The Reinvention of Alan Greenspan

Commodities / Gold and Silver 2014 Nov 02, 2014 - 05:26 AM GMT Former chairman calls Fed balance sheet a tinder box, endorses private gold ownership

Former chairman calls Fed balance sheet a tinder box, endorses private gold ownership

During the time Alan Greenspan and representative Ron Paul had their famous series of exchanges (some might have labeled them confrontations) during Congressional hearings from 1997 to 2005, the congressman made what turns out to have been a prescient observation. "My questions," he said, "are always on the same subject. If I don't bring up the issue of hard money versus fiat money, Greenspan himself does." I say "prescient observation" because here we are a decade or more later and the "new" post-Fed Greenspan sounds very much like the "old" pre-Fed Greenspan-––the one who consistently advocated gold before he became Fed chairman.

Greenspan has always come across as a conflicted figure forced to reconcile his responsibilities as chairman of the Federal Reserve––the epicenter of the fiat money universe––with a "nostalgia," as he put it, for the gold standard, its diametric opposite. As such, I always saw him as torn between the two––the devil on one shoulder and an angel on the other.

Outside those memorable proddings by Congressman Paul, Greenspan rarely spoke publicly about the virtues of gold while Fed chairman, and when he did his approach seemed guarded. Even in the years following his tenure, he rarely broached the subject. In recent months though, as you are about to read, the gloves have come-off not just with respect to gold but with the dangers inherent to the fiat monetary system as well.

The reinvention of Alan Greenspan

Part one - an article in Foreign Affairs magazine

Greenspan's reinvention began with a surprising defense of gold in the October issue of Foreign Affairs magazine. In that article, titled "Golden Rule: Why Bejing Is Buying," he reminds top level policy makers of gold's role as a national asset of last resort. "If, in the words of the British economist John Maynard Keynes," he says, "gold were a 'barbarous relic,' central banks around the world would not have so much of an asset whose rate of return, including storage costs, is negative. . .Gold has special properties that no other currency, with the possible exception of silver, can claim."

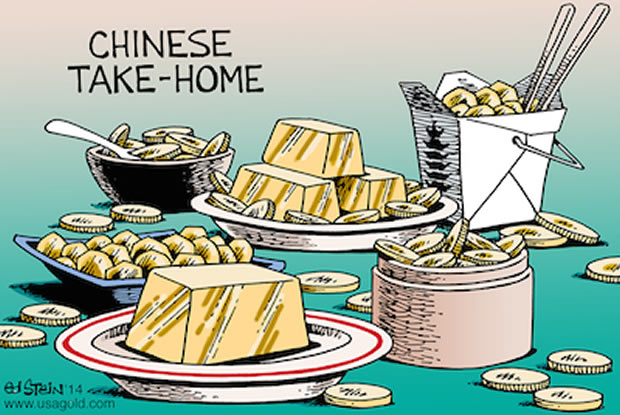

So why is Bejing buying gold?

"If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold," he says, "the country's currency could take on unexpected strength in today's international financial system. It would be a gamble, of course, for China to use part of its reserves to buy enough gold bullion to displace the United States from its position as the world's largest holder of monetary gold. But the penalty for being wrong, in terms of lost interest and the cost of storage, would be modest."

In short, China sees gold reserves as a means to building the credibility of the yuan as a global reserve currency that would compete with the dollar. As I mentioned in a recent issue of this newsletter, China could purchase the U.S. gold reserve in its entirety with only 8% of its $4 trillion in currency reserves and the entirety of global gold reserves with 32% of its foreign exchange holdings––some sobering numbers.

Part two - a speech before the Council on Foreign Relations (CFR)

Greenspan followed that article with a speech before the CFR in late October. In that speech, he raised questions about the effectiveness of the Fed's quantitative easing program. He also registered concern that the Fed might not be able to adequately control either a future rise in interest rates or the volatility (read downside) it might create in the markets. He also cast doubt on the viability of the euro in the absence of a European political union. In a surprise, he offered what I consider to be some very sound financial advice: "Gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments."

Part three - an appearance at the gold-friendly New Orleans Investment Conference

Greenspan also spoke at the New Orleans Investment Conference in October and here he offered some important insights into the role of the Federal Reserve in the present political economy. Henry Bonner (Sprott Global) who was in attendance offers this summation:

"[Greenspan] fell into his role as Fed Chairman purely by accident, he claimed, and what he did there, he did it because he had to. He explained that the capital needs of the Federal government were so massive that the only way to prevent disaster for the rest of the economy was to keep feeding the beast with cheap money. If the Fed hadn't created and circulated new money, the Treasury's insatiable demand for capital would certainly have 'crowded out' the rest of the economy, wrecking the entire private credit system. Political realities, he explained, in the form of entitlement spending and off-balance sheet obligations of the US government, trump the need for sound money every time."

In this context, he explained, a gold standard is impossible. Greenspan added flatly that he "never said the Fed was independent and that its heavily monetized balanced sheet is "a pile of tinder but it hasn't been lit. . . Inflation will eventually have to rise."

Why Greenspan's reinvention is important to the average investor

So why go to the trouble of cataloguing Alan Greenspan's October, 2014 epiphany?

We need to keep in mind that this is an individual who actually sat at the controls of the most important central bank in the world. As such he saw first-hand how the monetary system operates––the good, the bad and the ugly. For him to graduate from that experience a proponent of gold reveals more about the efficacy of central banks than perhaps those institutions would like to be known. After all, the central bankers' stock and trade is trust and belief. Wall Street trusts that the central bank knows what it is doing and it believes that it is powerful enough to make its will stick.

Greenspan in the course of thirty days has dispelled both notions. He tells us unambiguously that the Fed's power is limited; that its policies by and large are dictated by forces outside its control (as mentioned earlier, he exclaimed at one point that he "never said the Fed was independent"); and that the Fed's options are restricted by the overwhelming needs of a government fiscally out of control. What's more he recommends gold to the citizenry as a financial defense. Tellingly, the man who was once called "maestro" for his apparent mastery of economic orchestration appears to have been humbled by his experience. His born again embrace of gold, and as one of the Fed's most vocal critics, should be viewed as one of the more important curtain calls of the modern era. I am surprised that more has not been made of it.

Epilogue

As a young man Greenspan wrote what has become a famous tract––one widely referenced by gold advocates even now and one that still ranks among the most highly visited pages at USAGOLD. "Gold and Economic Freedom" is a strongly worded, no-holds-barred attack on fiat money and the welfare state written in the late 1960s. It also endorses the gold standard as a means to restraining those impulses.

Former Congressman Ron Paul once told the story of his owning an original copy of "Gold and Economic Freedom" and asking Greenspan to sign it. While doing so, Paul asked him if he still believed what he wrote in that essay some forty years earlier. Greenspan, then still Fed chairman, responded that he "wouldn't change a single word." True to his word, and after serving a 19-year stint as chairman of the Federal Reserve, he comes back to the place where he began. At nearly 89 years of age, he squares the books and adds a new and, in my view, useful chapter to his legacy. At the New Orleans conference Greenspan was asked where he thought gold would be in five years. He answered "higher." When asked how much, he said "measurably."

Welcome back, Mr. Greenspan.

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.