This Chart Proves the Bitcoin Market Is Maturing

Currencies / Bitcoin May 27, 2014 - 02:28 PM GMTBy: Money_Morning

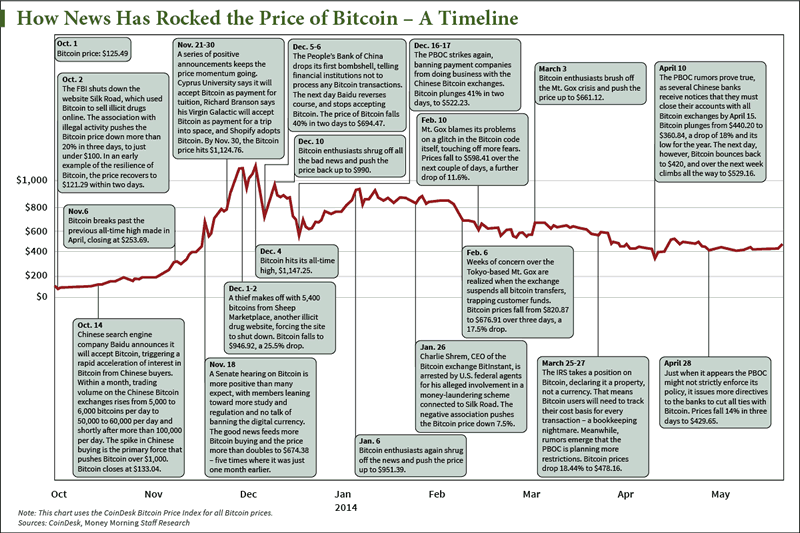

David Zeiler writes: One of the biggest knocks on the Bitcoin market has been the volatility of the price of Bitcoin, and looking at the price charts over the past six months, it's easy to see why.

David Zeiler writes: One of the biggest knocks on the Bitcoin market has been the volatility of the price of Bitcoin, and looking at the price charts over the past six months, it's easy to see why.

But as crazy as the Bitcoin market has been - just take a look at the timeline - the lack of any major news over the past few weeks has had a distinct calming effect on the digital currency.

After the CoinDesk Bitcoin Price index sunk just below $450 on April 25, it traded in a narrow range between $460 and $420 for the next couple of weeks. And the week leading up to yesterday (Tuesday), the Bitcoin price was very quiet, trading in the mid $440s.

The drop in Bitcoin price volatility - and the decrease in sensitivity to news and rumors - is a step toward the maturation of the Bitcoin market.

That's not to say a major announcement won't affect the Bitcoin market. All markets are affected by major news. But from here we should see less severe reactions to big news in the Bitcoin market and much more muted reactions to minor news and rumors than we saw last year.

Part of the reason is that the big price drops, combined with such disasters as the Mt. Gox bankruptcy, have flushed out many of the speculators that were driving the volatility.

Replacing them are more buy-and-hold investors looking at Bitcoin as just another asset class, and, most importantly, people who are buying Bitcoin to spend as more merchants agree to accept the digital currency.

Note: The tech sector has been hit hard this year, but it's still by far the best place to invest your money for maximum growth. Here are the top two tech sectors for 2014...

More stability going forward should prove another crucial factor in the broader adoption of Bitcoin. One of the issues that has held Bitcoin back is that it's too risky to bother with. As that changes, more and more people will feel comfortable using it.

There's another effect of increased stability:

a slow, gradual increase in Bitcoin prices. That will be much different than the insane parabolic rise we saw last fall that inevitably led to a crash.

The price of Bitcoin is destined to rise not just because people are using it and investing in it, but because its digital nature gives it value beyond serving as yet another form of payment. For example, the blockchain that verifies each Bitcoin transaction can also verify other digital properties.

The 9% rise in the price of Bitcoin on Tuesday - for no apparent reason - could be the first stage in a gradual appreciation that will get Bitcoin back to its all-time high and beyond. That would be good news for Bitcoin enthusiasts as well as Bitcoin investors.

"While I'd like to see a huge rally in prices, the first step before that happens is to see steady trade," said Money Morning Defense & Tech Specialist Michael A. Robinson. "That way when the big move comes, existing investors will have established a long-term solid foundation."

How do you feel about the Bitcoin market? Are you ready to take the plunge, or are you still in wait-and-see mode? Tell us what you think on Twitter @moneymorning or Facebook.

Editor's Note: Thanks to innovative moves from CEO Elon Musk, Tesla (Nasdaq: TSLA) stock has gained a whopping 238% in the past year - and the company is not slowing down.

Now Tesla is engaged in a highly sensitive venture called BlueStar that could disrupt $737 billion of the U.S. economy and impact 98% of the population.

Few details concerning BlueStar have made their way into the press. However, a recent investigation uncovered some shocking revelations.

Click here to continue reading this must-see story...

Source : http://moneymorning.com/2014/05/21/this-chart-proves-the-bitcoin-market-is-maturing/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.