Gold and Silver Bull Market – The Fuse Is Lit!

Commodities / Gold & Silver May 09, 2008 - 12:42 AM GMTBy: Peter_Degraaf

Much discussion has taken place in recent weeks, regarding the possibility that gold and silver might continue to sink to lower levels, as the summer doldrums set in.

Much discussion has taken place in recent weeks, regarding the possibility that gold and silver might continue to sink to lower levels, as the summer doldrums set in.

Investors soon become shell-shocked with negative market analysis that looks at a half-full glass of water and refers to is as ‘half empty'.

They read about a member of the Federal Reserve Board who is quoted as saying that he is worried about inflation, and they interpret this to mean that the dollar is going to rise, and gold might fall, just because of that single comment. If the man was serious about his worry, he and his pals would be raising rates, not lowering them! Of course we know that their hands are tied, as the Fed cannot raise rates until the economy, especially the housing market, can handle higher rates.

The fact of the matter is that gold and silver are becoming more of a bargain on a daily basis . The reason is very simple: Every day, the central bank money spigots are spewing out at least ten times as much money, as miners are able to produce gold and silver!

Until this situation is reversed, the fundamentals will support higher prices.

Pull-backs or corrections usually swing too far in the opposite direction to the main trend, thereby providing opportunities for us to ‘buy the bargains'. This is the situation today.

For some examples of price increases:

- Platinum has gone from 400.00 to 2,000.00, an increase of 400%

- Copper from 0.75 to 4.00, an increase of 470%

- Lead from 0.20c to 1.20, an increase of 500%

- Uranium from 0.63 to 63.00, an increase of 530%

- Crude oil from 12.00 to 124.00, an increase of 900%

- Molybdenum from 2.50 to 32.50, an increase of 1300%

- Rhodium from 400.00 to 9,400.00, an increase of 2200%

Many of these commodities are trading at all-time high prices!

By comparison, gold has crawled, from 260.00 to 880.00, for an increase of 338%. Gold is currently trading at 1/3 rd of its inflation adjusted previous high price.

Silver from 4.00 – 18.00 has increased by 350%

Silver is currently trading at 1/8 th of its inflation adjusted previous high price. That's right, silver has to increase by a factor of 8 times to reach 135.00, which is its 1980 price, when adjusted for inflation. And that's if you use the official CPI numbers. By using actual inflation data, the number is even higher.

Gold and silver are still bargains!

Charts courtesy www.stockcharts.com

Featured is the daily gold chart. The correction that started in mid-March ended at the Fibonacci 50% level. Price today broke out above the current downtrend line (blue arrow), and is now headed for higher levels. The 3 supporting indicators are turning positive (green lines). The 50DMA is in positive alignment to the 200DMA (green arrow), the sign of a bull market. THE FUSE IS LIT!

Featured is the weekly gold chart. The blue arrow points to the bottoming of the 7 – 8 week gold cycle. ‘X' marks the spot where the cycle missed, due to excessive bullishness. The cycle returned to normal on Friday May 2nd . The green arrow points to confirmation of the cycle. Unless gold closes below the thin purple line tomorrow, the upside breakout (green arrow), coming from beneath 8 weeks of resistance, will confirm the cycle bottom. (The thin dashed purple line connects the Friday closing prices).

The RSI is beginning to rise up from its support line (black arrow).

THE FUSE IS LIT!

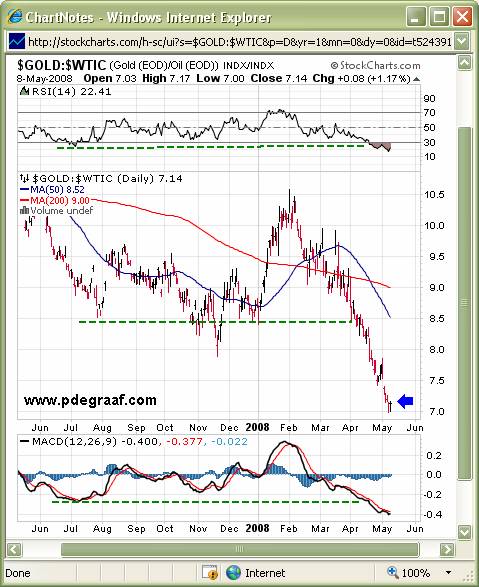

Featured is the index that compares gold to oil. Since the mid 1960's the historical average has been 15.4 barrels of oil equals an ounce of gold. Today this index touched 7, indicating that 7 barrels will buy an ounce of gold. GOLD IS HALF PRICE COMPARED TO OIL! The blue arrow points to a positive closing price today. This may indicate that the trend is about to change. The index at 7.14 is 26% below the 200DMA, which is extreme. The RSI and MACD are deeply oversold (green lines).

THE FUSE IS LIT!

Featured is the daily silver chart. The correction which began in mid-March ended right at the Fibonacci 50% level. Confirmation will come at this Friday's close, providing silver closes somewhere near the green arrow, above the thin purple downtrend line, which connects the Friday closing prices for the past 9 weeks. The RSI is positive, and rising up from its support line (green line). THE FUSE IS LIT!

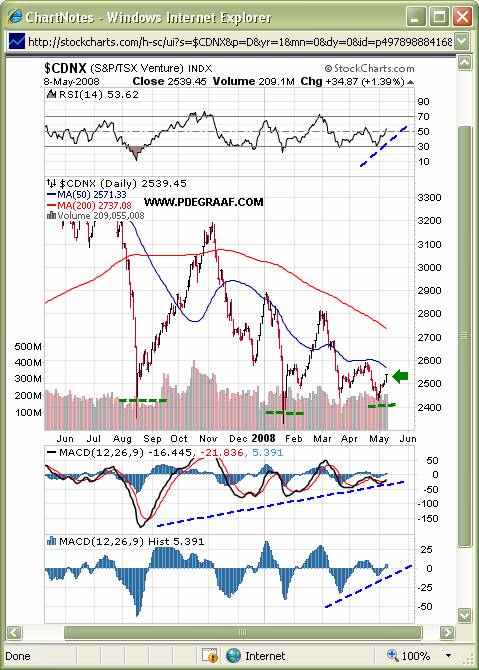

Featured is the CDNX index. The Juniors are ready to join the party! The index had its best day in over a month (green arrow), and is bouncing off a triple bottom (green lines).

The 3 supporting indicators are positive (blue lines). THE FUSE IS LIT!

Summary:

When you read a comment that is negative to a rising gold price, remember Gibson's Paradox: “When real interest rates (T-bills less CPI) are negative, gold will rise.”

This will keep you invested, while the bull rises in saw-tooth manner, ‘up two and down one'. To quote Richard Russell: “He who buys the dips, and rides the waves, wins in the end.”

By Peter Degraaf.

Peter Degraaf is an on-line stock trader, with over 50 years of investing experience. He issues a weekly alert to his subscribers. For a 60 day free trial, send him an E-mail itiswell@cogeco.net , or visit his website www.pdegraaf.com

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.