More Weakness in Bitcoin Price

Currencies / Bitcoin Oct 31, 2014 - 06:10 PM GMTBy: Mike_McAra

To the point: speculative short positions, stop-loss at $377, take-profit at $307.

To the point: speculative short positions, stop-loss at $377, take-profit at $307.

Jon Matonis, the executive director of the Bitcoin Foundation has resigned, we read on the NY Times website:

The Bitcoin Foundation announced on Thursday that Jon Matonis, one of the foundation's founding board members, was stepping down as its executive director, effective on Friday. Mr. Matonis will remain on the foundation's board until Dec. 31.

Mr. Matonis, who was named executive director in July 2013, will be succeeded by Patrick Murck, the foundation's general counsel.

"Leading the Bitcoin Foundation has been a once in a lifetime opportunity," Mr. Matonis said in a statement. "Merging the diverse interests of the Bitcoin community has been intellectually and professionally stimulating."

Whoever is at its helm, the Bitcoin Foundation has still work to do. This year, it's been marred by unfortunate circumstances, with Charlie Shrem, a board member, pleading guilty to aiding and abetting an unlicensed money transmission operation. Mark Karpeles of the Mt. Gox fame was also a member of the board before stepping down in the wake of the controversy surrounding his exchanges' operations.

Altogether, the Bitcoin Foundation will certainly have to work further to change its perception by market participants. It will have to do so in order to effectively forward the interests of the Bitcoin community.

For now, let's turn to the charts.

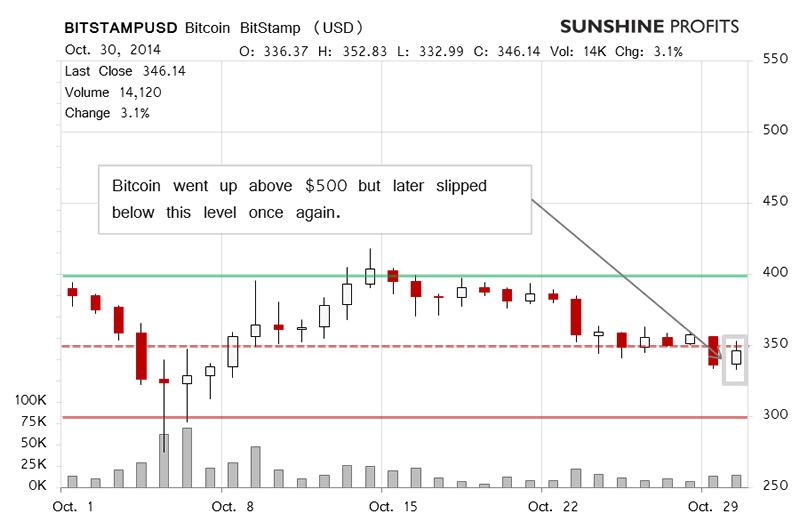

On BitStamp, there was appreciation yesterday and the price was even pushed above $350 for a time, before declining back to around $345 at the end of the day. The volume was elevated and this made the action yesterday well-worth noting. The failed move above $350 could have been indicative of a lack of strength.

Even though we saw a move up yesterday, today seems to be a completely different story. The price has gone down slightly (this is written after 11:30 a.m. ET) and the volume has been decidedly weaker than yesterday and on the day before yesterday.

What do we make of this kind of action? First of all, the lack of move above $350 might be indicative of a lack of buying power in the market. Secondly, the volume is not quite convincing. Thirdly, the price range today has been narrower than yesterday. All these points suggest that we might be seeing a cooling in trading. This, in turn might be a hint that the momentum is still very much in line with the recent trend, which has been down.

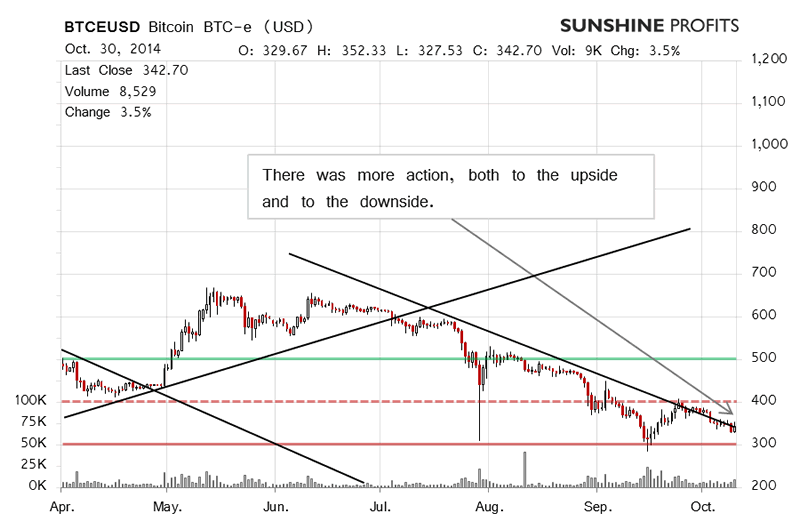

On the long-term BTC-e chart, we see yesterday's move up relatively clearly. The move was similar to what we saw on BitStamp in that we also witnessed appreciation above $350 but a slide below this level late in the day. Yesterday, before most of the appreciation materialized, we wrote:

Today, the currency has remained where it was yesterday with the volume down. At the moment, it seems that we might see some wavering here but given the level of $332 being reached we favor short speculative positions at this time.

In light of what has happened today, the appreciation of yesterday may in fact be a symptom of "wavering" as we described it. Today, Bitcoin has depreciated slightly, erasing some of yesterday's gains and, perhaps more importantly, showing that the recent move up might not be more than a one-day tick.

Taking the above into account, it seems to us that it is best to position oneself so as to profit from a move down in Bitcoin. This means that the short-term outlook remains largely unchanged from yesterday and is bearish. Actually, more action similar to what we've seen today, even without a strong move down, could suggest that there is little strength in the market.

Summing up, in our opinion short speculative positions might be the way to go now.

Trading positions (short-term, our opinion): short speculative positions, stop-loss at $377, take-profit at $307. Additionally, a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.