You Can Make Money in Stocks No Matter What Rates Do

Companies / Investing 2014 May 16, 2014 - 10:32 PM GMTBy: Money_Morning

It's commonly held wisdom that stock markets go to heck in a hand basket when interest rates rise. So, the thinking goes, you'd be better off selling ahead of time before that happens.

It's commonly held wisdom that stock markets go to heck in a hand basket when interest rates rise. So, the thinking goes, you'd be better off selling ahead of time before that happens.

No doubt it's tempting to head for the hills with rates at historical lows, but it pays to do your research before you hit the "sell" button.

The three companies I'm going to show you today, for example, can actually benefit from rising rates.

First, let's take an "Econ 101" look at the impact interest rates can have on stocks, especially when rates start rising...

How This Urban Legend Got Started

Like most urban legends, there's a grain of truth when it comes to interest rates and your money. That's because interest rates are quite literally a reflection of the time value of money. When rates are rising, the cost of borrowing goes up. When rates are falling, money gets cheaper.

Economic theory tells us that more expensive money decreases the amount of money in circulation because customers tighten up while cheaper money increases the amount of money at work. That's why the Fed, which subscribes to this theory, has kept rates so low for so long. Team Bernanke and now Team Yellen want to ensure there's money available and, by implication, that people borrow enough to keep it moving and the economy in recovery mode.

Practically speaking, you see this in everything from credit card statements to home mortgages. As rates rise, the propensity to borrow declines and there's less discretionary money spent. But as they fall, consumers head out to spend based in good part on borrowing that has "stimulated" the system. Personally, I think it's a sad state of affairs that debt has become so critical to our way of life, but that's really a story for another time.

What you need to know today is how the relationship I've just described impacts stock prices.

Companies are valued based on earnings. And earnings, in turn, are a function of the time value of money associated with all future cash flows. Loosely speaking, therefore, the more a company earns, the higher the expected stock price is ahead.

Theoretically, if rates rise that means money is getting more expensive so the cost of debt rises and revenue from customers drops. Earnings then take a nose dive and, not surprisingly, so do stock prices which, in turn, makes stock ownership less desirable.

Here's where it gets sticky.

By stimulating the economy and keeping rates so low for so long at the same time, the Fed is clearly fanning inflationary embers while seemingly acting to keep rates low. Every dollar the Fed kicks into the system diminishes the value of every other dollar already out there.

Ultimately rates will have to rise to compensate for the lost value, goes the argument for millions of investors.

Take Winners on the Overlooked Rising Rate Bounce

But here's the thing. You don't just immediately jump from a slight increase in "Treasury yields that's barely noticeable on a ten-year chart to hyperinflation even when it's the worry du jour," according to Jim Cramer in his book Getting Back To Even.

As we talk about so frequently, there has to be growth first. More to the point, there's also got to be a real, meaningful rise in interest rates to affect the markets on anything more than a short- term basis.

Look, you and I both know that rates will eventually rise. That's a harsh reality that our political leaders don't understand, which is why they're constantly kicking the can down the road and spending our country into oblivion.

But pulling your money out of the markets preemptively when we haven't had real interest rate hikes based on growth yet is a mistake. It's one thing to take heed of the lessons that led up to the Financial Crisis and entirely another to fall prey to erroneous conclusions by keeping your finger on the sell button or hitting it too early.

That's not to say the thinking isn't compelling - it is, especially since it's based on the intense emotional distress of the Financial Crisis. It's just not in your best interest. Ask anybody who sat out the rally off March 2009 lows. They've missed an amazing 273% S&P 500 run to new all-time record highs.

And that brings me to what happens when rates actually do rise.

Believe it or not, stocks have rallied for nearly two full years following the first interest rate hike according to Sadoff Investment Management and Fed data.

Here's something else.

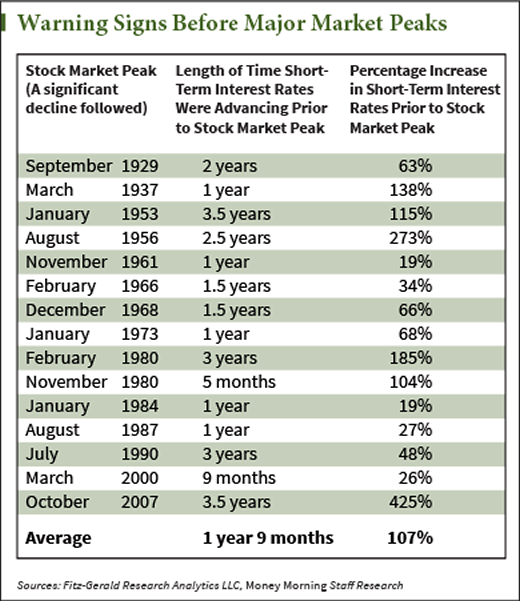

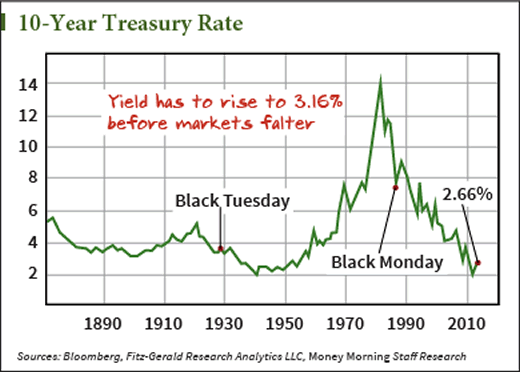

Since 1929, the average increase in short-term rates is 107% before the markets falter. Practically speaking, this means the 10-year Treasury yield would have to rise from a July 2012 of 1.53% to 3.16% before we hit the threshold. That's another 61 basis points or 23.9% above where the yield is today, according to Bloomberg.

So how do you invest until then?

Plenty of Great Investment Runway Ahead

First, you miss 100% of the shots you never take, and what I mean by that is that you stand to gain nothing if you aren't in the markets. DALBAR data shows that the average investor may be 200% to 300% behind the markets because they are prematurely trying to time the markets. Ouch!

The Fed has made it very clear that it won't be raising rates until mid-next year at the earliest and only if Yellen gets comfortable with progress in the meantime. So, barring an economic meltdown or global market reset, we've got some runway in front of us.

My preference is definitely for "global challengers" with strong cash flow, experienced management, and powerful brands in the meantime. Examples include ABB Ltd (ADR) (NYSE: ABB), Becton Dickinson and Co. (NYSE: BDX), and American Water Works Company Inc. (NYSE: AWK) that are drawn from our Money Map Report recommendations. Not only are these companies and others like them tapped into global money flows that continue unabated, but these types of companies can actually benefit from rising rates rather than get crushed by them. Remember, earnings... earnings... earnings!

Second, new highs are inevitably accompanied by short-term market noise, so it's not uncommon to get some give and take as the markets digest the implications of record price levels. In fact, I'd bet on it.

Make sure you have trailing stops in place ahead of time to protect profits and your capital in the event there is a hiccup. My suggestion is that 25% below your entry price is a pretty good place to start. You can always tighten that up if you like, but that's really splitting hairs. Protection against the unexpected at all times is the issue. [Editor's Note: You can track your trailing stops much more easily now. Money Morning Members have access to the best deal (in the world) on TradeStops. Learn more.]

If you don't like trailing stops, consider using options or a specialized inverse fund to protect your money and take the sting out of any short-term market movements that catch others by surprise.

Third, you want to be constantly hunting for new opportunities. I am sure your parents instructed you on the importance of "buy low and sell high." So wading in on pullbacks when everybody else is heading for the exits makes sense as a path to bigger profits...

...especially when the markets could run for a lot longer than interest rate doomsters think.

Source : http://moneymorning.com/2014/05/16/you-can-m...

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.