The Hard Facts of Manipulated Economic Statistics

Stock-Markets / Financial Markets May 09, 2008 - 02:34 PM GMT

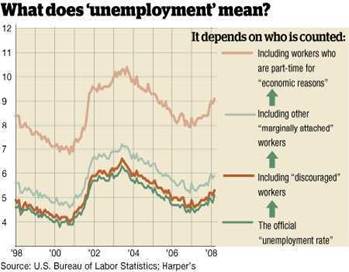

The debasement of the economic indicators by our federal government is finally getting some attention from the public media . All of the indicators, including the money supply, the unemployment statistics and inflation are being “doctored” to make thing appear better than they are.

The debasement of the economic indicators by our federal government is finally getting some attention from the public media . All of the indicators, including the money supply, the unemployment statistics and inflation are being “doctored” to make thing appear better than they are.

Unfortunately, consumers, businesses and government entities base their assumptions on these false numbers and make far-reaching decisions that have serious ramifications on the outlook for the future.

For example, the amount of junk bonds sold by corporations has reached astounding levels in the past year, based on an economic recovery that wasn't. More than $22 billion of debt issued by companies with lower credit ratings comes due the next three quarters, meaning they'll have to borrow amid a hostile debt market. Next year, companies with lower credit ratings see $40 billion in debt come due, and the amount will be double that each year through 2014.

The next crisis for consumers is already here. Credit card defaults . Our normally optimistic consumer has overloaded himself with credit card debt after their homes wouldn't support any more refinancing. The figures on credit card debt show a $34 billion increase in the first quarter, the most since the first quarter of 2001, when we were in the last “official” recession.

Another unforeseen consequence of the credit market is that municipalities are now facing bankruptcy. The housing boom gave municipalities a reason for expanding their services. Unfortunately, they are learning that the expansion was unsustainable.

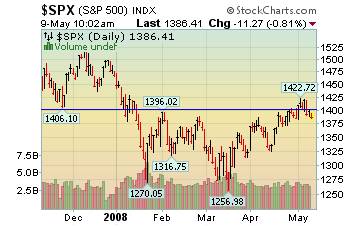

As losses climb, how will the S&P?

The S&P 500 is down 5.7 percent this year as losses at the world's largest financial firms have climbed to more than $321 billion following the collapse of the subprime mortgage market. Profits have slumped 18 percent on average for the 420 companies in the index that have reported first-quarter results so far, led by an 86 percent decline at financial companies, data compiled by Bloomberg show.

Inflation fear is back in the bond market.

The flight-to-safety argument for bonds last year has apparently given way to flight from inflation . The headline consumer price index has been running at or above 4 percent on a year-over-year basis for five consecutive months as of March, and is forecast to have held there again in April. The last time it consistently ran at those levels was early in 1991, when the 10-year Treasury note yield traded mostly above 8 percent.

The flight-to-safety argument for bonds last year has apparently given way to flight from inflation . The headline consumer price index has been running at or above 4 percent on a year-over-year basis for five consecutive months as of March, and is forecast to have held there again in April. The last time it consistently ran at those levels was early in 1991, when the 10-year Treasury note yield traded mostly above 8 percent.

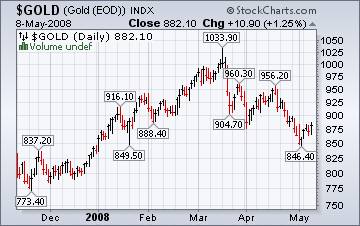

Is gold rising…or falling?

Analysts claim that gold moves in line with high oil prices as investors hedge against inflation and counter to the dollar as it is seen as an alternative asset.

Analysts claim that gold moves in line with high oil prices as investors hedge against inflation and counter to the dollar as it is seen as an alternative asset.

Unfortunately, while there may be some correlation between the price of oil and gold, that relationship is not in 100% agreement. Had you put your money in oil in the past two months, your investment would be up over 16.25%. Meanwhile, your investment in gold would have lost about 15%. It would be more accurate to say that, from time to time, their cycles may run in parallel patterns. This is not one of them.

The gain chasers were set up for a disappointment.

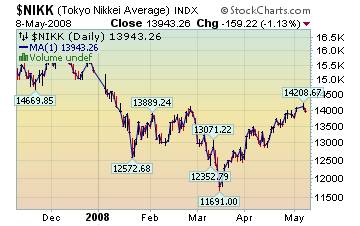

Most Asian markets fell Friday, with Japan 's key stock index dropping more than 2 percent following Toyota 's bleak earnings projection.

Most Asian markets fell Friday, with Japan 's key stock index dropping more than 2 percent following Toyota 's bleak earnings projection.

In Tokyo, sentiment was downbeat throughout the day after investors were jolted by Toyota Motor Corp.'s announcement Thursday that its fiscal fourth quarter profit dropped 28 percent from a year ago and that it expected this fiscal year's profit to tumble 27 percent.

That would be the carmaker's first decline in annual earnings in seven years. So much for chasing gains.

The Shanghai rally nearing an end.

Chinese stocks fell Friday (not shown on chart) as newly released inflation data revived worries of further credit tightening.

The Shanghai benchmark fell as much as 2.9 percent earlier in the day after the government reported that the producer price index, a key inflation indicator, rose 8.1 percent in April compared with the same month a year ago.

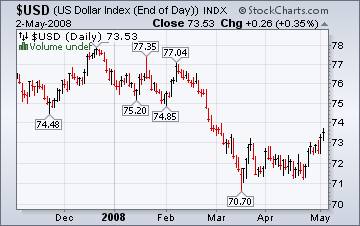

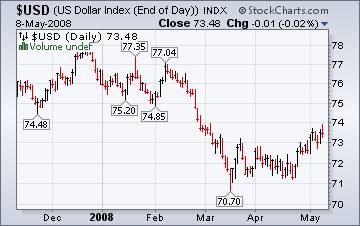

Media still talking “Weak Dollar.”

Official figures show that the US trade deficit shrank to $58.2 billion in March from a revised $61.7 billion a month earlier, as the weak US dollar fuelled a surge in exports. The gap was narrower than economists had expected.

Official figures show that the US trade deficit shrank to $58.2 billion in March from a revised $61.7 billion a month earlier, as the weak US dollar fuelled a surge in exports. The gap was narrower than economists had expected.

Traders continued to unwind expectations that the Federal Reserve might start raising interest rates at the end of the year. In the meantime, the dollar may end up surprising the pundits.

Fannie is misbehaving badly. Where will it end?

Some financial experts worry that Fannie Mae and Freddie Mac are dangerously close to the edge, especially if home prices go through another steep decline. Their combined cushion of $83 billion — the capital that their regulator requires them to hold — underpins a colossal $5 trillion in debt and other financial commitments. This represents leverage of over 60-to1. Several hedge funds went under with leverage of 25 and 30-to-1 leverage. Will these companies fare any better? Fannie Mae – or may not!

Some financial experts worry that Fannie Mae and Freddie Mac are dangerously close to the edge, especially if home prices go through another steep decline. Their combined cushion of $83 billion — the capital that their regulator requires them to hold — underpins a colossal $5 trillion in debt and other financial commitments. This represents leverage of over 60-to1. Several hedge funds went under with leverage of 25 and 30-to-1 leverage. Will these companies fare any better? Fannie Mae – or may not!

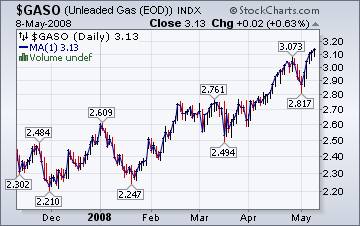

Whipsaw at the gasoline pumps!

Retail gasoline prices have jumped to yet another record high, drivers' advocacy group AAA's Web site showed Friday. The national average price for a gallon of regular unleaded gasoline rose 2.6 cents to $3.671, breaking the record set the previous day. It was the second day in a row that gas prices set a record, and follows a 17-day streak of record-breaking days that ended May 1.

Retail gasoline prices have jumped to yet another record high, drivers' advocacy group AAA's Web site showed Friday. The national average price for a gallon of regular unleaded gasoline rose 2.6 cents to $3.671, breaking the record set the previous day. It was the second day in a row that gas prices set a record, and follows a 17-day streak of record-breaking days that ended May 1.

The Energy Information Administration's This Week In Petroleum tells us that One reason for the rising gasoline prices is the increase in demand as drivers roll down their windows and venture farther into the great outdoors. Another important, but less well known, reason is that May 1 marks the date for most of the country when more expensive-to-produce summer-grade gasoline is required (April 1 in southern California ).

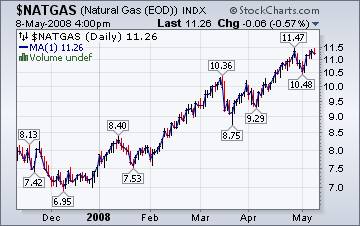

Relief could be on the way.

The Natural Gas Weekly Update claims that “ The Independence Hub can process approximately 1 Bcf of natural gas capacity per day, which is about 10 percent of the natural gas produced in the Gulf of Mexico . According to Reuters, natural gas production at the Independence Hub is expected to resume by mid-May. The resumption of natural gas production at the Independence Hub should ease natural gas prices.

The Natural Gas Weekly Update claims that “ The Independence Hub can process approximately 1 Bcf of natural gas capacity per day, which is about 10 percent of the natural gas produced in the Gulf of Mexico . According to Reuters, natural gas production at the Independence Hub is expected to resume by mid-May. The resumption of natural gas production at the Independence Hub should ease natural gas prices.

Gathering Storms.

Thomas Kostigen, ( Marketwatch ) Writes that a deadly threat lurks just off our shores and we a not prepared for it. Unlike Myanmar , s o far, no mega cities have been whacked by crushing storms. We shouldn't wait until that happens (which without proper warning systems and procedures, just might).

“With so much attention being given to the tragedy in Myanmar -- new figures put the number of dead or missing at 70,000 due to the devastating effects of Cyclone Nargis -- it's worth looking at our own shores for potential catastrophe: Half the U.S. population lives within 50 miles of seashore.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

I am now a regular guest on www.yorba.tv every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.