Outlook on U.S. Dollar, Currencies & Markets: Look Out Below!

Stock-Markets / Financial Markets 2014 Jun 18, 2014 - 02:41 PM GMTBy: Axel_Merk

The FIFA World Cup and market predictions have in common that we are tempted to create a world of make-believe when it comes to predicting outcomes. While others ponder about the meaning of a round ball, we’ll focus on the implications of a make-believe world comprised of ever-higher asset prices. Our caution: look out below!

The FIFA World Cup and market predictions have in common that we are tempted to create a world of make-believe when it comes to predicting outcomes. While others ponder about the meaning of a round ball, we’ll focus on the implications of a make-believe world comprised of ever-higher asset prices. Our caution: look out below!

Investors have a tendency to ignore the hidden risks in their investments, even if those risks may be hiding in plain sight. You may recall the references to a "goldilocks" economy in the run-up to the 2008 credit crisis. Similarly, in the 1990s, what could possibly go wrong investing in tech stocks? What these episodes have in common is that the downside volatility of asset prices was unusually low. The pessimists warn of pending collapse, yet are ignored.

As an optimist, I agree with the pessimists. Not because I think the world will come to an end, but because the path from euphoric to normal is a rough one. When low asset price volatility lulls investors into believing the markets have become safer than they really are, folks take risks that they are bound to regret. Those that pile into the equity markets on the backdrop of ever shorter corrections, of ever higher asset prices, of historically low volatility, may be running for the exit fast when they realize they had no business being over-exposed to the equity markets in the first place.

Some laugh at gold investors that saw the price of gold drop sharply in 2013. What many fail to realize is that the very same can happen in the equity markets just as easily. When an asset (gold in this case) rises for 12 years in a row, there will be those taking out a loan to invest in the yellow metal. Similarly, investors have taken out ever more debt to buy stocks. For such euphoria to end, we don't need a crisis, all we need is fear levels to return to "normal."

Liquidity is dead

The low volatility environment has been accompanied by what is historically low volume. When liquidity in the market is low, it provides fertile ground for more abrupt price moves. One reason why liquidity may be low is due to the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank"). Dodd-Frank, with its good intentions, has banished a lot of risk taking by financial institutions. That may be a good thing in some ways, but it has also curtailed major liquidity providers. The next sharp correction in the markets may well be an indication of whether the dearth of market participants is a problem.

Other markets infected

The above symptoms don't just affect the equity markets. In the fixed-income markets, our analysis shows:

- Volatility has been rather low of late;

- Liquidity is sharply reduced as banks have sharply reduced their trading activities (due to Dodd-Frank);

- Investors chase yield (mostly by chasing "credit", i.e. lower quality debt instruments; but some also take on more interest rate risk by investing in longer-dated debt securities).

- Investors increasingly embrace what we call creative bond funds that brag about holdings in Master-Limited Partnerships ("MLPs") and ultimately have big exposure to dividend paying emerging market equity securities.

Currency markets have also experienced extraordinarily low volatility of late. Having said that, we have not seen leverage increase much in this market, as folks abstain rather than take huge positions.

Policy makers concerned

Folks at the Fed have started to talk about complacency, with New York Fed President Dudley saying, "Volatility in the markets is unusually low." At a dinner of the Hoover Institution I attended, Kansas City Fed President George mentioned in a speech: "The incentives to reach for yield extend to smaller financial institutions as well... If longer-term interest rates were to suddenly move higher, these institutions could face heavy losses."

Should you be concerned?

If you are not concerned, you are not paying attention. The reason I say this is because when the masses are complacent, it is my assessment that it is prudent to be fearful. The time to prepare for the next correction is now. And you don't need to think a crash is imminent to endorse the idea that it might be a good idea to rebalance a portfolio when equity securities have taken on a greater portion of one's portfolio.

Do I think a crash may be coming our way soon? Yes. What can trigger such a crash? Nothing in particular, yet anything can, given the high degree of complacency we see in the markets. Could I be wrong? Certainly.

What can you do about it?

First, if the equity exposure in your portfolio has grown, consider rebalancing in the context of your longer-term goals. This is a prudent exercise no matter what your long-term outlook is. Beyond that, to the extent you want to be invested in equities:

- Consider an enhanced, hedged or market neutral strategy. There are many flavors out there of equity strategies, each of them have their own set of risks and opportunities. You'll have to do your homework to be comfortable with them.

- There will always be some sector in the market outperforming. Rather than chasing the winners, consider looking at areas that have underperformed.

Even these types of strategies may experience negative returns in a down market, but you may consider yourself a winner with many of these strategies if you lose less than the market.

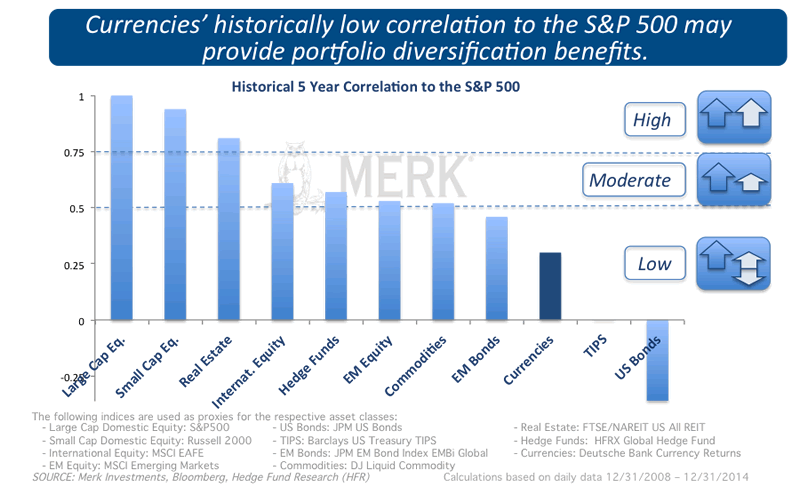

Second, diversify. As already eluded to with the reference to different types of equity strategies, key to thriving when equity returns sour is to have assets that produce a return stream with low or even negative correlation to the equity markets:

As one can see from the illustration, bonds have historically been powerful diversifiers for equity portfolios. Trouble is that investors not only want low correlation, but they also like positive performance. And while bonds have historically done just fine with regard to performance, many investors, including yours truly, aren't so sure that this will be the case going forward. However, rather than finding an incarnation of a "new generation" fixed income fund that engages in what may be unnecessarily risky bets or masks an emerging market equity strategy as a fixed income play (because those stocks pay a dividend), we prefer to look elsewhere.

As many of our readers know, we have increasingly been looking at gold as a long-term diversifier as we think real interest rates, i.e. interest rates after inflation, may be negative for a long time. Today, we take it a step further, focusing on our currency outlook for the second half of the year. We like the currency market for a couple of reasons, including:

- Historically, exchange rates exhibit low correlation to equity markets; in fact, if one employs an absolute return (long/short) currency strategy, one can design a portfolio that should exhibit low correlation to equities over time. An example I like to cite is that taking a position in the New Zealand Dollar versus the Australian dollar will almost certainly generate returns that are not correlated to how equity prices behave.

- If deployed without leverage, a long/short currency strategy has a risk profile that - in our assessment - makes it a good candidate to be used instead of a bond allocation. While there are bond strategies that have historically had an even lower risk profile, few alternatives offer as compelling a risk profile as currencies.

- The currency market provides unique profit opportunities as many market participants are not seeking to maximize their profits: from corporate hedgers to central banks, even tourists spending money abroad.

That said, here's a summary of our current outlook. For more in-depth information, make sure to also register for our free Webinar on Tuesday, June 24, at 4:15pm ET.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.