Stock Market Reset Due

Stock-Markets / Stock Markets 2014 Oct 10, 2014 - 03:37 PM GMTBy: Alasdair_Macleod

Recent evidence points increasingly towards global economic contraction. Parts of the Eurozone are in great difficulty, and only last weekend S&P the rating agency warned that Greece will default on its debts “at some point in the next fifteen months”. Japan is collapsing under the wealth-destruction of Abenomics. China is juggling with a debt bubble that threatens to implode. The US tells us through government statistics that their outlook is promising, but the reality is very different with one-third of employable adults not working; furthermore the GDP deflator is significantly greater than officially admitted. And the UK is financially over-geared and over-dependent on a failing Eurozone.

Recent evidence points increasingly towards global economic contraction. Parts of the Eurozone are in great difficulty, and only last weekend S&P the rating agency warned that Greece will default on its debts “at some point in the next fifteen months”. Japan is collapsing under the wealth-destruction of Abenomics. China is juggling with a debt bubble that threatens to implode. The US tells us through government statistics that their outlook is promising, but the reality is very different with one-third of employable adults not working; furthermore the GDP deflator is significantly greater than officially admitted. And the UK is financially over-geared and over-dependent on a failing Eurozone.

This is hardly surprising, because the monetary inflation of recent years has transferred wealth from the majority of the saving and working population to a financial minority. A stealth tax through monetary inflation has been imposed on the majority of people trying to earn an honest living on a fixed salary. It has been under-recorded in consumer price statistics but has occurred nonetheless. Six years of this wealth transfer may have enriched Wall Street, but it has also impoverished Main Street.

The developed world is now in deep financial trouble. This is a situation which may be coming to a debt-laden conclusion. Those in charge of our money know that monetary expansion has failed to stimulate recovery. They also know that their management of financial markets, always with the objective of fostering confidence, has left them with market distortions that now threaten to derail bonds, equities and derivatives.

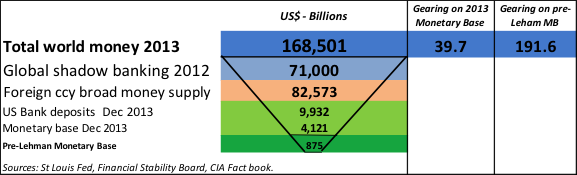

Today, central banking’s greatest worry is falling prices. The early signs are now upon us, reflected in dollar strength, as well as falling commodity and energy prices. In an economic contraction exposure to foreign currencies is the primary risk faced by international businesses and investors. The world’s financial system is based on the dollar as reserve currency for all the others: it is the back-to-base option for international exposure. The trouble is that leverage between foreign currencies and the US dollar has grown to highly dangerous levels, as shown below.

Plainly, there is great potential for currency instability, compounded by over-priced bond markets. Greece, facing another default, borrows ten-year money in euros at about 6.5%, while Spain and Italy at 2.1% and 2.3% respectively. Investors accepting these low returns should be asking themselves what will be the marginal cost of financing a large increase in government deficits brought on by an economic slump.

A slump will obviously escalate risk for owners of government bonds. The principal holders are banks whose asset-to-equity ratios can be as much as 40-50 times excluding goodwill, particularly when derivative exposure is taken into account. The stark reality is that banks risk failure not because of Irving Fisher’s debt-deflation theory, but because they are exposed to a government debt bubble that will inevitably burst: only a two per cent rise in Eurozone bond yields may be sufficient to trigger a global banking crisis. Fisher’s nightmare of bad debts from failing businesses and falling loan collateral values will merely be an additional burden.

Prices

Macro-economists refer to a slump as deflation, but we face something far more complex and worth taking the trouble to understand.

The weakness of modern macro-economics is not based on a credible theory of prices. Instead of a mechanical relationship between changes in the quantity of money and prices, the purchasing power of a fiat currency is mainly dependent on the confidence its users have in it. This is expressed in preferences for money compared with goods, and these preferences can change for any number of reasons.

When an indebted individual is unable to access further credit, he may be forced to raise cash by selling marketable assets and by reducing consumption. In a normal economy, there are always some people doing this, but when they are outnumbered by others in a happier position, overall the economy progresses. A slump occurs when those that need or want to reduce their financial commitments outnumber those that don’t. There arises an overall shift in preferences in favour of cash, so all other things being equal prices fall.

Shifts in these preferences are almost always the result of past and anticipated state intervention, which replaces the randomness of a free market with a behavioural bias. But this is just one factor that sets price relationships: confidence in the purchasing power of government-issued currency must also be considered and will be uppermost in the minds of those not facing financial difficulties. This is reflected by markets reacting, among other things, to the changing outlook for the issuing government’s finances. If it appears to enough people that the issuing government’s finances are likely to deteriorate significantly, there will be a run against the currency, usually in favour of the dollar upon which all currencies are based. And those holding dollars and aware of the increasing risk to the dollar’s own future purchasing power can only turn to gold and subsequently those goods that represent the necessities of life. And when that happens we have a crack-up boom and the final destruction of the dollar as money.

So the idea that the outlook is for either deflation or inflation is incorrect, and betrays a superficial analysis founded on the misconceptions of macro-economics. Nor does one lead to the other: what really happens is the overall preference between money and goods shifts, influenced not only by current events but by anticipated ones as well.

Gold

Recently a rising dollar has led to a falling gold price. This raises the question as to whether further dollar strength against other currencies will continue to undermine the gold price.

Let us assume that the central banks will at some time in the future try to prevent a financial crisis triggered by an economic slump. Their natural response is to expand money and credit. However, this policy-route will be closed off for non-dollar currencies already weakened by a flight into the dollar, leaving us with the bulk of the world’s monetary reflation the responsibility of the Fed.

With this background to the gold price, Asians in their domestic markets are likely to continue to accumulate physical gold, perhaps accelerating their purchases to reflect a renewed bout of scepticism over the local currency. Wealthy investors in Europe will also buy gold, partly through bullion banks, but on the margin demand for delivered physical seems likely to increase. Investment managers and hedge funds in North America will likely close their paper-gold shorts and go long when their computers (which do most of the trading) detect a change in trend.

It seems likely that a change in trend for the gold price in western capital markets will be a component part of a wider reset for all financial markets, because it will signal a change in perceptions of risk for bonds and currencies. With a growing realisation that the great welfare economies are all sliding into a slump, the moment for this reset has moved an important step closer.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.