the equity volatility will remain contained. The chart below highlights the last Fed hiking cycle in which volatility was low and relatively well behaved. Historically equity volatility is much more likely to spike during times of central bank easing than tightening.

Recently our largest position has been in short VIX positions on its spike up to 30 and whilst we are more neutral on the index at these levels, we do not think that the VIX is a buy unless it is below 12. Towards 20 and higher would be our targets for re-entering short VIX trades.

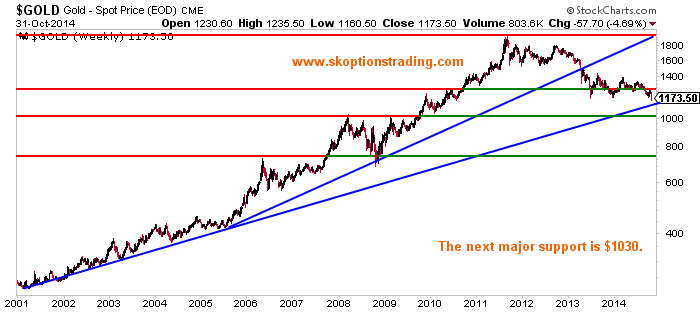

Precious Metals Sliding Further South

As a function of our view that the Fed will continue shifting to tighter monetary policy we have been bearish on precious metals since the end of 2012. We retain our view that gold prices will move towards $1000 and that rallies are to be faded as any increase in QE from the BOJ will be countered with more hawkish rhetoric from the Fed. We also view the ECB’s currently ABS purchase program as bearish for gold prices on a standalone basis, however a larger sovereign debt purchase program would tilt global monetary policy towards an easing bias, therefore it would depend on what action the Fed was taking under that scenario regarding if we changed our bearish stance on gold and silver.

Conclusion

Our core view is that on global monetary policy is the key dynamic in current markets, far more so than the actions of any one central bank due to the highly interconnected nature of the economic system across borders. On balance global policy is still accommodative, this is supportive of higher stock prices and should keep equity volatility subdued even if the stock market does not soar higher. However on balance globally monetary policy is more likely to tighten from current levels, led by the Fed, and this change is bearish for gold prices. These are the key themes we are focused on at present, to find out more about what trades we are executing and how we are allocating capital in our model portfolio please visit www.skoptiontrading.com to subscribe.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.