U.S. Bond Market Warning to Stock Market Traders

Stock-Markets / Stock Markets 2014 May 18, 2014 - 03:59 PM GMTBy: Investment_U

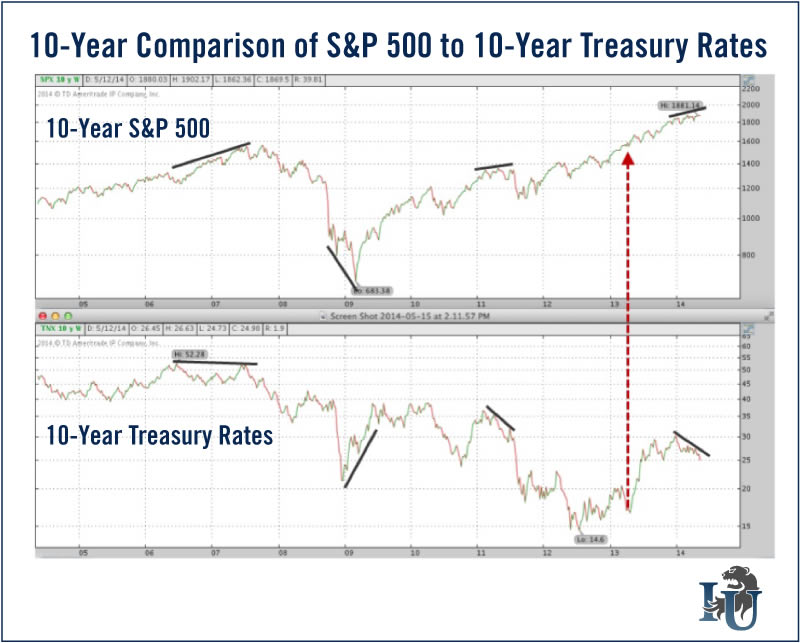

Christopher Rowe writes: The 10-year Treasury note just fell to a seven-month low and is a hair away from an 11-month low. This week’s chart compares the S&P 500 to the Treasury rate for a 10-year period.

Christopher Rowe writes: The 10-year Treasury note just fell to a seven-month low and is a hair away from an 11-month low. This week’s chart compares the S&P 500 to the Treasury rate for a 10-year period.

The chart shows the 10-Year Treasury Index (^TNX). Move the decimal one space to the left to get the current interest rate. EXAMPLE: TNX is at 29.50 when the “10-Year” pays 2.95% interest.

Bonds and interest rates have an inverse relationship. Declining rates imply a flight to quality and fear of the stock market. When stocks go down, interest rates tend to follow suit because investors sell stocks and buy bonds, pushing rates lower. This relationship is pointed out using black lines in the chart.

Bond investors are considered by many to be “the smart guys” compared to stock investors. And there may be something to it - watching for interest rates that diverge from the direction of the stock market can give an early indication that stock prices may change direction.

For example:

•The S&P 500 made higher highs from 2006-2007 while 10-year Treasury rates made lower-than-previous highs.

•10-year rates bottomed at the end of 2008 and shot much higher while the S&P 500 declined into March 2009.

•10-year rates topped out in January 2011, moving sharply lower while stocks moved higher until May 2011, followed by a 20% market decline.

Despite there being a traditional inverse relationship, interest rates won’t always steer stock traders in the right direction. Rates fell through the first half of 2012 while stocks still advanced.

Two Interesting Dates

The Federal Reserve didn’t start publicly discussing tapering its bond-buying program, quantitative easing, until May 13, 2013. But rates bottomed out on May 2, 2013 (as indicated by the red arrow), and then spiked higher by over one full percentage point in just over two months.

On December 31, 2013, 10-year rates topped out. Clearly bond traders see 2014 in a different light than they saw 2013.

Today we are seeing a major divergence in the direction of interest rates compared to the direction of stock prices. Therefore, bond investors are warning stock traders of an impending decline.

Source: http://www.investmentu.com/article/detail/37435/warning-stock-traders

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.