U.S. Housing Buyers Fools Paradise. Lying Spanish Banks...

Stock-Markets / Financial Markets 2014 Jul 18, 2014 - 12:29 PM GMTBy: Ty_Andros

There is no shortage of interesting items to choose from. The world is unraveling fast and the absurdities just keep piling up. Here are a few from the last week...

There is no shortage of interesting items to choose from. The world is unraveling fast and the absurdities just keep piling up. Here are a few from the last week...

- The Wizards of LIBERTY Street

- Big Buyers in a fool's paradise

- Is the TOP in for European Banks?

- Spanish Banks, Lying with numbers.

- David Letterman's top 10 reasons to vote democrat

- Huckabee and the truth about the US border crisis

- The REAL cost Illegal Immigration

- Militarization of the UNITED STATES

- Honest Abe and three Benedict Arnolds

The Wizards of LIBERTY Street

Most everybody has seen the Wizard of Oz, but most don't understand that it is a story about the removal of Gold from behind the dollar and the Federal Reserve at that time. The wizard was supposed to be the Federal Reserve chairman of that time, pulling levers on the economy and managing it from the seat of his pants. Well, nothing has changed. Fed chair, Yellen, commenting on recent legislation urging the Fed to create some rule like the Taylor rule (mathematical rule to guide interest rate decisions based upon GDP growth and inflation) to guide future interest rate decisions.

"It would be a grave mistake for the Fed to commit to conduct monetary policy according to a mathematical rule." - Janet Yellen

Keep in mind the fed has been flying by the seat of its pants since the Global financial crisis erupted. Policies previously UNSEEN in history (other than Zimbabwe, the Weimar republic, Argentina and previous hyperinflations) such as UNLIMITED money printing and zero bound interest rates for almost 6 years are illustrations of financial and monetary system on life support. Money at no cost to the banks and government but priced expensively for the public, and savers who earn nothing on their accumulated life savings.

The very idea that unaccountable mandarins of money need to play with no rules or guidelines should have been halted decades ago. Now, it is TOO LATE to DO SO. Normalization of rates will bring down more things than any of us can imagine as the world is awash in financial assets which yield little or nothing. Malinvestments in the classic Austrian definition.

Big Buyers in a fools paradise

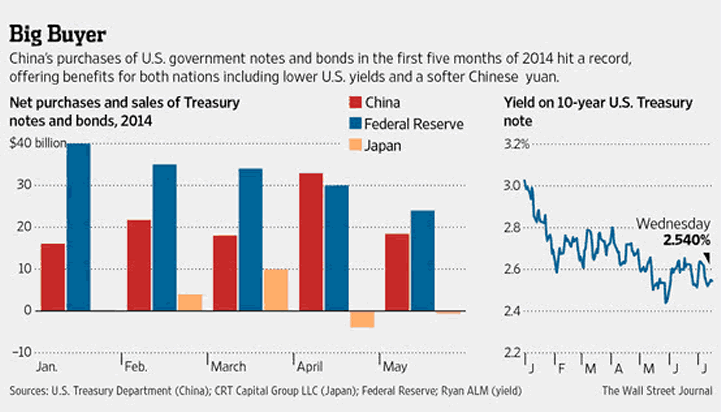

The mortgage markets are dead meat to investors unless the issues are "government guaranteed" and it would appear much of the US treasury market is unattractive to the private sector as well. Taking a look at treasury issuance since January, the vast majority of them have been hoovered up by central banks, most notably the Federal Reserve, Bank of China and Japan.

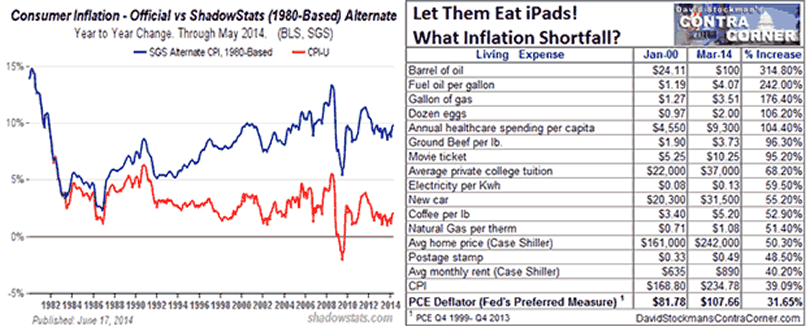

Looking closely at the purchases reveals the fed is the dominant buyer. It has monetized over 50% of US debt since 2009. Is it for quantitative easing purposes as they say or FUNDING of the DEFICIT? To me, it is the latter, regardless of the story they say. In real terms, inflation is probably 9 to 10%.

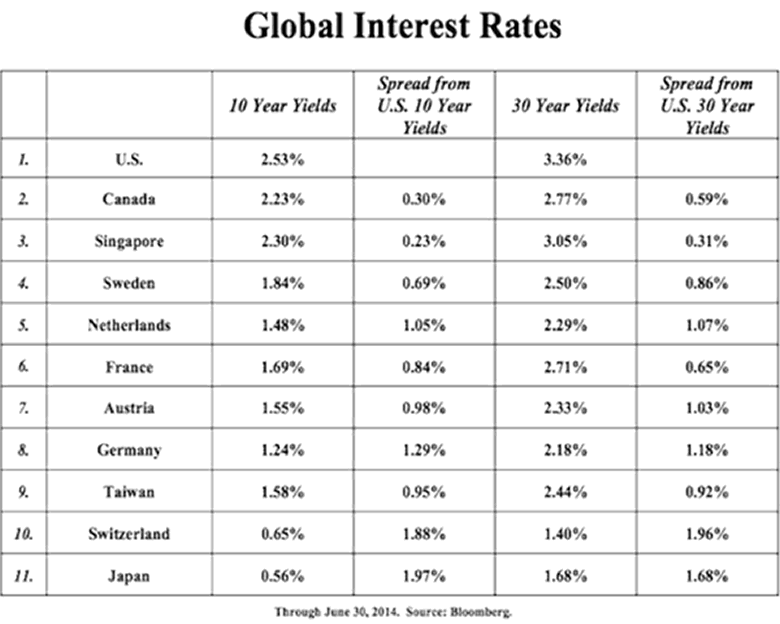

At 2% on a ten year treasury, you are guaranteed to lose half of the purchasing power if held to maturity and CAPITAL risk is enormous as any backup in rates (higher) will rob investors of virtually all the coupons. But big buyers can be seen globally as a quick glance at global yields REVEALS:

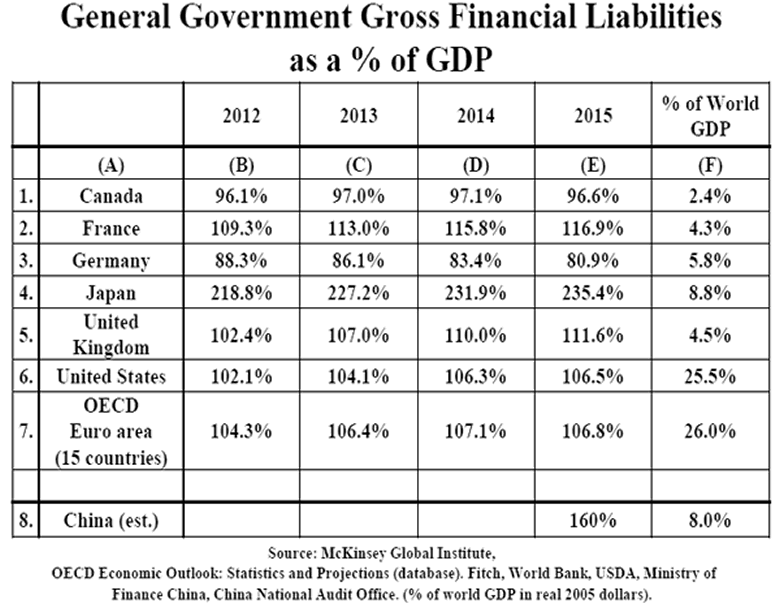

A SHOCKING picture of NOTHINGNESS when it comes to returns and the United States paying the HIGHEST yields of all. They are all IOU's denominated in IOU's. The markets are saying that the US creditworthiness is the WEAKEST of them all. No doubt those spreads will be arbed out so lower rates would appear to be on the horizon. France, a mathematically insolvent sovereign is paying the lowest rate since Napoleon walked the earth. Japan yields reflect the government controlled market it is. Is all of this a picture of unfolding deflation? In contrast to their levels of indebtedness, you would think, "who are these fools?" Deficits which except for Germany and Switzerland is SPIRALING HIGHER.

This does not include unfunded liabilities such as pensions and healthcare. It is obvious they are pricing in the money printing to come for the USA versus the others. This is also a breathtaking display of willful blindness of the buyers of the insolvency of many of the sovereigns as well. Officially, this is deemed RISK FREE; in REALITY it will never BE REPAID. The question becomes what happens when they WAKE UP and FLEE?

Is the TOP in for European Banks?

Last week Portugal's second largest Bank Espirito Santo parent company missed a bond payment and markets reacted accordingly by tanking. Regular readers to this missive know that none of the banking problems in the European banking systems has even been remotely addressed. The next exercise in HOT AIR and PR is currently underway as the European Banking Authority and the ECB work together to boost CONFIDENCE with the AQR (asset quality review). I can confidently tell you in advance that ALL IS WELL. Maybe one or two banks will fail to provide the veneer of robust exams but the result was written before the test if past episodes are prologue.

Europe's problems have not been addressed: Quoting Allianz SE's chief Investment officer Max Zimmerer (Europe's largest insurer managing assets of over $757 BILLION dollars) and owner of PIMCO:

"The fundamental problems are not solved and everybody knows it"... "The euro crisis in not over"... "Countries are still building their debt piles and that's storing up trouble for the future". "There is only one country where the debt level last year was lower than 2012 and this is a signal the debt crisis can't be over, only a recognition of the debt crisis has changed"... If the debt levels are not going down in the end we will have a problem, that is for sure."

Thank you Max for a very candid assessment of what lies ahead and Max is NOBODYS FOOL. Both the banks and Sovereigns are in worse shape than ever. The only thing that has recovered is the perception of the health of the nations and banks and for that we can thank the main stream media and morally and fiscally bankrupt politicians throughout the continent. Add to this the $30 Trillion dollars ($30 million million also known as a lot of ROTTING paper/cabbage) created out of thin air since 2008 desperately seeking a home anywhere a yield can be found (regardless of the risk). Although the markets MAY NOT BE FOOLED:

That's a BIG head and shoulders TOP and fully active in technical terms projecting a 15%+ decline from here. We shall soon see if it is reflective of the CREDIT and SOLVENCY crisis returning which is baked in the cake. The only question is WHEN WILL PEOPLE WAKE UP? Is the next wave of insolvency beginning NOW?

Spanish Banks, Lying with numbers.

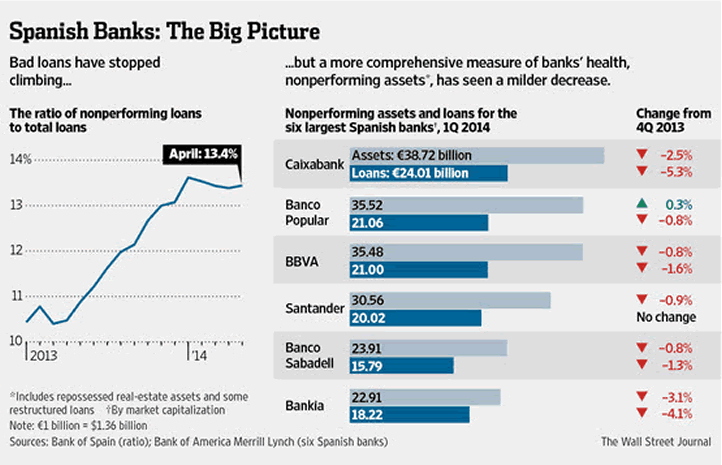

Throughout the EU the official story is one of recovery in economies and the financial system. Neither could be further from the truth in my opinion. It is all HOT AIR courtesy of the MAIN STREAM media and the people that control them. Supposedly Spain has bitten the bullet and is firmly on the road to recovery financially and economically. But a close look at the banks REAL condition tell a different story. It is a story of selective presentation of the numbers and SPIN. Politicians and bank analysts are pointing to a leveling off of NON PERFORMING loans. Upon closer inspection their condition are barely improving and probably a result of accounting magic. Take a look at this chart of the 5 biggest banks showing the headline NON PERFORMING LOANS numbers in dark blue and the real numbers in light blue of NON PERFORMING LOANS and ASSETS combined:

"Nonperforming assets are a better measure of banks' health, some analysts say, because the metric shows the full extent of bad debts the lenders have to work through and provide a more realistic picture of the continued drag on earnings that banks face. It captures foreclosed homes a bank will have to try to sell and repeatedly refinanced loans to property developers or other businesses that are unlikely to be paid." - Wall Street Journal

Merrill lynch reports their estimate of total non-performing assets to be euro 433 billion or $588 billion ($588,000 million) dollars or 40% of Spanish GDP. Doing the math: Non-performing assets are 22% of their balance sheets and their reserves barely 10%, simply doing the math says they are operating in BANKRUPTCY and negative equity of 12%. When will the RUNS BEGIN? Loan growth to the private sector is still CONTRACTING and buying of government debt still BALLOONING. Recent bond offerings of the banks have been gobbled up just as in all of Europe including GREECE. It's all a con game. Who are these FOOLS?

David Letterman's top 10 reasons to vote democrat

I received this on the internet and sometimes we all need a good laugh... Enjoy

#10. I vote Democrat because I love the fact that I can now marry whatever I want. I've decided to marry my German shepherd. #9. I vote Democrat because I believe oil companies' profits of 4% on a gallon of gas are obscene, but the government taxing the same gallon at 15% isn't. #8. I vote Democrat because I believe the government will do a better job of spending the money I earn than I would. #7. I vote Democrat because Freedom of Speech is fine as long as nobody is offended by it. #6. I vote Democrat because I'm way too irresponsible to own a gun, and I know that my local police are all I need to protect me from murderers and thieves. I am also thankful that we have a 911 service that gets police to your home in order to identify your body after a home invasion. #5. I vote Democrat because I'm not concerned about millions of babies being aborted so long as we keep all death row inmates alive and comfy. #4. I vote Democrat because I think illegal aliens have rights to free health care, education, and Social Security benefits, and we should take away Social Security from those who paid into it. #3. I vote Democrat because I believe that businesses should not be allowed to make profits for themselves. They need to break even and give the rest away to the government for redistribution as the Democrat Party sees fit. #2. I vote Democrat because I believe liberal judges need to rewrite the Constitution every few days to suit fringe kooks who would never get their agendas past the voters. ... And, the #1 reason I vote Democrat is because I think it's better to pay $billions$ for oil to people who hate us, but not drill our own because it might upset some endangered beetle, gopher, or fish here in America. We don't care about the beetles, gophers, or fish in those other countries.

Thinking about it should we laugh or cry? Democrats are Marxist socialist wolves working to rob you of your freedom, Heritage and futures. Please vote.

"The difference between genius and stupidity is that genius has its limits" - Albert Einstein

Huckabee and the true story of the border crisis

This weekend's Huckabee on Fox news was a real eye opener. A gentleman covering the immigration crisis on the Southern US border reported that the government in DC has placed the Border enforcement headquarters almost 50 miles from the border they are assigned to patrol.

Then he showed a film illustrating that they have them working by day and stopping at the end of the day until the following morning. I bet you can guess what happens then? A flood of immigrants into the US overnight. The report highlighted the intent of the Central government in DC: FOMENTING a HUMANITARIAN DISASTER! Then Jon Voight gave a stirring presentation to the president: https://www.youtube.com/watch?v=V-726MZt_14

Thank you for covering and saying what the main stream media will not... of course the MSM stand for none of what Huckabee and Voight do. True patriots.

The REAL cost of Illegal Immigration

I am a supporter of immigration reform and legal immigration. My wife is Chinese and received her citizenship on July 4th; she plays by the rules, pays her taxes and works as a manager for a local company. The president is asking for $3.7 billion dollars for the crisis on the border his executive orders created. The money he requests does not go to fix the borders, it goes for the health and welfare of the children going forward to the tune of almost $70,000 dollars per person for healthcare, attorneys, resettlement and other benefits. Well, who wouldn't come to the US and get paid for coming? I received the rest of this in an email and decided to pass it along: Many seniors are losing more and more benefits.... They are getting blamed for the country going broke. It's easy to dismiss individual programs that benefit non-citizens until they're put together and this picture emerges. Someone did a lot of research to put together a lot this data. Often these programs are buried within other programs making them difficult to find. I got this via email from a reader.

WHY is the USA BANKRUPT? Read this: We have been hammered with the propaganda that it was the Iraq war and the war on terror that is bankrupting us. I hope the following 14 reasons are forwarded over and over again until they are read so many times that the readers get sick of reading them. I also have included the URL's for verification of all the following facts.

- $11 Billion to $22 billion is spent on welfare to illegal aliens each year by state governments. Verify at: http://www.fairus.org/site/PageServer?pagename=iic_immigrationissuecenters7fd8

- $22 Billion dollars a year is spent on food assistance programs such as food stamps, WIC, and freeschool lunches for illegal aliens. Verify at: http://www.cis.org/articles/2004/fiscalexec.HTML

- $2.5 Billion dollars a year is spent on Medicaid for illegal aliens. Verify at: http://www.cis.org/articles/2004/fiscalexec.HTMLhttp://www.cis.org/articles/2004/fiscalexec.HTML

- $12 Billion dollars a year is spent on primary and secondary school education for children here illegally and they cannot speak a word of... Verify at: http://transcripts.cnn.com/TRANscriptS/0604/01/ldt.01.HTML

- $17 Billion dollars a year is spent for education for the American-born children of illegal aliens, known as anchor babies. Verify At http://transcripts.cnn.com/TRANscriptS/0604/01/ldt.01.HTML

- $3 Million Dollars a DAY is spent to incarcerate illegal aliens. Verify at: http://transcripts.cnn.com/TRANscriptS/0604/01/ldt.01.HTML

- 30% percent of all Federal Prison inmates are illegal aliens. Verify at: https://owa.slugger.com/owa/UrlBlockedError.aspx

- $90 Billion Dollars a year is spent on illegal aliens for Welfare &Social Services by the American taxpayers. Verify at: http://premium.cnn.com/TRANSCIPTS/0610/29/ldt.01.HTML

- $200 Billion dollars a year in suppressed American wages are caused by the illegal aliens. Verify at: http://transcripts.cnn.com/TRANSCRIPTS/0604/01/ldt.01.html

- In 2006, illegal aliens sent home $45 BILLION in remittances to their countries of origin. Verify at: http://rense.com/general75/niht.htm

- The dark side of illegal immigration: Nearly One million sex crimes committed by illegal immigrants in the United States. Verify at: http:// www.drdsk.com/articleshtml

The total cost is a whopping $ 338.3 BILLION DOLLARS (338,000 Million) A YEAR AND, IF YOU'RE LIKE ME, HAVING TROUBLE UNDERSTANDING THIS AMOUNT OF MONEY, IT IS $338,300,000,000.00 WHICH WOULD BE ENOUGH TO STIMULATE THE ECONOMY FOR THE CITIZENS OF THIS COUNTRY.

I support immigration reform that gives current illegals a path to legitimacy. For my wife the legal path took seven years. Jeb Bush said illegal immigration was an act of love. For most illegals, this is a true. The children are just part of the story. The president needs to just move the budget around. The real crime is a government that fails to create the tax and regulatory structures that allow our economy to thrive and grow. In a growing country there are jobs for everyone. Growth in anything but debt (who does this benefit? Can you say banksters?) is prohibited by LAW. This issue like all of them in the US is a MAN MADE disaster courtesy of Washington DC.

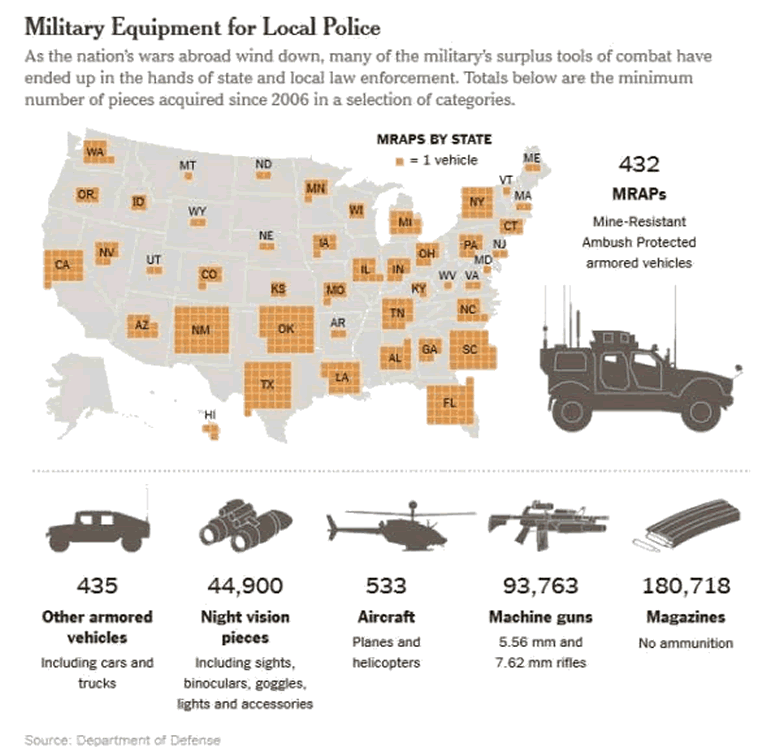

Militarization of the UNITED STATES

For many years now astute observers of the Government have been watching preparations being made for CONFLICT between Government and the Public at large. The department of homeland security is nothing but a domestic POLICE force similar to that of the GESTAPO of NAZI Germany. In fact Gestapo in German is the word for homeland security. Government CEASED to be the servant to citizens many years ago and now the public serves Leviathan government. It has taken place slowly but surely since Breton woods II removed the shackles of sound money and created the ability for unlimited borrowing. Kind of like the frog in water as it slowly rises to boiling, that is what is transpiring today to the middle class. They are being SLOWLY BOILED into a totalitarian system and are so dumbed down they can't see it. Whether it is the 1.5 billion bullets that have been purchased by domestic branches of government, Fema camps, marshal law being imposed on Boston during the bombing, BLM police forces, EPA thugs, or RUNAWAY swat teams it all adds up to very disturbing conclusions. Now we get this little illustration courtesy of Peter Degraaf's market report (I highly recommend this commentary very insightful and affordable):

The government is preparing for nationwide martial law when the system collapses, it is called Cloward Piven and Rules for Radicals, (look them up and weep as the fingerprints are clear) The only thing holding them back is the guns you keep in your home and the big collapse has not occurred YET. Support the NRA. Vote to limit government and support the constitution. And PRAY to God.. Now for a History lesson.

Honest Abe and three Benedict Arnolds

If you recall Abraham Lincoln fought the CIVIL war, ENDED SLAVERY and was a God fearing, bible toting leader as so many of our founding fathers that went before him. To him the thought of slavery and one man taking the fruits of another man's labor by FORCE was repulsive, Immoral and he died ending it. Now slavery is commonplace in the US as Government takes at the point of a government gun from the hardest working and most prudent among us and redistributes it to those who REFUSE to live prudent, hard working lives and calls it FAIRNESS. To him the constitution was inspired by God and I believe this also. Americans have forgotten the lessons of history, the constitution or should I say many were never taught them. It extends right up to the man in the white house and those who support him. This image is from the ROLLS report (I highly recommend it), but it says it all about how far we have slid down the slippery slope to socialism, destroyed the constitutional government we once had and are now led by a quasi-SOCIALIST/Marxist DICTATOR:

I have written regularly about the unfolding constitutional crisis and this is a SMALL example of it and the IGNORANCE and lack of Knowledge of the history and laws of the United States among the electorate. The constitution, bill of rights and the reasons for divided government were taught to me in civics class in grade school, now it is purposely buried to prevent the ultimate uprising which will occur if we are to regain our freedom, a better future for our children and prosperity. FYI, money printed out of thin air was also PROHIBITED by the constitution but Woodrow Wilson (created the federal reserve monopoly owned by private banks) and Richard Nixon (converted the last vestiges of sound money to worthless IOU's at Breton woods II) Betrayed us all.

Now the piper must be paid for all of this BETRAYAL of the people by many generations of leaders and the central government in Washington DC with the blood of patriots, Lets pray to God for their success.. A lot of turmoil and social unrest will unfold as the Socialists/Marxist system IMPLODES under its own weight as they have throughout HISTORY.

In closing, I hope you enjoyed these short vignettes on unfolding topics. They are a compendium of my daily exercises at our Austrian Blog: www.TedBits.com that you can have it daily and so much more by stopping by the website. The latest TedBits Newsletter will be released tomorrow: Useful Idiots and the Something for Nothing Society. It is a tour de force on the malignancy which has brought about the demise of almost every great empire in history, and the hows and whys of its evolution. It's a man made disaster. Don't miss it. Would you like this delivered into your inbox? Subscriptions for the weekly wrap and Tedbits Austrian Commentary are free at CLICK HERE.

May God Bless you, Ty

By Ty Andros

TraderView

Copyright © 2014 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.