There Are No – Financial – Black Swans

Economics / US Economy Jun 27, 2014 - 02:54 PM GMTBy: Raul_I_Meijer

Oh Japan, what are you doing, where are you going? As Japanese consumer prices rose 3.4% in May (and I do wish people would stop calling this inflation, it is not and never will be), consumer spending was down -8.9% (!). That is from a year earlier, so it has nothing to do with the April 1 tax hike! It’s an insane number when you think about it, and it’s the direct result of Abenomics tightening the thumb screws. With the population having seen their savings collapse, their wages move way down, and now rising prices for food and other basics. While the government and central bank are spending with unparalleled abandon, and pension funds are moving into riskier assets, away from government bonds, which have that same central bank as their only buyer left. Is it also going to purchase all the bonds the pensions funds will bring into the market? Frankly, how can it not?

Oh Japan, what are you doing, where are you going? As Japanese consumer prices rose 3.4% in May (and I do wish people would stop calling this inflation, it is not and never will be), consumer spending was down -8.9% (!). That is from a year earlier, so it has nothing to do with the April 1 tax hike! It’s an insane number when you think about it, and it’s the direct result of Abenomics tightening the thumb screws. With the population having seen their savings collapse, their wages move way down, and now rising prices for food and other basics. While the government and central bank are spending with unparalleled abandon, and pension funds are moving into riskier assets, away from government bonds, which have that same central bank as their only buyer left. Is it also going to purchase all the bonds the pensions funds will bring into the market? Frankly, how can it not?

As for the US, Lance Roberts at STA sums it up in just a few words:

The Great American Economic Growth Myth

… the economic prosperity of the last 30 years has been a fantasy. While America, at least on the surface, was the envy of the world for its apparent success and prosperity, the underlying cancer of debt expansion and declining wages was eating away at the core. The only way to maintain the “standard of living” that American’s were told they “deserved,” was to utilize ever increasing levels of debt. The now deregulated financial institutions were only too happy to provide that “credit” as it was a financial windfall of mass proportions.

When credit creation can no longer be sustained, the process of clearing the excesses must be completed before the cycle can resume. Only then can resources be reallocated back towards more efficient uses. [..] … fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process. The clearing process is going to be very substantial. The economy currently requires $2.75 of debt to create $1 of real (inflation adjusted) economic growth. A reversion to a structurally manageable level of debt would require in excess of $35 Trillion in debt reduction.

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will continue to observe an economy plagued by more frequent recessionary spats, more volatile equity market returns and a stagflationary environment as wages remain suppressed while costs of living rise.

The Automatic Earth has been warning you about this for years now. I said again, only recently, that Japan’s biggest mistake has been that in the mid 1990s, it refused to accept restructuring and defaults of its financial sector debt. Now it has public debt of some 400% of GDP, a level that is miles beyond out-of-proportion. The only reason Japan hasn’t collapsed in the past 20 years is that the rest of the world plunged headfirst into excessive debt as well, and could therefore – seemingly – continue to afford to buy Japanese products. Shinzo Abe’s desperate reply to the demise of that insurance policy has been to pile in more debt, not to restructure the already humongous existing pile.

Neither are America or Europe doing it, their policies are solely based on declaring banks too big to fail, which precludes restructuring, a fatal error, at least from the point of view of the real economy and the majority of the population who depend on it for their incomes. As Roberts says, the restructuring of debt, or ‘clearing process’, is inevitable, and because of the shortsighted measures taken by myopic ‘leaders’ interested only in short term power, the process, when it comes, will bring with it deep and bitter misery for most.

And as I also said again yesterday, they couldn’t get away with it if they didn’t play masterfully on our own short term memories and interests. Just imagine what would happen if it were the US that announced an -8.9% plunge in consumer spending. Still, that is not much different from that -2.96% drop in US Q1 GDP. What is different is that the latter lies well in the rearview mirror, where objects always appear to be smaller, and our attention is without fail focused on today and tomorrow, not yesterday.

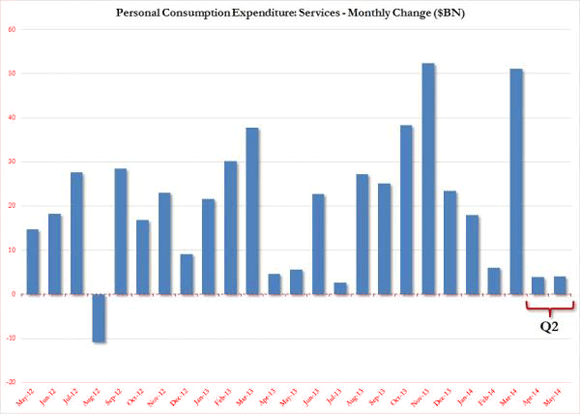

All it takes to divert attention away from Q1 GDP is rosy predictions for Q2 (we see nothing else, though ‘experts’ have hastily started backtracking). Predictions which can and will then subsequently be lowered time and again just like the last one. It’s a stupid ploy to fall for, but then we’re not all that bright to begin with at all. What will Q2 GDP be like? Tyler Durden has the perfect graph to show you:

• Please Help Us Find The Q2 “Spending Surge”

US services (and thus services spending) account for 68% of US GDP and 4 out of 5 US jobs. Thus, without spending on services the US economy can barely grow. That much is clear. What is also clear is that pundit after pundit has been lining up to explain how the Q1 economic collapse is to be ignored because it was due to, don’t laugh, snow. Snow, which somehow wiped out of $100 billion in growth from initial expectations of Q1 GDP rising by 2.5%. [..] What is certainly clear is that without spending on services in the second quarter, it is impossible for US GDP to hit its much desired 4% “bounceback” GDP print. All of that is very clear. What is not at all clear is just where is this services spending spree.

Durden also dug up a video from April 2014 posted at Renegade Economist, which features longtime and dear friend of The Automatic Earth, Steve Keen, who we must congratulate on his recent appointment as professor and Head of the School of Economics, History and Politics at Kingston University in London. Which means at least one university will teach something resembling sound economics.

In the video, which is an absolute must see and can’t miss, Steve explains exactly what is wrong with the US – and global – economy , as well as why and how this must be resolved the way it will be. It is not rocket science, it’s terribly simple really, we just have to deal with the constant stream of haze, befuddlement and discombobulation unleashed upon us by those who either have an active interest in keeping us locked up in a constant state of confusion, or are just not that sharp. That’s why the voice over in the video says “There are no black swans, there are just people who ignore the lessons of history”. And 2008 was just the beginning.

“In economics, [the mainstream] rely on experts who don’t know what they are talking about,” explains Professor Steve Keen in this brief but compelling documentary discussing ‘when the herd turns’. “Herd behavior is a fundamental aspect of capitalism,” Keen chides, but it is left out of conventional economic theory “because they don’t believe it;” instead having faith that investors are all “rational individuals”, which he notes, means “[economists] can’t foresee any crisis in the future.” The reality is – “we do have herd behavior” and people will follow the herd off a cliff unless they are aware it’s going to happen. “Contrary to herd wisdom, financial crises are not unpredictable black swans…”

To sum it up: it’s inevitable that there will be no economic recovery, and it’s equally inevitable that the economy must crash. If you move with the herd, you will be crushed.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.