Crucial Days Ahead for Bitcoin

Commodities / Bitcoin May 30, 2014 - 06:43 PM GMTBy: Mike_McAra

To the point: we don’t support any short-term position in the Bitcoin market.

To the point: we don’t support any short-term position in the Bitcoin market.

Amazon has been granted a patent which mentions the possible use of Bitcoin by the company, CoinDesk reported yesterday. Bitcoin and other cryptocurrencies could be used by Amazon Web Services, Amazon’s cloud computing platform, to accept payments.

This is in contrast to the earlier claims made by Amazon’s head of payments, Tom Taylor, who said that the company didn’t have any plans to immediately accept Bitcoin. But in the already mentioned patent, we read:

Various types of digital cash, electronic money, or crypto-currency can be used, such as Bitcoins provided by the Bitcoin P2P Currency System.

The patent was filed two years ago. It doesn’t necessarily have to indicate that Amazon will be accepting Bitcoin anytime soon since the mention of virtual currency is only a very small part of the overall patent.

On the other hand, this might indicate that Amazon doesn’t rule out future integration of cryptocurrencies should they gain customer awareness. If increasing numbers of customers ask for the possibility of payment in Bitcoin, Amazon might actually make use of Bitcoin. This is, however, not the case just now.

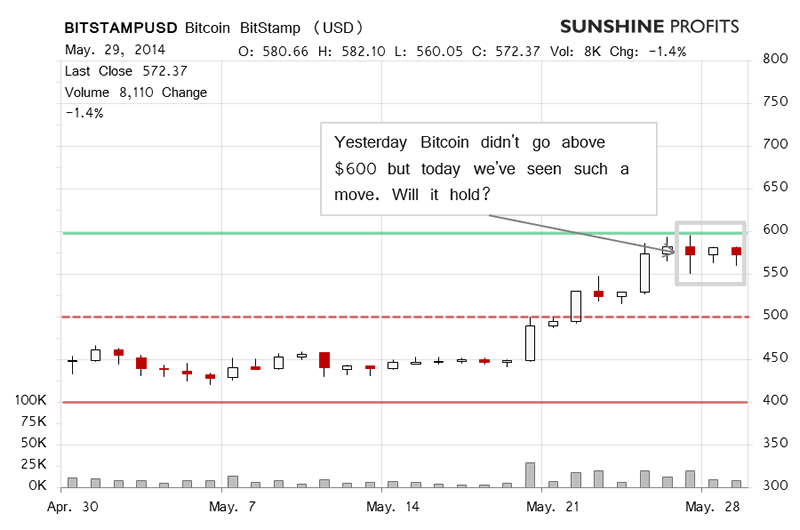

Let’s take a look at the charts today.

We’ve seen a move above $600 today (this is written before 11:00 a.m. EDT) on BitStamp. This is a major development in the sense that it might change not only the short-term outlook but also the medium-term outlook if it is confirmed by Bitcoin staying above $600 for a longer period of time.

For now, the breakout is still not confirmed but today’s action and the developments today might be one of the most important parts of the year for Bitcoin investors. This is far from being sure, but the possible move above $600 combined with the first possible higher high in months suggests that whether Bitcoin stays above $600 or plunges below it might be indicative of the main trend for the weeks and months to come.

Recall what we wrote yesterday:

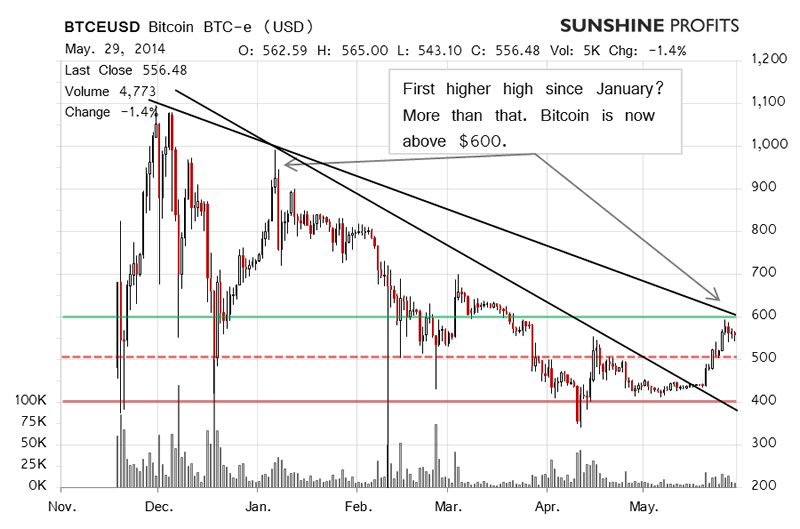

The situation has in fact become tenser. A second look at the above chart also points to an important development. Bitcoin might have just formed, or will form in the future, a first visible higher high since January. A lot might depend on the next big move in the market. If it is to the upside and Bitcoin stays above $600, we might have a buying opportunity and the outlook might change to bullish. If, however, there is no break above $600 or there is one but invalidated, we might return to the downtrend.

On BTC-e there was a move above $600 today (not yet seen on the chart above) but, unlike on BitStamp, Bitcoin has retraced to below this level since then. This weakens the bullish implications coming from the analysis of the BitStamp chart but not to the point of invalidating it. In other words, the mere fact that BTC-e hasn’t stayed above $600 doesn’t by itself mean that the short-term outlook remains bearish.

The situation is less than clear right now. BitStamp might see a first close above $600 in months. BTC-e doesn’t quite support that move yet. Our bet is still that we’ll see a move down. However, in light of the recent developments, we would have to see the move above $600 being denied before considering any short positions.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market.

Trading position (short-term, our opinion): no positions. The next few days might prove crucial in pointing to the direction of the main trend.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.