Dangerous Investor Choices - Black Swans on Final Approach

Stock-Markets / Financial Markets 2014 Aug 14, 2014 - 07:34 AM GMTBy: DeviantInvestor

There are several potential disasters that could disrupt the financial and political status quo, much like what happened after an Archduke was shot 100 years ago.

There are several potential disasters that could disrupt the financial and political status quo, much like what happened after an Archduke was shot 100 years ago.

Brutal Facts: From Simon Black regarding the experiences of US Navy Pilot James Stockdale in captivity in the "Hanoi Hilton" in the late 1960s.

"Who didn't make it out?"

"Oh, that's easy," replied Stockdale. "The optimists." ... "This is a very important lesson. You must never confuse faith that you will prevail in the end - which you can never afford to lose - with the discipline to confront the most brutal facts of your current reality, whatever they might be." (emphasis mine)

From David Stockman on Zerohedge:

"Our foreign policy is collapsing everywhere and yet the Washington war party keeps wanting to do more of the same. This confrontation with Putin is utterly out of hand and unnecessary. Now we have a trade war going that is going to ricochet through an already fragile European economy." ... "So those are the factors that will ultimately cause a major collapse. It's just a question of when the black swan comes flying in, or when the confidence in this whole central banking illusion finally breaks down in the markets."

From Ron Paul on US sanctions on Russia:

"The US government's decision to apply more sanctions on Russia is a grave mistake and will only escalate an already tense situation, ultimately harming the US economy itself. While the effect of sanctions on the dollar may not be appreciated in the short term, in the long run these sanctions are just another step toward the dollar's eventual demise as the world's reserve currency."

From Zerohedge and Steve Forbes' new book on money:

"Unstable money is a little bit like carbon monoxide: it's odorless and colorless. Most people don't realize the damage it's doing until it's very nearly too late."

Conclusions

Skip the unfounded optimism, forget "hope and change," ignore the media hype and face the brutal facts:

-

The world is overwhelmed with debt; far more debt than can ever be repaid with current dollars, yen, euros or pounds. The choices are massive inflation and/or default.

-

The rumblings from the "drums of war" are reverberating across the globe. War benefits bankers and military contractors so anticipating another large war is a reasonable expectation.

-

Sanctions, trade wars, currency wars, and shooting wars are destructive to almost everyone. Ask the French, Germans or English in 1919 what they thought about the First World War. Ask the Ukrainians, Palestinians or Israelis of today how much they like the current war.

-

The global economic system is heavily dependent upon confidence, especially confidence in the global reserve currency, the US dollar. This utterly essential confidence in the dollar is weakening, particularly as confidence in foreign policy decisions and global hegemony is deteriorating.

-

Unstable and devaluing money, exacerbated by too much debt, welfare and warfare, Quantitative Easing, leverage, derivatives, and weakening confidence will aggravate a long list of existing economic and political problems.

-

Markets, elections, and the media are managed and manipulated to ensure the survival of the status quo, the treasury market, and the stock market. But the S&P can be levitated only so long, and gold prices cannot be suppressed forever. The reversal time for both is near.

-

Gold shines in the face of unstable money, weakening confidence in the reserve currency, trade and currency wars, fear of another shooting war, crude oil supply disruptions, and destructive foreign policies.

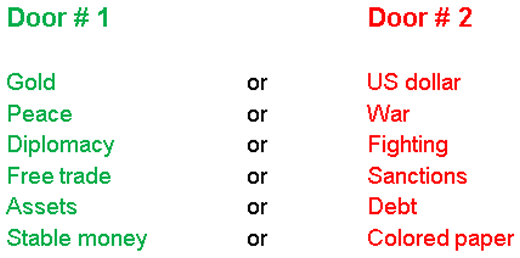

Choices:

There is still time to protect yourself from some of the dangerous consequences found behind door # 2. Consider hard assets, gold, silver, and land.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.