Islamic Caliphate is Born, World War III has BEGUN!

Stock-Markets / Financial Markets 2014 Jun 21, 2014 - 07:50 AM GMTBy: Ty_Andros

Insanity is coming at US in huge waves. This week really saw a lot of new tea leaves presented to those working through the puzzle of the MAN MADE disaster. We are indeed living in interesting times, and I believe they will be studied and written about for decades and centuries into the future. I also believe this time period offers the greatest opportunity's in history if played from an applied Austrian economic perspective, and a good handle on history. They are one and the same actually. So let's look at some of the vignettes we covered this week:

Insanity is coming at US in huge waves. This week really saw a lot of new tea leaves presented to those working through the puzzle of the MAN MADE disaster. We are indeed living in interesting times, and I believe they will be studied and written about for decades and centuries into the future. I also believe this time period offers the greatest opportunity's in history if played from an applied Austrian economic perspective, and a good handle on history. They are one and the same actually. So let's look at some of the vignettes we covered this week:

- An Islamic Caliphate has been born, World War III has BEGUN!

- Central Banks Lifeboating themselves

- Highest Market Cap for US bank since 2001?

- The Dollar and the DODO bird

- Friday night info dump

- UNRELIABLE SUPPLY

- SILVER coiled and ready to LAUNCH?

- Federal Reserve FOLLIES

- Political correctness that short circuits an invaluable gathering of EXPERIENCE

An Islamic Caliphate has been born, World War III has BEGUN!

Lightly covered by the Mainstream News, a new and vicious ISLAMIC caliphate has been born and World War III has commenced. The Middle East will be irreparably changed in the near future or should I say engulfed in FLAMES. The spineless leaders of the developed world have allowed order to be DESTROYED rather than place the proper emphasis on peace through strength. Now we will pay the price of the breach for their fiduciary duties. Teddy Roosevelt in 1907 said: "walk softly and carry a big stick", sadly those wise words have been lost and forgotten. Relearning this will be extremely difficult as humpty dumpty has fallen, and putting him back together again may be an impossible task. Global and regional leadership is dead in the developed world: where are the Reagans, Churchill's and Thatcher's of the world for this generation. The bold leaders NOW with visions for the future reside in the Chinas, Russias, Singapores and al Qaedas of the world.

"If history teaches anything, it teaches that simple-minded appeasement or wishful thinking about our adversaries is folly. It means the betrayal of our past, the squandering of our freedom."

- President Ronald Reagan, 1983

The Caliphate calls itself ISIS (the Islamic States of Iraq and Syria) and is a ruthless Al Qaeda political force. Numerous reports of beheadings, mass executions and random killings to foster TERROR in the eyes of their opponents are occurring and it is working. If you are a Christian or Shiite Muslim, the sentence is immediate death upon discovery or capture. Thousands have already been executed already and posted on the internet. A small army of less than 10,000 men has faced and beaten forces 10 times their size.

Soldiers are taking off their uniforms to avoid certain death that capture insures. Then, the terrorists take the discarded uniforms and use them to move freely behind enemy lines. They have now captured major IRAQI military bases and are well armed and supplied with MODERN WEAPONS. At this point, stopping them is not an option. They then retain the territory, oil fields, refineries and the funds for future JIHAD. I can promise you 10's of thousands of jihadists are making their way there from around the world to participate in the JIHAD state. They have already looted over $450,000,000 million dollars from banks, while the oil insures ongoing income. This is not a group that wants to live peacefully with their neighbors. No, they want to consolidate long enough to develop plans for the next excursion to expand their territory, treasure and sharia law.

"The Syrians and the Iraqis have made their own beds--so why stick our noses in now? The answer is that al Qaeda, ISIS and others will not stop at Iraq and Syria. Lebanon, Jordan, Israel, Turkey, Egypt, Yemen, Saudi Arabia, the United Arab Emirates and others will be next."

- General Jack Keane ret.

To them, it is convert to Sunni Islam or be killed as INFIDELS. For many of the terrorists that will not be enough and if they capture the US embassy (to me this is just a matter of time, just like the Viet Nam War). The carnage and death to many Americans is assured. Mercy is and will not be considered. It is part of their power over their adversaries. The power of abject FEAR!

In my opinion the greatest manmade disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with EYES WIDE SHUT? Are you prepared to turn it into opportunity by properly diversifying your portfolio? Adding absolute return investments which have the potential to thrive (up and down markets) regardless of what unfolds economically or politically? This is what I do for investors; help them diversify into investments which are created to potentially thrive in the storm. For a personal FREE consultation with me CLICK HERE!

The main stream news breathlessly reports the news without telling the audience the grim conclusions that can already be made. The administration is calling for a multi ethnic reconciliation of the Sunnis, Shiites and Kurds before help is considered, placing an impossible task for the Iraqi government on the table to prevent the US from having any possibility providing assistance. This type of reconciliation takes weeks and months to accomplish... do you really think that republicans and democrats could reconcile overnight in Washington? The world knows through the experience of the last 6 years that there is no challenge or previous commitment from which America will not retreat. This administration in Washington has systematically undermined the strongmen of the Middle East and, if we ever find out the truth, maybe had a hand in overthrowing them. Did any of you think someday you would be rooting for IRAN to prevail in IRAQ? Me neither but now it is in my daily prayers as the developed world will just sit around and let us be destroyed. There is no shrinking from this moment. We must confront it or be killed by it as we shall soon see!

"Think subcontracting the job to Iran is the right call? Surely, no one wishes a Middle East managed by the ayatollahs in Tehran. Don't care? Remember the admonition of the 9/11 Commission: "The most important failure was one of imagination." Imagine what controlling vast areas of the Middle East will do for extremists of all stripes."

- General Jack Keane ret.

Say what you will about Saddam Hussein, Moamar Qaddafi and Hosni Mubarak, strong men and dictators who held power in an iron and sadistic grip. But they all understood the DEADLY NATURE of FUNDAMENTALIST ISLAM and DID NOT ALLOW IT TO GAIN FOOTHOLDS in their COUNTRIES. They also controlled the thousands of years of tribal animosities in their countries, which as we can see was and is enormous. Just stopping ISIS is insufficient. They must completely be vanquished and the territory they hold liberated. Nothing less, or a regional war will widen into conflicts/attacks throughout Europe and then the world. Nothing like that will be considered by the developed world and many in the Middle East wish to see the latter happen. ISIS has been primarily funded by Saudi Arabia, Qatar, and Kuwait up to this point. Since the conflict has flared, Putin has sent arms, tanks and supplies into Ukraine in the last week. When can we expect the next move by China to be? Will they widen their grasp of the South China Sea? SOON! A weak US military and NATO will be challenged as NEVER BEFORE around the world. The socialists and leaders of the developed world are weak as kittens and spineless as worms. Mark my word, World War III has JUST BEGUN!

It has been a wild and woolly weekend as the news just keeps shocking a numb population too weary to keep up with the tea leaves: Important announcements about central banks lifeboating themselves from their own money printing, rotating HUGE parts of their reserves from INTANGIBLE financial assets to tangibles.

Central Banks Lifeboating themselves

Regardless of their words, the highest echelons of the Central banks know some history. Their rhetoric and obfuscation of their true motives remain indecipherable. But sometime we get a glimpse of their actions to find out the true story. In this case, it is being reported by the financial times and Official Monetary and financial institutions forum that they have ACCUMULATED over $29 TRILLION dollars ($29 million million) of REAL THINGS such as Gold, Stocks, Real estate, etc. This report is due to be released on June 17, 2014. Of course, a lot of the money they are SPENDING was PRINTED out of THIN air. Now, instead of buying WORTHLESS government bonds and calling them assets on their balance sheets they are buying REAL tangible property in exchange for their worthless IOU's known as sovereign currencies. The sum of the currencies that the sellers are reaping would appear to be gains, thus becoming the future victims of the systems they live in (who do not teach them what money is). Money in the developed world is mathematically WORTHLESS; we are just waiting for the public to WAKE UP to the crime perpetrated on them by their central banks and public servants.

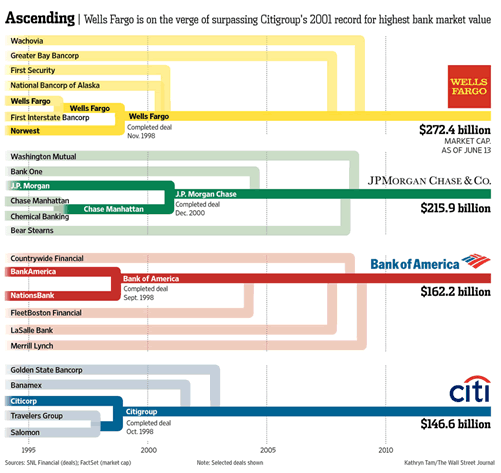

Highest Market Cap for US bank since 2001?

Today's Wall Street Journal TRUMPETS the new high equity valuation by some of the nation's BIGGEST banks;

Look at all the dinosaurs that went extinct over the last 13 years, rolled up just as banks were during the GREAT DEPRESSION. An 'apples to apples' comparison would not include the assets that were gathered. The WSJ wants you to believe it signifies a recovery of asset values, which couldn't be further from the truth. The purchasing power of the currency they are dominated (dollar) has been cut in half since 2001. So have the values of these behemoths in purchasing power terms (what you can by with the same amount of money). Hugely misleading to those who do not know the dollar is an IOU (printed endlessly) and no longer MONEY (store of value) in the historical sense. Do you really think the dollars have the same value (purchasing power) after this?

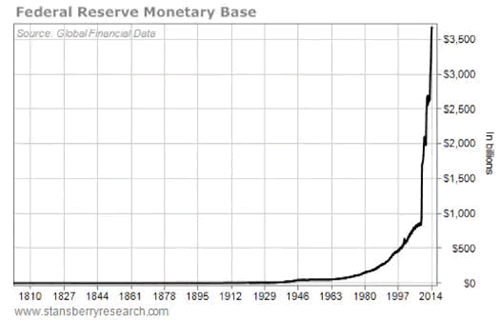

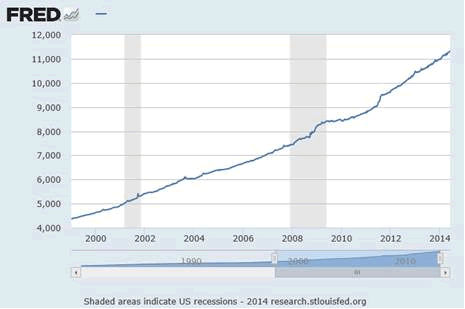

M2 Chart

M2 up 200% in 10 years! Base money supply up 500%! Do you really believe that PILE of worthless paper can be RESOLVED in a SAFE manner? Do you think the value (purchasing power) of the dollars is worth the same as it was in 2000 (or is it down 50 to 80%)? Do you think the value of a dollar has held constant after these moon shot of money printing? Nominally (in fiat currency) they are approaching old highs, by this measure alone Banks are still down about 75% from those values. Do you believe in the tooth fairy? Santa Claus?

Friday night info dump

Friday nights are typically the days governments release information they do not want reported or noticed by the public. Last Friday was a doozy as the administration er IRS said they had lost several years of emails from Lois Lerner's computer who had had a hard drive failure. What a hoot. For you readers who do not know, nothing is ever LOST on the internet, ever. You can delete it over and over again and it will never be lost. These files are not lost either, if you or I attempted this we would be obstructing justice and destroying evidence among a number of other felonies we would be charged with. But the administration has shown many times that laws can be used or ignored at will and do so with regularity. This is just another constitutional crisis going unreported or addressed.

The internet is like a postcard and YOUR privacy is the victim. Do not ever write something you don't want another to see. It becomes public information for governments and anyone else...

Unreliable Supply

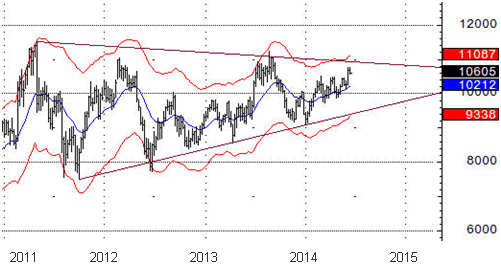

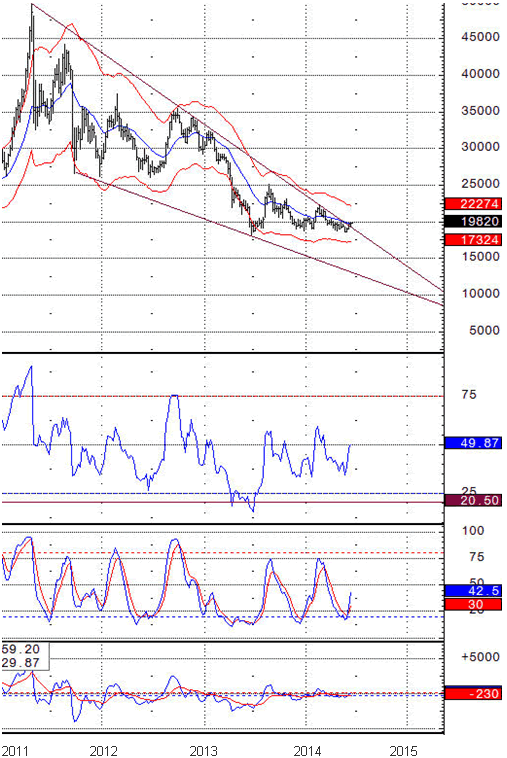

The unrest unfolding in the Middle East has far more implications for the price of energy than can be seen in the mild breakout of recent TRADING ranges actually portends an explosive move in energy markets. A rising wedge can be clearly seen and OIL is COILED for an explosive move higher. Take a look at this weekly chart formation:

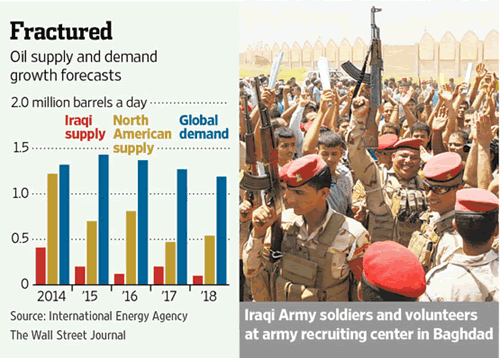

This pattern has been under construction for almost 4 ½ years and it is a rising wedge. When we move through the high trend line priced should quickly move $20 dollars a barrel and ultimately should move at least 40 dollars higher. During the time it was being formed we have seen shale oil production in the US skyrocket, while production out of OPEC members Libya, Iran, Nigeria, and Venezuela (don't leave Mexico out where production has declined by over 1 million barrels a day) tumbling with losses of production outpacing the increases. Now Oil production looks set to tumble in Iraq as it breaks apart before our eyes. The IEA expects Oil consumption is set to rise about 6.58 million barrels a day by 2018, with most of the additional supply forecast to come out of North America and Iraq. Forecasted supply and demand growth per year:

Do you really think any investment is going to enter Iraq? Do you think the ISIS will attack the oil fields of their foes? Do you think instability or stability will grow in the Middle East? My bet is on INSTABILITY! Do you think this will be good for economic growth?

SILVER coiled and ready to LAUNCH?

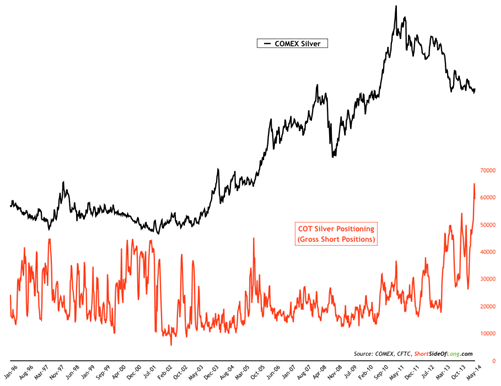

Silver has been undergoing in my opinion a cyclical bear market since 2011in a secular bull market which began with the gold bull market back in 2001. It has been correcting and moving sideways just as crude oil has done above virtually the same amount of time. Bear markets don't last forever just as bulls don't. Take a look at this weekly chart:

RSI which is the first study under the chart has CLEAR BULLISH Divergences, slow stochastic's is clearly giving a buy signal and MACD show virtually no Volatility. In terms of time and price Fibonacci has been quite an accurate overlay and trend lines are now under challenge from BELOW. A clear Bear wedge is in place and the market would look to be coiled like a spring to leap higher. Now let's look at a graph of gross SHORTS provided by www.theshortsideoflong.com :

Any kind of move higher should light a BONFIRE under the shorts. Typically when it has been this high a powerful move is in the offing. Could this be the beginning of the end of the bear market that began in 2011?

It doesn't matter whether it is food, energy or precious metals it appears the next legs higher for the commodity complex could be on the near horizon after almost 4 years of corrective activity.

Federal Reserve FOLLIES

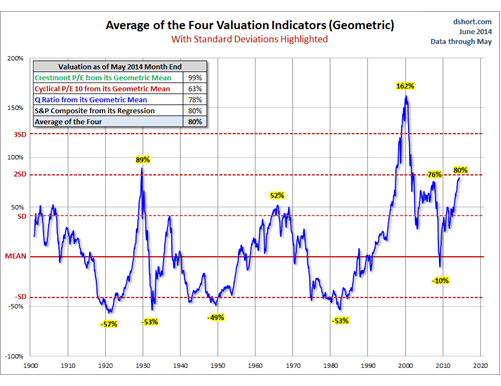

The market saw a crash yesterday after Janet Yellen gave her remarks. The crash was in the VIX volatility index and it was down almost 13% signifying the magnitude of the moral hazard her words meant to the markets, market makers and investors. Worldwide stock and bomb er bond markets have NO FEAR and she fed the beast of insane behavior. She also ventured where no Fed Chairman had publicly gone before in that she commented on Stock market valuations. Saying she saw no problems with valuations. Well a quick look at www.dshort.com market valuations reveals a Janet in Wonderland perspective on a historical basis.

Look carefully at this chart. We are at valuations which have PRECEDED every crash in the last 100 years (1929, 1937, 2000, and 2008) except 2000, which went insanely above current levels. What do you think is the chance that this is not a prelude to a similar resolution? That this time is different?

Political correctness that short circuits an invaluable gathering of EXPERIENCE

John Stossel writing at reason.com, June 4:

I've had hundreds of employees whom I paid nothing: student interns. Unpaid internships were allowed for years, because it was understood that interns learn by working. My interns learned a lot. Many went on to successful careers in journalism. One won a Pulitzer Prize. Many said they learned more working for me than at college (despite $50,000 tuition). They benefited and I benefited. Win-win.

So for year's government ignored Labor Department rules that decreed unpaid internships legal only if an employer gets "no immediate advantage" from the intern. Geez, who wants that? Of course I got an advantage from my interns. That's why I employed them!

Recently, President Barack Obama's Labor Department announced it would enforce the internship rules, and some interns sued their former employers, claiming internships were "unfair." Charlie Rose forked over a quarter of a million dollars. Word spread, so now unpaid internships are vanishing.

Some people say it's good that unpaid internships are gone, because they are unfair to poor people, who can't afford volunteer work. But getting rid of opportunities does nothing to help anyone. Employers lose and students lose.

Difficult as it can seem to make your own way in this world without a phony government promise that you'll be taken care of, or that every job will pay at least $15 an hour, success happens when markets are relatively free. Individual initiative creates new things, companies, job opportunities--whole new ways of life--that make the world better for all of us.

In closing, Iraq just keeps going down the rabbit hole and will continue to do so. Southern Iraq is where the bulk of Iraqi oil production takes place and probably will soon be a territory of Iran. In anticipation of the battlefront to move to them the oil majors in southern Iraq are pulling out their personnel. How long do you think oil production will continue without the professionals that keep it GOING? What do you think the price of oil will be if OPEC quits supplying the 10% of production Iraq represents? Keep in mind that the EPA is effectively shutting down the coal fired electric supply's (about 40%) in the United States over the next several years. A perfect storm is rapidly unfolding in the energy sector and the next decade could be brutal. Do you think the blind ideologues in Washington care about the public at large? The answer is self-evident. Think about what impact their policy's may have 1, 5 or 10 years into the future.

See you next week, Ty

Did you like this post? They are posted daily at www.tedbits.com our new blog or get them directly into your inbox along with the TedBits commentary, the Economic and Financial NO SPIN zone. Subscriptions are free HERE

By Ty Andros

TraderView

Copyright © 2014 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.