US Now Importing the World's Deflation

Economics / Deflation Nov 01, 2014 - 04:08 AM GMTBy: John_Rubino

With US QE about to end, the rest of the world faced the prospect of another "taper tantrum" financial crisis, one that this time around could suck the world into a deflationary vortex. So it should come as no surprise that the end of QE was countered with a series of offsetting treats for the global financial markets:

With US QE about to end, the rest of the world faced the prospect of another "taper tantrum" financial crisis, one that this time around could suck the world into a deflationary vortex. So it should come as no surprise that the end of QE was countered with a series of offsetting treats for the global financial markets:

• The US Fed promised to keep interest rates low for a really long time.

• The European Central Bank announced that in November it would start buying asset backed bonds, in effect beginning an open-ended, potentially huge debt monetization program of its own.

• Japan's version of Social Security is massively increasing its equity purchases:

Japan's public retirement-savings manager will put half its holdings in local and foreign stocks and start investing in alternative assets as the world's biggest pension fund seeks higher returns.

The 127.3 trillion yen ($1.1 trillion) Government Pension Investment Fund set allocation targets of 25 percent each for Japanese and overseas equities, up from 12 percent each, it said at a briefing today in Tokyo. GPIF will reduce domestic bonds to 35 percent of assets from 60 percent. The new figures don't include an allocation to short-term assets, while the previous targets did. Analysts surveyed by Bloomberg this month had anticipated levels of 24 percent for local stocks, 15 percent for global shares and 40 percent for Japanese bonds, taking short-term holdings into account.

And last but definitely not least:

Japan central bank shocks market with fresh easing

LOS ANGELES (MarketWatch) -- In an unexpected move, the Bank of Japan's policy board voted by a 5-to-4 margin to expand the pace of its quantitative easing, sending Tokyo stocks soaring and the Japanese yen falling sharply.

The central bank expanded the size of its Japanese Government Bond purchases to the equivalent of "about 80 trillion yen" ($727 billion) a year, an increase of ¥30 trillion from the previous pace. It said it would also buy longer-dated JGBs, seeking an average remaining maturity of 7-10 years.

The central bank also said it would triple its purchases of exchange-traded funds and real-estate investment trusts.

Concerns about dwindling inflation appeared to drive the move, with the Bank of Japan saying that "on the price front, somewhat weak developments in demand following the [April 1] consumption-tax hike and a substantial decline in crude-oil prices have been exerting downward pressure recently."

The equity markets loved all this, of course. Japan's Nikkei index rose an amazing 4.83% on Friday. The S&P 500 is up about 3% on the week and most emerging markets are soaring. From the point of view of bureaucrats attempting manipulating formerly-free markets, this is a ringing success. Unfortunately, like most attempts to mess with the laws of nature, it contains the seeds of its own demise.

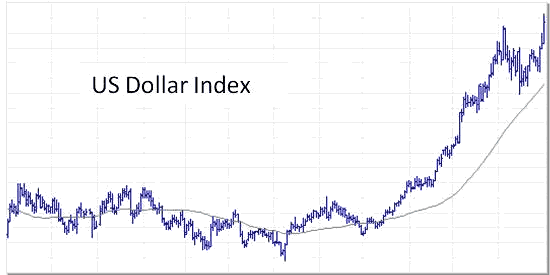

First and foremost, the end of QE in the US coupled with a ramp-up of bond buying in Europe and Japan has the dollar up sharply:

A surging currency is functionally the same thing as rising interest rates in that it tends to cut corporate profits while making debt harder to manage for pretty much everyone. So it's good for savers (who see the value of their savings rise) and bad for borrowers, both individual and governmental. And that -- more onerous debts and plunging corporate profits -- is what the US is looking at in 2015.

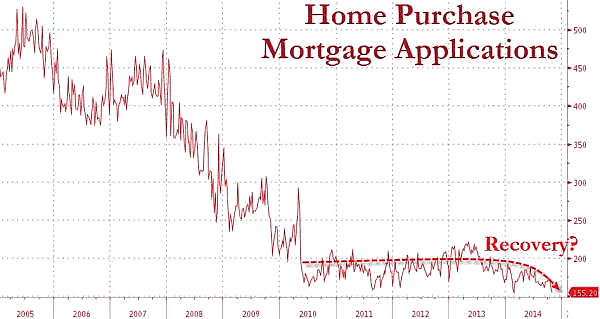

This is coming at a really bad time for some crucial parts of the economy. Housing, for instance, is looking like the end rather than the beginning of a recovery, with mortgage purchase applications at 19-year lows (chart courtesy of Zero Hedge):

The upshot: As good as things feel right now in the stock and bond markets, they'll feel that bad or worse when it dawns on the leveraged speculating community that the rest of the world is exporting their deflation to America.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.