China’s Stock Market Finally Looks Like A Buy

Stock-Markets / Chinese Stock Market Jul 26, 2014 - 01:59 PM GMTBy: Sy_Harding

Is China’s economy, the second largest in the world, a disaster coming down to a hard landing, which has been the popular forecast for four or five years now? Or is it merely slowing from unsustainable double-digit growth of more than 12% a few years ago, to a more reasonable and sustainable pace?

Is China’s economy, the second largest in the world, a disaster coming down to a hard landing, which has been the popular forecast for four or five years now? Or is it merely slowing from unsustainable double-digit growth of more than 12% a few years ago, to a more reasonable and sustainable pace?

This week the International Monetary Fund cut its forecast for China’s 2014 economic growth to 7.4% from its 7.5% forecast in April.

At the same time, it cut its forecast for overall global growth in 2014 to 3.4%, and for 2014 growth for the U.S. economy to just 1.7% from its forecast of 2.8% three months ago.

Iinvestor concerns are that the twin bubbles in China’s real estate market and the nation’s credit structure, and its underdeveloped financial markets, will result in a hard landing for its economy. Those concerns have had China’s stock market in a long bear market in which it has declined 65% since its peak in 2007, and 39% from its peak in 2009.

As a result, the Shanghai Composite is selling at just 7.9 times 12-month projected earnings, down from its 5-year average P/E ratio of 11.3. Meanwhile, in the U.S. the S&P 500 has been in a powerful bull market since 2009, which has it selling at 18 times projected earnings.

Those are interesting comparisons. An economy projected to grow 7.4% in 2014 has a stock market plunged to a five-year low and selling at only 7.9 times earnings, while an economy projected to slow to 1.7% growth has its stock market at a five-year high, and selling at 18 times projected earnings.

Perhaps it is justified.

Sentiment for the U.S. economy and market is at high bullish levels of bullishness and complacency, even though the U.S. Fed is cutting back its stimulus. Sentiment for China’s economy and stock market remains negative in spite of aggressive moves by China’s government to protect and re-stimulate its economy, and impressive economic reports in recent months that indicate the moves are working.

China has been spending aggressively on the nation’s infrastructure to produce jobs. It cut reserve requirements for banks. In March, it issued rules allowing banks to sell preferred stock, providing another avenue for banks to raise their capital to healthier levels. This week it ruled that China’s banks can roll loans for “qualified” companies facing liquidity problems over into new loans, to avoid defaults.

On the economy, early this month China reported its third-largest quarterly trade surplus on record.

This week HSBC reported that its flash China PMI Mfg Index rose to 52 in July from 50.7 in June, and 49.4 in May. Within the index; new orders, new export orders, backlogs, employment, and prices all improved. It was the most positive PMI report since early 2013.

However, Norman Chan, investment director at NAB Private Wealth Advisory says, “Sentiment on China is so negative that every piece of good news is treated as the glass being half empty.”

Alastair Chan, an economist at Moody’s Analytics, says the big challenge for China will be to control what has been runaway property price inflation without deflating the market and sparking a significant economic downturn.

That has been the main concern for the last five years.

However, there are more positive voices showing up lately.

Dai Ming, at Hengsheng Hongding Asset Management in Shanghai, says, “There’s a consensus growing that China’s economy can stabilize.”

Peter Sartori, head of San Equities at Nikko Asset Ltd in Singapore, said in an interview with Bloomberg, “We have been underweight the Chinese banks for many years. The time is right to reassess. China’s banks have stopped underperforming - but there will have to be more reforms in China for banks to start outperforming.”

Mark Mobius, well-known chairman of Templeton Emerging Markets Group, says the new rally in China “is sustainable because of the incredible amount of money available for the market. Banks are sitting on a lot of fuel to add to the fire.” He projects a further gain of 20% for China’s stock market.

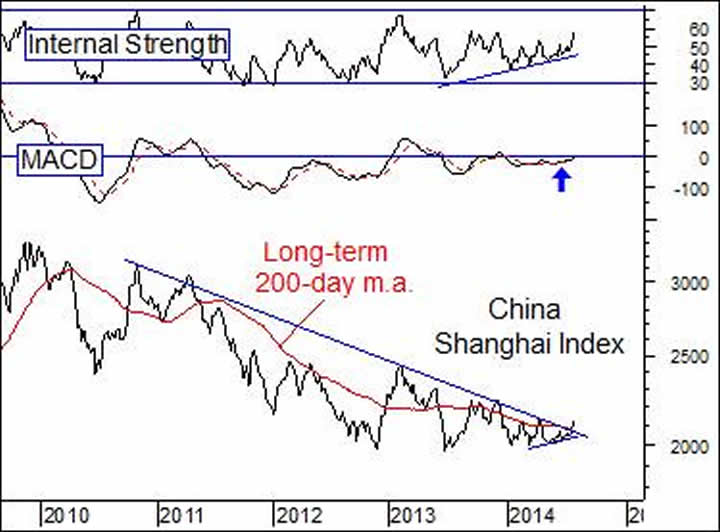

Meanwhile, the consensus of our technical indicators triggered a buy signal on China, and the Shanghai Index has broken out above its long-term 200-day m.a., and through the trendline resistance that stopped all its rallies of the last several years.

Mark Mobius, well-known chairman of Templeton Emerging Markets Group, says the new rally in China “is sustainable because of the incredible amount of money available for the market. Banks are sitting on a lot of fuel to add to the fire.” He projects a further gain of 20% for China’s stock market.

Meanwhile, the consensus of our technical indicators triggered a buy signal on China, and the Shanghai Index has broken out above its long-term 200-day m.a., and through the trendline resistance that stopped all its rallies of the last several years.

It’s interesting that Bloomberg reports that since the advance began investors pulled $700 million out of U.S. ETF’s tracking China’s market. Could that be another example of investors pulling money out of markets after bear markets have ended and new bull markets have begun? My column last week showed how investors held all the way through the 2007-2009 bear market in the U.S., and only pulled money out after it ended (and continued to do so through 2010, 2011, and 2012).

We believe our technical buy signal is supported by China’s improving economic fundamentals.

Given the valuation levels and risk in the U.S. market, there is also an attraction to a market that has so clearly demonstrated an ability to move independent of the U.S. market.

In the interest of full disclosure, my subscribers and I have a position in the SPDR S&P 500 China ETF, symbol GXC.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.