Gold, Silver Fell 5%, 6% Last Week - Remain Vulnerable

Commodities / Gold and Silver 2014 Nov 03, 2014 - 12:22 PM GMTBy: GoldCore

Today’s AM fix was USD 1,170.75, EUR 936.90 and GBP 731.90 per ounce.

Today’s AM fix was USD 1,170.75, EUR 936.90 and GBP 731.90 per ounce.

Friday’s AM fix was USD 1,173.25, EUR 933.45 and GBP 733.47 per ounce.

Gold and silver were both sharply down for the week at 4.78% and 5.99% respectively.

Gold fell $26.30 or 2.2% to $1,172.40 per ounce Friday and silver slid $0.33 or 2% to $16.16 per ounce.

Gold fell nearly 1% to $1,161.75/oz today and dropped to 4 year lows as the U.S. dollar strengthened and technical selling continued as prices had a weekly close below $1,180/oz.

Gold in U.S. Dollars - 5 Years (Thomson Reuters)

Gold for immediate delivery fell 0.3% to $1,169.28/oz by midday in London. Silver fell 2.4% to $15.77 an ounce in London, its lowest price since February 2010. Platinum remained unchanged at $1,236.30 an ounce. Palladium added 1.4% and is back over $800 at $803.45 an ounce.

The price of silver is down 18% this year after a 36% fall in 2013 which is leading to buyers again buying the dip. However, we as ever caution to avoid trying to catch a falling knife. Wait for the knife to land, bounce and stabilise before calmly picking it up. Therefore, it remains prudent to wait for a higher weekly or monthly close prior to dollar cost averaging into position.

The U.S. Fed said that it was ending QE3 last week and this has seen the dollar and equities make strong gains - pressurising gold. Investors are now awaiting a time frame for an interest rate hike. The Bank of Japan increased its QE from 60 trillion to 80 trillion yen per year.

Gold, in the short term, looks prone to further weakness. We could see gold test support at $1,156. which is the 61.8% retracement of the move from the October 2008 low to the all-time high at $1,921.

Below that is the big round number of $1,100/oz and then the even bigger round number of $1,000/oz.

Precious metals analysts are warning of further losses. Goldman, SocGen and Barclays and other banks expect weakness into year end. This seems quite possible given the poor technical position, poor sentiment in western markets and momentum which can be a powerful thing.

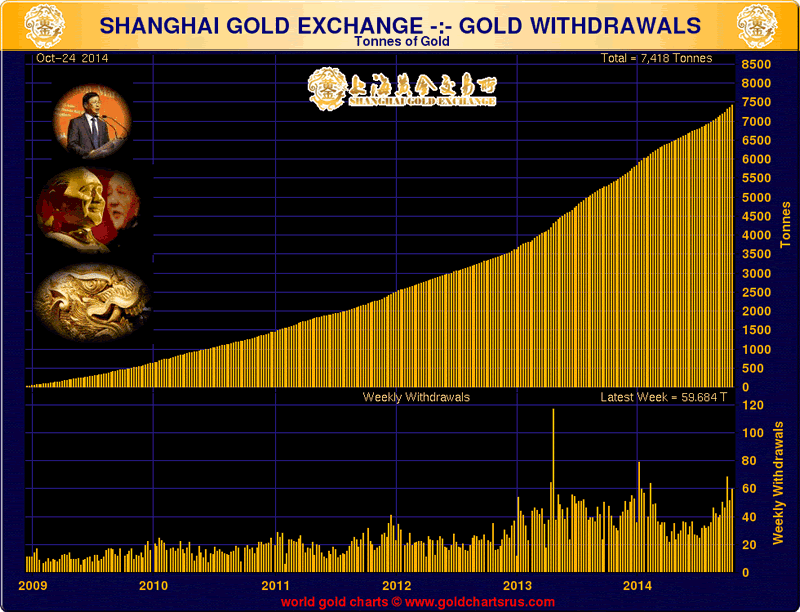

Another powerful thing not being factored into bearish analysts equation is huge Chinese demand for physical bullion.

Chinese demand’s best proxy is Shanghai Gold Exchange (SGE) withdrawals which were nearly 60 tonnes last week and heading for over 1,600 tonnes so far in 2014. On an annualised basis, Chinese demand looks set to be double the estimates of the World Gold Council which are accepted by the financial media and western gold analysts.

Gold’s 14 day relative-strength index (RSI) dropped to 25.5 on October 31st, below the level of 30 that suggests to some traders who study technical charts that price may be poised to rebound. The RSI was at 24.4 today.

However, short term weakness, possibly into year end seems likely prior to the secular bull market reasserting itself.

Another positive factor in the gold market being ignored by futures traders is the Swiss Gold Initiative.

Support for the Swiss gold initiative has waned marginally but remains high, according to a poll published late on Friday by the free Swiss newspaper 20 Minuten. Unusually, Reuters did not release the story to the wires and it appears to have been given exclusively to the Daily Mail in the UK.

The initiative has sent jitters through both the gold and currency markets, since it would require the SNB to massively increase its holdings of gold bullion and informed analysts think that it has a good chance of passing.

Speaking in Dubai last week, Dr Burkhard Varnholt, the CIO of Julius Baer, the Swiss private bank, said that he thinks the Swiss gold initiative referendum is likely to go through and that this should lead to higher gold prices.

Dr Varnholt is not against a gold standard but he said he would personally be voting against the referendum due to what he sees as the inflexibility it will causes the SNB in their implementation of monetary policy as reported by Arabian Money. Julius Baer is also a gold product provider through their Julius Baer Physical Gold Fund.

Interestingly, enough the respected Swiss bank which acquired Merrill Lynch private clients and their sizeable bank of high net worth clients in 2012, is recommending a healthy allocation of 10 to 20% gold bullion in their portfolios for diversification and protection against renewed dollar weakness.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.