Crude Oil Up and Down. Who Will Take Control?

Commodities / Crude Oil Aug 14, 2014 - 07:46 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 0.68% as the bearish report from the International Energy Agency and waning concerns over Iraq supply disruptions weighed on the price. As a result, light crude re-tested the strength of the support zone and approached the recent lows. Will we see a breakthrough in the next few days?

The International Energy Agency cut its 2014 global oil demand growth forecast by 180,000 barrels per day to 1.0 million due to lower‐than‐expected deliveries in the second quarter and the International Monetary Fund's weaker outlook for economic growth. The IEA said in its monthly oil-market report that the oil market looks better supplied than expected (despite armed conflict in Libya, Iraq and Ukraine), which had a negative impact on the price.

Additionally, Iraq's oil output still hasn’t been affected as the insurgency hasn't reached the southern part of the country, where main oilfields and export facilities are located. As a result, the commodity extended losses and dropped below $98 once again. Will we see further deterioration in the near future? (charts courtesy of http://stockcharts.com).

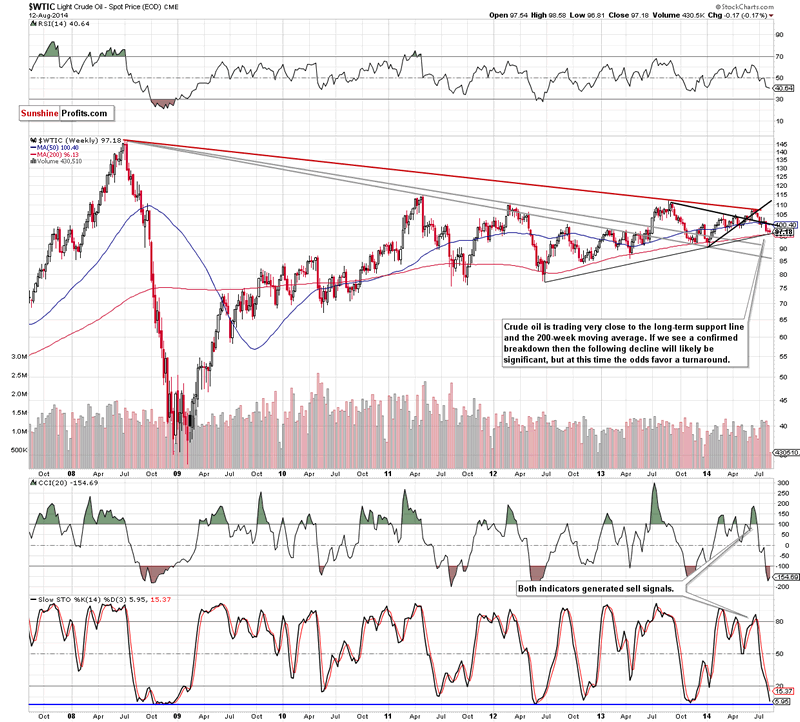

The situation in the long- and medium-term remains unchanged as crude oil is still trading in a narrow range. Therefore, what we wrote yesterday is still up-to-date:

The price currently rests at the long-term support. The combination of the rising support line based on 2 major tops and the 200-week moving average is something that should make you alert – it certainly makes us alert. The combination of these two support levels is strong enough to stop the current decline, but on the other hand, if it is broken, we will likely see a quite significant slide. Consequently, we keep monitoring this area with extra attention.

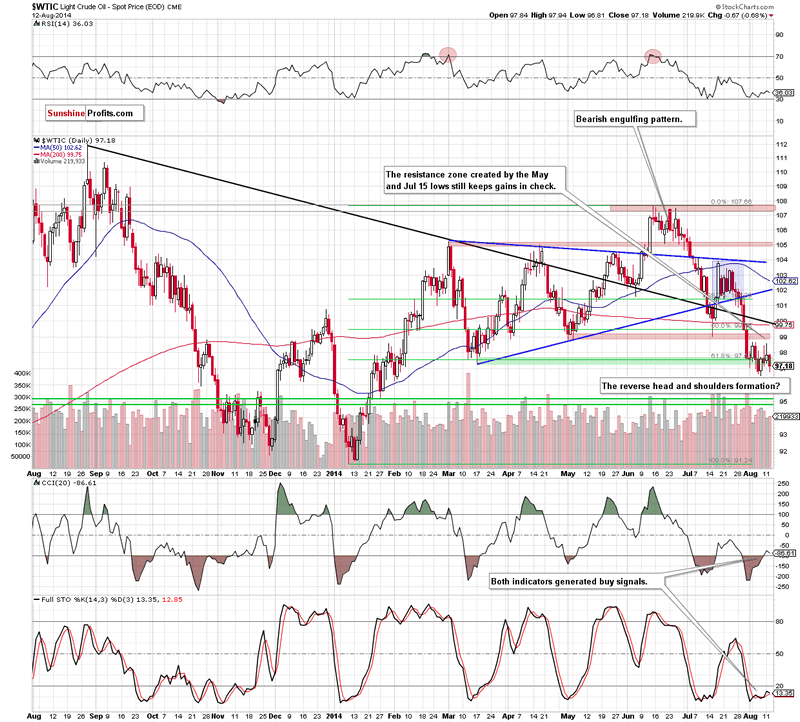

Can we infer something more from the very short-term perspective? Let’s examine the daily chart and find out.

On the above chart, we see that crude oil still remains between the recent lows and the resistance zone created by the May and Jul 15 lows, which makes the very short-term situation unclear. However, when we take a closer look at the chart, we can see a potential reverse head and shoulders formation. If this is the case, and the commodity is building a right shoulder at the moment, we may see a short-term trend reversal in the near future. Please note that this scenario is currently reinforced by the medium-term outlook that we discussed above and the current position of the indicators (the CCI and Stochastic Oscillator generated buy signals). Nevertheless, as long as there is no breakout above the neck line (based on the Aug 4 and Aug 11 highs), another sizable move is not likely to be seen.

Summing up, the overall situation hasn’t changed much as crude oil is still trading in a narrow range slightly above the rising, long-term support line and the 200-week moving average. Although we noticed a potential reverse head and shoulders formation, it’s too early to open long position as there is no breakout above the neck line and the nearest resistance zone still holds. Therefore, we think that it’s worth to stay on the sidelines waiting for another profitable buying or selling opportunity.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.