Africa: The Good, the Bad and the Ugly

Economics / Africa Aug 16, 2014 - 04:34 PM GMTBy: Steve_H_Hanke

Last week, President Obama hosted the U.S.-Africa Leaders Summit in Washington, D.C. He welcomed over 40 African heads of state and their outsized entourages to what was a festive affair. Indeed, even the Ebola virus in West Africa failed to dampen spirits in the Nation's capital. Perhaps it was the billions of dollars in African investment, announced by America's great private companies, that was so uplifting.

Last week, President Obama hosted the U.S.-Africa Leaders Summit in Washington, D.C. He welcomed over 40 African heads of state and their outsized entourages to what was a festive affair. Indeed, even the Ebola virus in West Africa failed to dampen spirits in the Nation's capital. Perhaps it was the billions of dollars in African investment, announced by America's great private companies, that was so uplifting.

Good cheer was also observed in the advertising departments of major newspapers. Yes, many of the guest countries paid for lengthy advertisements -- page turners -- in the newspapers of record. That said, the substantive coverage of this gathering was thin. Neither the good, the bad, nor the ugly, received much ink.

What about the good? Private business creates prosperity, and prosperity is literally good for your health. My friend, the late Peter T. Bauer, documented the benefits of private trade in his classic 1954 book West African Trade. In many subsequent studies, Lord Bauer refuted conventional wisdom with detailed case studies and sharp economic reasoning. He concluded that the only precondition for private trade and prosperity to flourish was individual freedom reinforced by security for person and property.

More recently, Ann Bernstein, a South African, makes clear that the establishment and operation of private businesses does a lot of economic good (see: The Case for Business in Developing Countries, 2010). Yes, businesses create jobs, supply goods and services, spread knowledge, pay taxes, and so forth. Alas, in the Leaders Summit reportage that covered the multi-billion dollar investments by the likes of The Coca-Cola Co., General Electric and Ford Motor Co., the benefits of the humdrum activity of business and trade were nowhere to be found. But, as they say, "that's not the President's thing."

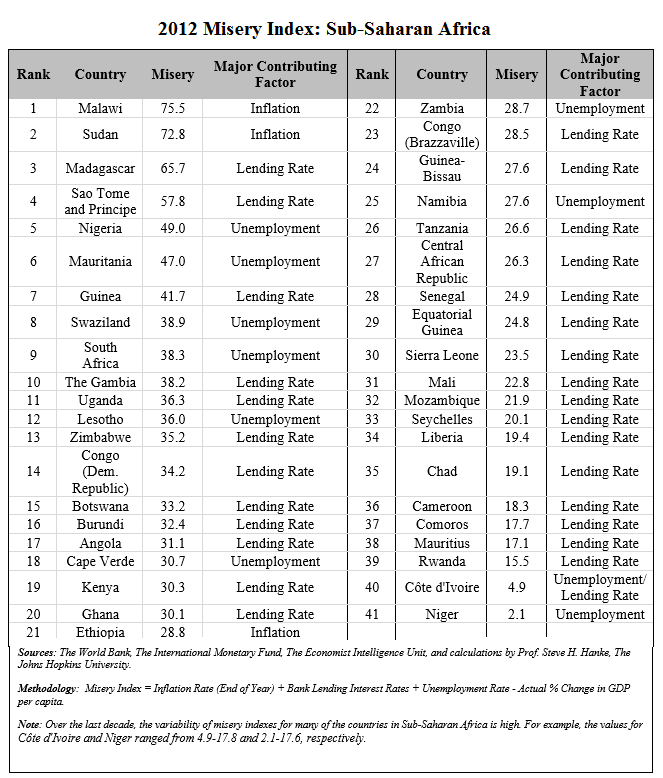

Let's move from the good to the bad and the ugly, and focus on the profound misery in Sub-Saharan Africa. I measure misery with a misery index. It is the simple sum of inflation, unemployment and the bank lending interest rate, minus year on year GDP per capita growth. Using this metric, the countries for Sub-Saharan Africa are ranked in the accompanying table for 2012.

As I discussed in my recent Globe Asia column, index scores of around 10 or below indicate a relatively free economy, and countries with scores around 20 indicate considerable dysfunction, requiring serious structural (read: free market) reforms. The Sub-Saharan rankings show that the region literally goes from bad to ugly. For most of these countries to be hospitable for private businesses and the prosperity they bring, huge structural reforms will have to be undertaken.

Can the governments govern? Are they up to the basic tasks which include: the maintenance of law and order; the effective management of monetary and fiscal affairs; and the provision of suitable institutions to support private activities?

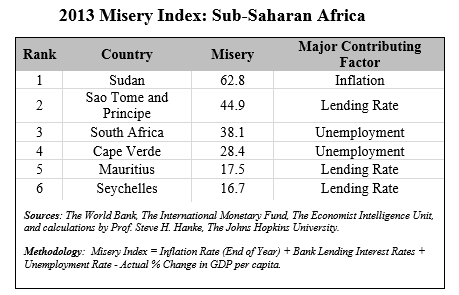

For governments in Sub-Saharan Africa, the ability to produce timely economic data sheds some light on these questions. For 2013, only six countries reported the data required to construct a misery index (see the accompanying table). For the other 42 countries in Sub-Saharan Africa, the basic economic data required to produce a misery index are 1.5 years out of date.

So, even if there is a will to tackle the enormous structural economic problems facing most of Africa's countries, do they have the capacity to deliver, or is everyone just pretending?

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2014 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.