The Global Middle Class and Copper Consumption, A Stop Spike Event

Commodities / Copper Sep 27, 2014 - 04:12 PM GMTBy: Richard_Mills

Population growth reports say we can expect, barring WW lll or a virus like Ebola going airborne, upwards of 11.4 billion people on the planet by the 2060s. There's just over 7 billion of us now. A possible 50 percent plus gain in our numbers over such a short time is going to put enormous strain on our abilities to source the needed inputs for survival let alone bring those in the developing world up to the same level of amenities that we in the developed world have or expect to obtain.

Population growth reports say we can expect, barring WW lll or a virus like Ebola going airborne, upwards of 11.4 billion people on the planet by the 2060s. There's just over 7 billion of us now. A possible 50 percent plus gain in our numbers over such a short time is going to put enormous strain on our abilities to source the needed inputs for survival let alone bring those in the developing world up to the same level of amenities that we in the developed world have or expect to obtain.

Rising global scarcity of minerals - the metals our industrial and connected society uses every day to sustain its lifestyle - is a subject we will all become very familiar with. That's because there's no getting around the fact we live on a planet with a finite resource base and a growing population.

Lets state the obvious:

- For over the last twelve years supply has struggled to keep pace with demand

- Metal supply is finite and subject to compounding demand from developing nations

- Metal production is highly cyclical, with intermittent peaks and troughs which are closely linked to economic cycles - declining production has historically been driven by falling demand and prices, not by scarcity

- Rates of production and amounts of reserves continually change in response to movements in markets and technological advances

- Most mineral resources will not be exhausted in the near future

- If energy was cheap and unlimited then recoverable resources would be unlimited

But

- Discovery and development is increasingly becoming more challenging and expensive

- Average ore grades are in decline for most minerals, yet production has increased dramatically

- Our most important metals are suffering from declining ore quality and rising extraction (ore is a different and inferior chemical or structural composition) costs

- Our prosperity has always been based on the fact that producing resources yielded more resources than it cost. However the cost of *energy is climbing, the amount used is climbing but the returns from energy expended is declining. Eventually the quantity of resources used in the extraction process will be 100% of what is produced

- Most older existing mines, the foundation of our supply, have increasing costs with production rates stagnating or even declining

- The rate of discovery is not keeping pace with the rate of depletion, let alone being higher

*Energy can be thought of as a proxy for labor, materials, energy and externalities - environmental, community impact etc.

The Global Middle Class

The newly emerging middle class are a major contributing factor to the fundamental demand shift in global commodity markets and per capita consumption of commodities in developing countries is still only a fraction of the level it is in developed countries.

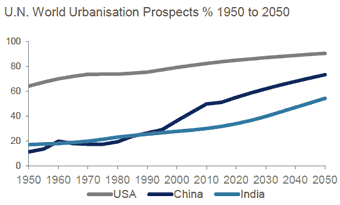

Infrastructure spending and increased discretionary spending by consumers are the key factors driving this rising demand - as more and more people in emerging markets move from rural areas to the cities, consumption will increase putting massive upward pressure on commodities.

The World Bank estimates that the global middle class is likely to grow from 430 million in 2000 to 1.15 billion in 2030. The bank defines the middle class as earners making between $10 and $20 a day - adjusted for local prices.

Most of the world's middle class has, until recently, been located in Europe, North America and Japan.

In the 1970s and 1980s South Korea, Brazil, Mexico and Argentina built sizeable middle-class populations. Today its China, India, Asia and Africa adding to the world's middle class. In 2000, developing countries were home to 56 percent of the global middle class, by 2030 that figure is expected to reach 93 percent.

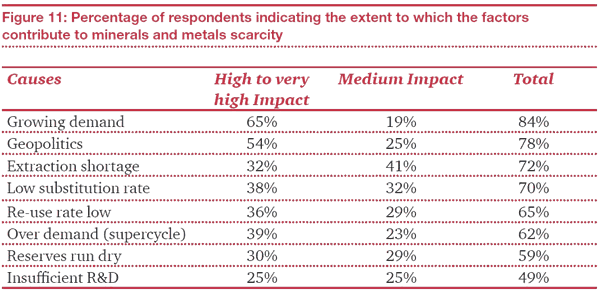

The following graph is from PricewaterhouseCoopers (PwC) 'Minerals and metals scarcity in manufacturing: the ticking timebomb.' A survey of senior executives of leading global companies on the impact of minerals & metals scarcity on business.

PwC

Let's take an in-depth look at the challenges the mining industry is facing going forward. Copper is a very good representative metal to use.

Copper Consumption

Per capita consumption of copper in the United States was 10 kilograms per person 1965, the same in 1995. In Japan per capita consumption increased from 6 kilograms per person to 11 kilograms per person over the same time period. Copper consumption in Korea in 1965 was less than 1000 tons. By 1995, Korea's consumption of copper had reached 637,000 tons, or more than 14 kilograms per person.

In China, even after years of economic growth, per capita copper usage is about 5.4 kg. As China's populace urbanizes, builds up its infrastructure and becomes more of a consuming society, there's no reason to suspect Chinese copper consumption won't approach or even surpass U.S., Japanese and South Korean levels. There's 1.3 billion people in China, even a slight increase in Chinese consumption will translate into enormous demand growth.

The preliminary purchasing managers' index (PMI) for China rose to 50.5, up from Augusts 50.2. Any number above 50.0 indicates expansion in the manufacturing sector; any number below, contraction. This is the fourth consecutive month that China's PMI has remained above the 50 mark - meaning manufacturing is stabilizing.

World Bureau of Metal Statistics data shows 12 month average copper consumption rising to a record in China (already the world's largest user of copper), while over the same time period use in the U.S. climbed to its highest since 2009. The U.S. is the world's second-largest consumer of the red metal. U.S. manufacturing activity hovered at a near 4-1/2-year high in September and factory employment surged. According to Morgan Stanley U.S. copper demand is expected to grow by 4.4 percent this year and is on track to expand for two consecutive years, the first time since 2000. New-home sales surged in August to the highest level in more than six years.

India, with its 1.2 billion people, is presently using 0.4 kg of copper per person. The country is modernizing and needs to invest heavily in electrical power infrastructure. According to the International Energy Agency (IEA), India's power production will need to rise by up to 20 percent annually to keep pace with its economic and population growth. Just meeting the required power target would double India's annual copper consumption.

India's economy grew by 5.7% in the three months to June, its fastest pace in two-and-a-half years. The new government of Narendra Modi is focusing on Asian partners China and Japan for enhancing investments in infrastructure and manufacturing. The growth model pursued by China and Japan - export oriented manufacturing, heavy infrastructure building and urbanization - has become India's blueprint for pushing growth up to and beyond the 7 percent mark.The annual world average per-capita consumption of copper is 2.7 kg.

Resource Nationalism & Political Risk

Resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory.

The major benefit for developing countries from natural resource development comes in the form of:

- Employment/wage's

- Government revenues - taxes, royalties or dividends

- There can also be indirect benefits such as knowledge and technology transfers.

- Foreign investments, made for off-take agreements, can also involve infrastructure investments, sometimes on a massive scale, like electricity, water supplies, roads, railways, bridges and ports.

Indonesia's President Yudhoyono prohibited ore exports from Southeast Asia's largest economy in January. He's betting that investment and higher prices would more than offset job cuts and lost revenue from unprocessed ore shipments. The Energy and Mineral Resources Ministry said on August 14th the ban on ore exports will remain in place. The curbs could spur as much as $18 billion in investment in processing plants by 2017, US$4.5 billion has been invested so far this year.

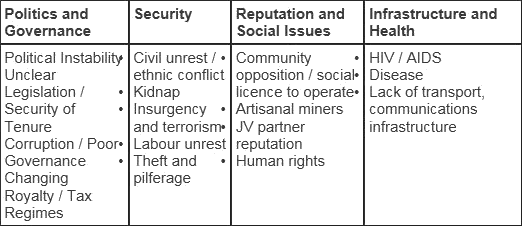

Resource extraction companies, because the number of discoveries was falling and existing deposits were being quickly depleted, have had to diversify away from the traditional geo-politically safe producing countries.

The move out of these "safe haven" countries has exposed investors to a lot of additional risk.

"National governments are no longer the only, or even in many cases the primary, source of political risk in mining projects. Political risk can stem from local governments, international and local NGOs, community groups, local competitors or any other group advancing political objectives. Similarly, the types of issues that mining companies have to deal with are quite varied. These range from having to deal with things like corruption, NGO scrutiny, maintaining a social license to operate, a lack of clarity over the implementation of mining legislation through to poor infrastructure and HIV/AIDS." ~ Ben Cattaneo, Managing political risk in mining

Human Resources

The Mining Industry Human Resources Council (MIHRC) estimates that over 60,000 people employed in the mining sector are expected to retire by 2020 but that the industry will need an additional 100,000 people just to maintain current levels of production.

The Petroleum Human Resources Council of Canada warned a severe oil patch labor shortage is looming and that the "patch" will need to hire 24,000 new employees by 2014.

In both industries the biggest demands will be for workers to replace staff who reach retirement age.

The existing shortage of skilled personnel and the imminent retirement of so many baby boomers (many are mid level managers) means the mining sector is in direct competition with the energy sector for people to train and prospects are bleak for either industry to obtain the necessary bodies and minds.

"One of the challenges facing Teck Cominco is the pending labor shortage. Almost 50% of our labor force is eligible for retirement over the next 10 years." Donald Lindsay, President and CEO, Teck Cominco Limited

Copper Talk

Kitco has a few things to say regarding copper:

"Further urbanization and industrialization of China, and to a lesser extent India, will continue to increase copper intensity; persistently threatening to overwhelm annual global copper production by 2019...

For many developed nations within the Organization for Economic Co-operation and Development (OECD), developing significant new (Greenfield) copper mining projects has become a serious challenge as stricter regulations, environmental concerns, and an inability to accurately predict capital expenditures (Capex) prohibitively increase project costs without removing the risk of significant political opposition...

Though mined production of copper is set to increase over the next few years, increasing demand and reduced capital investment for exploration and development of new deposits will likely lead to material supply shortfalls around 2020...

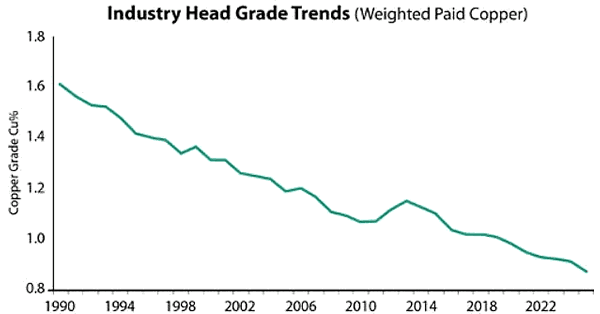

The long run trend of falling head grades for copper is an additional concern. Since 2000, average head grades for copper, without adjusting for production weightings, declined from 1.3% to 1.1% in 2012. Furthermore, the weighted average head grade for mined copper is likely less than 1% as several of the world's largest copper mines have been in production for many decades and are now mining extremely low grade ore (less than or equal to 0.5% Cu). As head grades decline, costs rise for a given tonnage." ~ Kitco.com, Multi-Year Global Copper Market Outlook

A Yale University study said new discoveries of copper have raised global reserves by just 0.63 percent per year since 1925 but usage has risen at 3.3 percent per year.

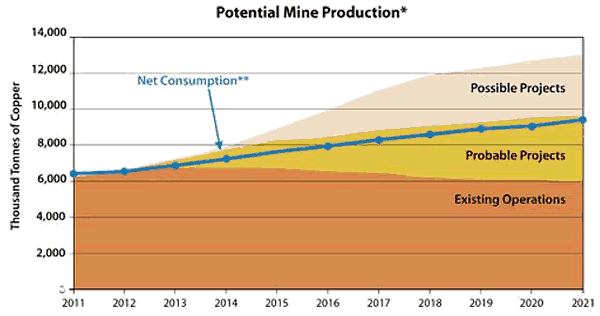

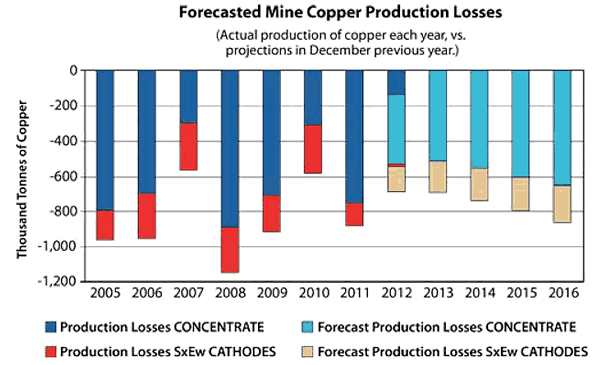

Over the past seven years, forecasts for world mine copper production have consistently exceeded actual production figures. An important take away from the graph below would be the decline in production from existing mines and how "Probable Projects" barely keep pace with expected consumption.

The chart below provides a graphic view of the decline in world average copper grades since 1985, plus the declining grade forecasts based on new mines under construction.

Source Brook Hunt

The metal content of copper ore has been falling since the mid 1990s. A miner now has to dig up an extra 50 percent of ore to get the same amount of copper. As grade drops the amount of rock that must be moved and processed per tonne of produced copper rises dramatically - all the while using more energy that costs several times more than it use to. With the lower grades of ores now being mined energy becomes more and more of a factor when considering economics.

Barclays said in February that the real expense of producing copper may be as much as 87 percent higher than back in 2007 due to higher labor and energy costs.

Miner and metals trader Glencore PLC forecast strong demand for copper from both China and the West in the latter part of 2014. Glencore also said the expected glut of supply in the market would be tempered by shortages of scrap metal and the risk of disruptions from both new and old mines.

Morgan Stanley said they were optimistic about copper prices because of acute shortages of copper scrap and strong copper demand.

Rio Tinto says growth will continue to be a challenge for several reasons:

- An increasing proportion of potential new supply is located in riskier countries.

- More challenging environments subject to a lack of infrastructure imply an increase in the capital intensity of new projects.

- Recent supply has continued to underperform with decreasing grades and disruptions impacting production.

- Major causes of supply disruption will continue, these causes being; Technical complexity, Project delays, Labor strike action

1m metric tonnes of new copper supply is required to be produced each year to keep up with copper demand. The following chart graphically illustrates how current projections for future copper production may be optimistic.

Source A. Gonzales

Correlation

Commerzbank said, in a March note to clients, that the market is not factoring in basic supply and demand elements, copper may have been oversold and the market is fairly tight meaning no long term justification for low prices.

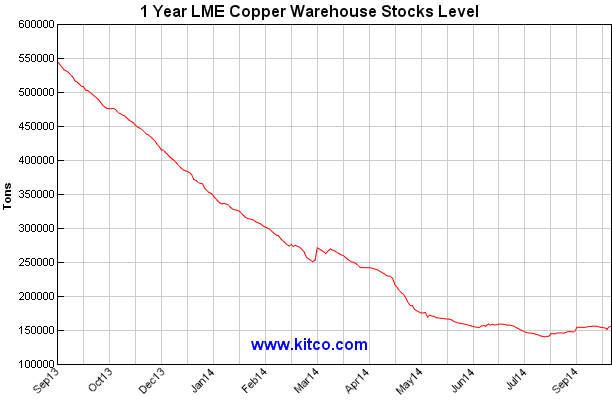

Global copper inventories have fallen by almost half this year and are near their lowest since 2008.

Data analysis by The International Copper Study Group (ICSG) shows there is a high correlation between supply/demand and the increase or decrease in warehoused copper inventories.If there's an increasing oversupply of copper than warehouse inventories should show a rising trend. A supply deficit of copper should be accompanied by falling inventories.

Below is a current chart of London Metal Exchange (LME) copper stocks.

Mining Facts:

- The low-hanging mineral fruit has been picked

- Metallurgy is becoming more complicated

- Energy is expensive and using more to achieve the same amount of production

- There is no substitute for many metals except other metals - plastic piping is one exception

- There hasn't been a new technology shift in mining for decades - heap leach and open pit mining come to mind but they are both decades old innovations

- Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and come with increased political risk

- Labor shortages loom, baby boomers are starting to retire en masse, and the resource-orientated talent pool is thinning out

- We're rushing headlong into shortages of resources and the conflicts generated from a lack of security of supply

Mine production of many metals shows us a number of similarities:

- Slowing production and dwindling reserves at many of the world's largest mines

- The pace of new elephant-sized discoveries has decreased in the mining industry

- All the oz's or pounds are never recovered from a mine - they simply becomes too expensive to recover

Conclusion

On September 16th 2014, copper futures on the Comex jumped the most in 13 months, triggering a brief trading halt. The cause? A news report had said China, the world's top metal user, had increased government stimulus measures by 500 billion yuan or US$81 billion.

Copper's price jumped as much as 4.1 percent on the news, the largest intraday increase since May 3, 2013. The increase triggered a "stop spike event" - a trading halt. Bloomberg said copper trading across all contracts was 70 percent more than the average of the past 100 days.

Now that's a jittery copper market and no wonder.

This author believes that today's worries have only temporarily unseated the commodities super-cycle with the recent sell-off being nothing more than a short downturn within a secular bull market for commodities.

Are metals, and perhaps a couple of copper junior resource companies, on your radar screen?

If not, it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2014 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.