Crude Oil Boom Reaches Tipping Point

Commodities / Crude Oil May 15, 2014 - 08:06 PM GMTBy: Investment_U

Sean Brodrick writes: The tsunami of U.S. petroleum production has been underway for several years, but last month it reached a tipping point.

Sean Brodrick writes: The tsunami of U.S. petroleum production has been underway for several years, but last month it reached a tipping point.

Global oil production plunged in March thanks to steeply lower OPEC output... while America's production soared to a 26-year high.

This massive shift in energy supply has huge implications for your portfolio.

Consider...

Our Exports Are Now Double Our Imports

U.S. exports of gasoline, diesel and other petroleum products jumped to a record 4.3 million barrels per day (bpd) at the end of last year, according to the Energy Information Administration (EIA). That's more than twice the 2.1 million bpd of petroleum products that the U.S. imported.

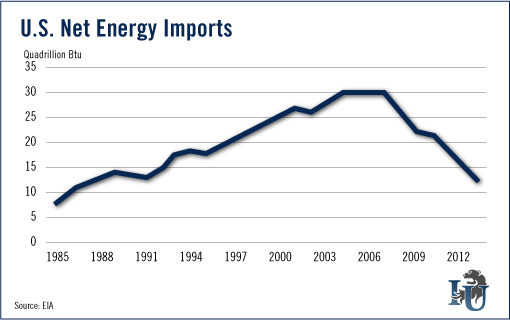

As a result, total U.S. net imports of energy declined last year to their lowest level in more than 20 years!

In fact, total energy imports fell a whopping 9% last year alone.

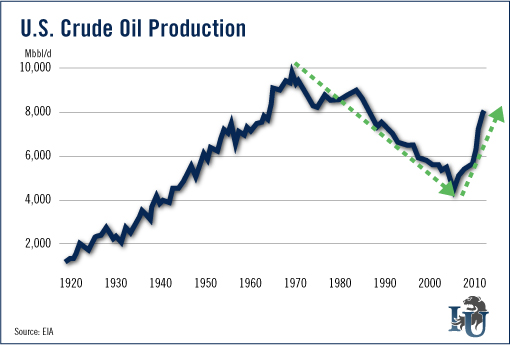

Thanks to hydraulic fracturing, U.S. oil production set a 26-year record in April, averaging 8.3 million bpd. Fracking has reversed a 40-year decline in crude oil output in just 5 1/2 years.

And it's nowhere near over. The EIA forecasts that the U.S. is on track to produce an average 9.2 million bpd in 2015. That's 11% more than our most productive month since 1988. That's average monthly projection for the entire year. And if the rate of growth stays the same, we could be producing closer to 10 million bpd by the end of 2015.

And guess who's going in the other direction?

China's Thirst for Oil Is Growing

China's daily use of crude oil shot to a new record in April. That means China had to import more oil - about 6.81 million bpd - last month.

We don't sell China a lot of oil... yet. America sold China a total of 47.3 million barrels of oil last year, according to EIA data. But that was a jump of nearly 200% in just five years.

There are some safe ways to play the oil boom. For example, the Market Vectors Oil Services ETF (NYSE: OIH) and the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) are up 17% and 24%, respectively, the last 12 months.

But the biggest profit opportunities will come from select refiners, energy producers and oil services companies. David Fessler and I have alerted our Oxford Resource Explorer subscribers to seven must-own energy companies, and we're about to add two more. (Learn how to join us by clicking here.)

America will be an energy superpower in the 21st century. You'd better come along for the ride, or get left in the dust.

Good investing,

Sean

Source: http://www.investmentu.com/article/detail/37443/oil-boom-tipping-point

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.