U.S. Economy Nothing New Under the Sun

Economics / US Economy Aug 12, 2014 - 07:08 AM GMTBy: Andy_Sutton

Probably the biggest reason this column has been silent for the past few months is that there has been so much to say; yet there is nothing really new to say. Sometimes I wonder how reporters do it. They write essentially the same story every week or month, but have to come up with different words and flavors. This is likely why the ratings for ‘news’ are so low these days. It isn’t because people have suddenly become adept at sorting the wheat from the chaff; it is just that the news, like most of our world, has become like a soap opera. You can take a few months off, come back, watch an episode or two, and be right back up to speed. Someone will be fighting someone over some doctrine that may or may not have changed.

Probably the biggest reason this column has been silent for the past few months is that there has been so much to say; yet there is nothing really new to say. Sometimes I wonder how reporters do it. They write essentially the same story every week or month, but have to come up with different words and flavors. This is likely why the ratings for ‘news’ are so low these days. It isn’t because people have suddenly become adept at sorting the wheat from the chaff; it is just that the news, like most of our world, has become like a soap opera. You can take a few months off, come back, watch an episode or two, and be right back up to speed. Someone will be fighting someone over some doctrine that may or may not have changed.

One group will be trying to steal from another while calling it something other than stealing. And yet another group entirely will be working around the clock to make the illegal legal, the insane sane, and the utterly preposterous somehow normal. Things don’t really change; there are just variations on a theme, and that theme is greed. Sadly, it penetrated nearly all levels of society. If you want to try this on for size, the next time you’re at a gathering ask everyone there what their definition of a ‘fair’ tax is. It is guaranteed to give you a chuckle.

The names, dates, and places change, but there is truly nothing new under the sun. The past decade has featured all sorts of buzzwords and terms like ‘management of expectations’, ‘quantitative easing’, and ‘jobless recovery’. When you look at it on face value, we’ve seen the themes of yesterday become the themes of tomorrow. While there may a small bit of predictive value in estimating how these things will all play out, it is more than likely an exercise in futility because if something begins to work for the target group, the rules will be changed. And for the most part, if you’re reading this, then you are likely part of the target group.

GDP – Can’t Have Two In a Row

When the revised Q1 numbers were released, I rather sarcastically posted on my blog that it would be interesting to see if the establishment would admit a recession in the middle of an election cycle. The theme of Q1 was ‘blame the weather’. It was cold so people didn’t spent money. On anything. You’d think, based on the rhetoric, that the American consumer forgot its collective wallet and lost its credit card. Yet a quick look at the borrowing habits shows that during Q1 Americans managed to rack up nearly an additional $70 billion in consumer credit. This doesn’t include mortgage debt. Ironically, during Q1 2013, the increase in consumer credit came in at just $40 billion – almost half that of 2014.

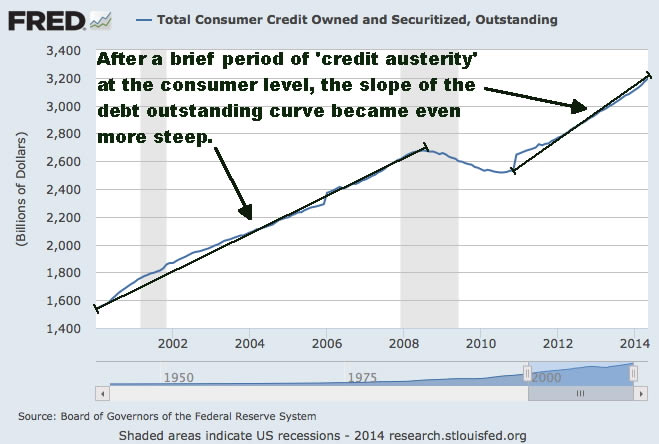

Why pick on consumer credit, as has been a recurring theme in this column since inception? It is because the US brags a consumer driven economy, with spending accounting for roughly 70% of economic activity. So if one is to endeavour to understand the USEconomy, one had best understand the consumer since it is the linchpin of the system. Notice the chart below, showing consumer credit outstanding since 1/1/2000, when most non-Keynesian economists are willing to admit that the economic/monetary cycle changed.

Going into the great crash of 2008, consumer credit had been growing steadily, but its overall contribution to the economy over the 8-year period remained fairly constant in that while the overall debt load was increasing, the rate of acceleration (shape of the curve) was fairly constant. The function remained fairly linear over that period. Then we had a brief period of credit austerity from around the end of 2009 through the beginning of 2011 where the American people actually got a bit of responsibility and paid off some debt.

However, the relief was short-lived and when we emerged from that austerity, we notice a subtle but distinct change in the rate of debt accumulation as the slope of the line increased. It is too early to tell if this is a trend or not, but if you look at the last year on at the end of the chart you’ll notice that the slope has increased once again. We’ll need another year or so to see if this develops into another trend shift or not, but it is worth noticing, especially when you consider how monetary and economic events are becoming more and more compressed from a time perspective. I’m not going to get into the slope calculations; for the purposes of understanding what is going on here, the qualitative analysis will suffice. Sometimes a picture truly is worth a thousand words.

What the above means is that the rate of debt accumulation has increased when compared to ‘pre-austerity’ levels and borrowing has become a bigger component of the still consumer-driven economy.

What is ironic is we have a situation in which, when some common sense is applied, we end up with something of a ‘divide by zero’ error. Let’s set the table:

- The US experiences the worst quarter of GDP growth in nearly five years in Q1 2014, sporting a -2.11% annualized growth rate.

- During this period, consumers add an additional $70 billion to their tab – not counting mortgage debt.

- During this period, there were over 91 million Americans not in the workforce.

- By comparison, the y/y comparison for the same quarter in 2013 shows consumers adding ‘only’ $40 billion in consumer debt while the USEconomy ‘grew’ by 2.74% annualized.

- There were almost 89 million Americans not in the workforce during the same period in 2013.

So we have fewer workers and consumers racking up more debt in 2014 than the year before and yet the economy manages to tank. The weather is blamed, of course, and the mainstream hedges its bets by saying that growth is already looking to rebound for Q2 as ‘pent up demand’ is unleashed by warmer temperatures. Miracle of miracles, the initial results for Q2 show a near 4% (3.94% initial) annualized growth rate. Incidentally, as this article goes out, consumer credit numbers have arrived and consumers piled on nearly $65 billion in additional debt during Q2 GDP, most of it being auto loans at first glance. Don’t forget also that the GDP formula was jiggered last year to allow more items to count as growth in GDP calculations so keep that in mind as you perform your own analyses.

Obviously neither of these trends is good. Less workers collecting more handouts from government and the rest borrowing more and at an accelerated rate. Further study will be necessary over a longer period of time to see how much of a determinant consumer borrowing represents with regard to economic ‘growth’, but we can draw a pretty simple conclusion – and again this is no surprise and I’ve said it before – there is no recovery. We can take this a step further and say the data suggest that borrowing cannot adequately replace jobs and working in terms of growth. Shocking huh? Add to this the fact that borrowing is reversible in that excess work is necessary at some point to pay off the borrowed money and the picture becomes all the more clear. But we already knew that!

The above facts and analysis jive nicely with a piece Eric Sprott compiled a few weeks ago, which takes a look at what America would look like minus all the handouts and government ‘prop-up’ programs. You can take an abstract plus a link to the actual work here. What should be notable to people is that Eric and myself came to essentially the same conclusions by looking at the same situation from two very different standpoints. He analyzed the welfare state whereas I analyzed the consumer’s own prop-up mechanism – credit. The interesting factoid here is that consumers either aren’t willing or aren’t able to fill the gap entirely on their own without borrowing and more and relying on the government every month to make ends meet. This is precisely what the central planners want, by the way. Independence is a dirty word to these people. They prefer dependence – on themselves through their tool – government. Basically it is a big power trip, but again, this is no big revelation.

Rigged Statistics and ‘Macroprudential Regulation’

In considering the above, one must weigh the reality of rigged statistics into the analysis. There have already been several mainstream articles written about how US and even global financial markets are rigged. The admission always comes after it is so blatantly obvious that even the dimmest bulb puts out enough light to expose it. Markets and stats aren’t rigged for the benefit of Joe Average either. So it is much likely that the situation is even worse than what is portrayed above. That is another reason I prefer to show you qualitative rather than quantitative analysis with scads of numbers that end up meaning almost nothing when a picture will suffice.

We’ve been over the rigging of the jobs numbers with the birth/death model, among other gimmicks, time and time again. GDP is a joke with government borrowing counting as ‘growth’, among other such statistical niceties. Rigged statistics are part of the ‘management of expectations’ theme discussed at the outset of the article. Few outside the circle of those who happen to be genuinely concerned – either for intellectual or patriotic reasons – will spend the time necessary to read an analysis of these matters let alone go and do the research for themselves. Again, nothing new under the sun.

All that said, it is very unlikely that we’ll have the spectacular crash that so many have been profiting off the prediction of and preparation for these past few years. Sure, another 2008 is certainly on the table, especially when one considers the greed motive and the fact that the institutions that caused 2008 have been given even more power over the financial system and have been allowed by our leaders (and ourselves!) to attach the well-being of the entire economy to their scandalous activities. There is no denying that we’re in a state of persistent crisis. There is always something going sideways somewhere these days. That will continue, but it will very likely be in the slow burn, put you to sleep fashion we’ve seen over the past 5 years rather than a knock your lights out display of economic pyrotechnics. So if you’re paying monthly subscription fees to these doomsday, Chicken Little publications, there is an excellent chance you’re wasting your money.

Exhibit one in this regard is the not-so-USFed’s ‘new’ doctrine of macroprudential regulation. Not only are they in charge of monetary policy, but now are suddenly in the risk management business as well. This makes no sense until you understand whom the ‘fed’ works for. The ‘fed’ being in the risk management business is ludicrous since it is the institution’s very owners who are responsible for generating the risk to begin with. Of course we already knew that and of course the ‘fed’ has been playing CYA for the largest banking institutions for decades now. Again, not a thing new under the sun, just another piece of jargon to describe something that already existed.

It is mechanisms and schools of thought such as what is outlined above that allow central planners to pseudo-engineer these crises to be self-limiting in nature. Think about 2008. It was called a credit crisis. The very idea of a situation where banks are afraid to lend to each other is absolutely insane when you take a step back and look at it. First of all, the banks were assured of a backstop. They own the preferred stock of the institution that creates the money and the monetary policy. The idiotic notion that nobody wanted to be caught dead at the discount window is nonsense too. By that logic, nobody would have taken TARP money, but the bobbleheads on the business networks forgot to mention that bit of logic. People need to grow up. 2008 was a managed looting of the middle class, just like 1929 before it. While it is certainly true that these institutions are notorious for cannibalizing each other (as is likely what happened with Lehman), there is no bunch on the face of this earth that is better at ganging up on the middle class than the banksters. And they do it on a global scale. ‘Macroprudential regulation’ is nothing new, but is merely a justification for another ongoing practice that will work to the detriment of the little guy.

Or maybe it is just that Janet Yellen needs her own buzzterm. After all, Volcker had the ‘Volcker Rule’, Greenspan’s buzzterm was ‘irrational exuberance’, and Bernanke’s was ‘quantitative easing’. Since none of the three previous buzzterms added anything in the way of new knowledge or understanding, perhaps it is par for the course that ‘macroprudential regulation’ adds nothing as well.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.