Commodity Currencies

Currencies / Forex Trading Aug 05, 2014 - 10:33 PM GMTBy: Ed_Carlson

Keeping an eye on the currencies of big commodity producing nations not only provides us insight into demand for commodities but the health of emerging markets as well.

Canadian Dollar (CAD) was turned back at the 38.2% retracement of the 2012 decline (part of the 2011 bear market). With the break of the bear flag last week it appears the bear market rally is over.

Figure 1 Canadian dollar

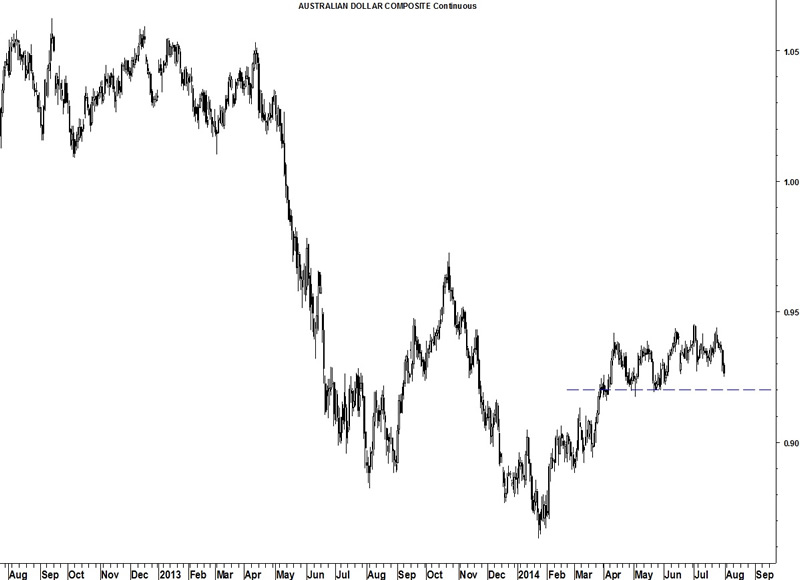

Australian Dollar (AUD) has been like watching paint dry since April. As long as support at 0.92 remains intact we have to assume the bear market rally is too. But with the break down in the CAD the Aussie is probably on borrowed time.

Figure 2 Australian dollar

The secular bear cycle in commodities is due to end near the end of this year.

Get your copy of the July Lindsay Report at SeattleTA

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2014 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.