Trip through TSA—When Stock Diversification Gets out of Hand

Portfolio / Learning to Invest Aug 12, 2014 - 03:47 PM GMTBy: Don_Miller

There are only a handful of ways to protect your investment portfolio, and proper diversification is chief among them. No matter how well you do your due diligence on a single investment or how disciplined you are at executing trades, if your portfolio looks like a bridge party among pals who’ve known each other just a tad too long you’re in trouble.

There are only a handful of ways to protect your investment portfolio, and proper diversification is chief among them. No matter how well you do your due diligence on a single investment or how disciplined you are at executing trades, if your portfolio looks like a bridge party among pals who’ve known each other just a tad too long you’re in trouble.

Our team at Miller’s Money Forever hears stories all the time from friends and subscribers about “someone they know” (could have been themselves—we don’t pry) holding just one or two stocks and feeling dandy about it. I don’t want to seem overly dramatic, but these sorts of anecdotes keep me up at night. Why? Because even though investing isn’t the most difficult of all human endeavors (I’d argue that getting through a TSA line with a shred of dignity intact is much more difficult), there are rules of thumb that everyone should follow.

In real life, we all need one or two good friends and a soul mate. The market, however, is different. No one company can make you whole. Best friends do exist, but there is no such thing as a single, all-time best and safest stock. It’s better to have a hard-working team of stocks adding to your net worth each year.

How large and diverse should your team be? The easy answer is: it depends. It depends on your net worth and risk tolerance, the amount of time you can realistically spend monitoring your investments, buying, selling, and rebalancing your portfolio, taxes, and other nuances. Volumes have been written on proper diversification, and still there’s no one mutually agreed to viewpoint. Don’t fret! I won’t leave you hanging without a concrete answer.

The Right Number of Investments to Keep Your Portfolio Inline

Past research suggests that holding 15-30 investments at a time puts you in a safe and advantageous position. Fewer than 15 exposes you to too much nonsystematic, or company-specific, risk. Going in the other direction and buying 200 stocks is not the solution, either. It would be very demanding just to keep track of your holdings and rebalance your portfolio when needed, let alone follow the companies’ press releases and build models. This lack of control would make anyone uneasy, and you don’t want that.

In other words, holding too few stocks overexposes you to company-specific risk. There is actually some risk in holding too many stocks too. Having a dozen or so mutual funds invested in 30-40 stocks each is not a simple solution. Often times these funds are not as diversified as you might think, and all of their holdings tend to move in lockstep with one another in response to fluctuations in the market. While it may seem like the more stocks you have the safer you are, overburdening yourself with too many makes things difficult to manage and could actually reduce your yield.

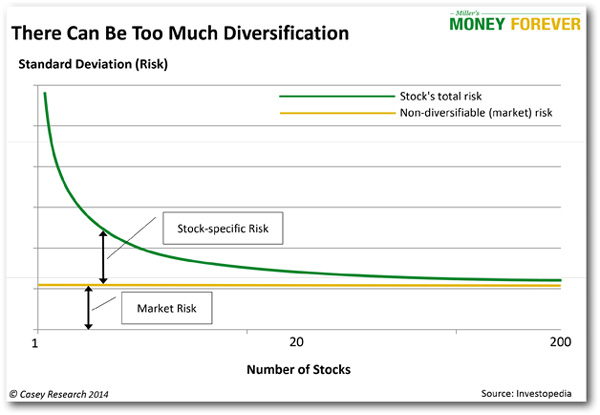

It’s been proven that a portfolio of just 20 properly chosen stocks provides enough diversification for an individual investor. Going significantly over that number will result in diminishing benefits. Take a look at the chart below.

The green line shows total risk a stock has; the yellow line shows systematic risk only, the one that all stocks are susceptible to. You cannot diversify away systematic risk.

The area between the yellow line and the green line is the nonsystematic, or company-specific, risk. It decreases dramatically as the number of stocks in your portfolio increases from 1 to about 20. It continues decreasing toward the market risk as the number of stocks goes up but the rate of the decrease slows. This is what we mean by the diminishing benefits of over-diversification.

For retirement money, 15-30 investments is the sweet spot. Also, those investments should be a diverse bunch spread across many sectors. You want exposure to growth of the US economy and the economies of foreign nations, equity and debt (bonds and bond funds), and large-cap companies and upstarts (it’s less risky to do that by investing in an intermediary run by venture capital experts, such as a business development corporation). Your portfolio should also be exposed to the energy production sector and infrastructure companies, foreign currencies, and physical commodities.

If that sounds like a tall order, note that you don’t have to fill it alone. My colleagues at Miller’s Money Forever and I have designed the Bulletproof Portfolio to take out all the guesswork for you. By continually combing through contrarian investments and performing rigorous, independent research, we’ve built a portfolio that provides optimal diversification, robust income, and the protection conservative investors want and retirement investors need.

Gain immediate access to the Bulletproof Portfolio by signing up risk-free for a 3-month trial subscription to Miller’s Money Forever. If you decide we’re not for you, just call or write within the first 90 days, and we’ll return every cent you paid, no questions asked. We’ll even prorate your refund if you change your mind after 90 days. You don’t have to go it alone. Start your no-risk subscription to Millers’ Money Forever now.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.