U.S. Dollar/Yen Dynamics and the Stock Market

Stock-Markets / US Dollar May 12, 2014 - 02:17 PM GMTBy: Michael_Pento

It is imperative to understand the dynamics between the U.S. dollar and the Japanese Yen in order to grasp what is occurring across international markets. Investors have been borrowing Yen at nearly zero percent interest rates and buying higher-yielding assets located worldwide. These market savvy institutions and individuals realize that buying income producing assets, which are backed by a currency that is gaining value against the Yen, is a win-win trade.

It is imperative to understand the dynamics between the U.S. dollar and the Japanese Yen in order to grasp what is occurring across international markets. Investors have been borrowing Yen at nearly zero percent interest rates and buying higher-yielding assets located worldwide. These market savvy institutions and individuals realize that buying income producing assets, which are backed by a currency that is gaining value against the Yen, is a win-win trade.

Because of the policies embraced under the regime of Japanese Prime Minister Shinzo Abe, the Japanese economy was subjected to significant currency depreciation, government deficit spending and stagflation. When global investors unanimously become assured that the economic "recovery plan" of Japan would be based on massive debt accumulation and money printing, the yen received a death sentence.

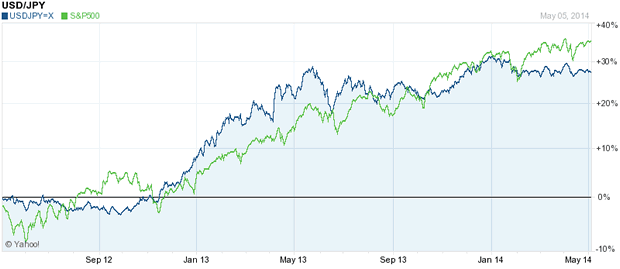

It was on this basis that the Yen suffered a decline of 25% against the dollar, since Abenomics went into effect late last year. The most interesting part of this failing economic plan of the Prime Minister, is the relationship between the Dollar/Yen and the performance of the S&P 500. The U.S. dollar appreciated 30% against the Japanese Yen since the assumption to office for Shinzo Abe (in December of 2013), through the commencement of the Fed's tapering of asset purchases, in January of 2014. It is no coincidence that the S&P 500 also appreciated 30% during that exact same timeframe. You can see the high correlation between the Dollar/Yen and the S&P in the two-year chart shown below.

The relationship between the dollar/yen and the U.S. market is undeniably clear. But it is also important to point out the divergence that has taken place since the start of this year. The dollar is beginning to lose strength against the yen; and yet the S&P 500 has managed to post a very small gain. It is prudent to conclude, given the dynamics of the dollar/yen relationship, that the U.S. stock market is about suffer a correction. This is especially true given the likelihood of further yen strengthening in the short term.

There exists two powerful reasons why the yen should rise against the dollar in the short term.

Reuters reported last month that for the first time in 13 years there was absolutely no trading in Japanese Government Bonds (JGBs) for more than one day. The fact is that no JGBs traded for 36 hours and the volume in Japanese debt is down 70% YOY. The Bank of Japan, in cooperation with the Abe government, has so perverted the bond market that private interest to buy JGBs has fallen to practically zilch.

With virtually no private market for Japanese debt and inflation soaring to over a five-year high, the BOJ may not be incentivized to further depreciate its currency and push JGB yields even lower by increasing its 70 trillion yen per annum stimulus plan at this juncture. In a rare and brief moment of sanity, the government of Japan could try to restore some liquidity in its bond market by allowing yields to incrementally rise from the current 0.6% on the Ten-Year Note. After all, yields must rise to a level that begins to reflect the realities of a bankrupt nation with rising inflation, in order to attract some interest from an entity other than the BOJ.

However, it is also true that the BOJ will eventually have to intervene in the JGB market to an even greater extent in order to keep debt service payments from spiraling out of control. But, in the short term, it is also likely that the Japanese government will not imminently expand its QE program, despite what all carry-trade investors are betting on. This is primarily because the central bank is reluctant to increase the pace of JGB ownership at this time.

The second reason why the dollar should lose ground against the yen in the short run is because the Fed may soon confound all carry-trade investors by getting back in the QE business.

The flat Q1 GDP print for the U.S. was summarily dismissed as a weather phenomenon. Nevertheless, when a "second-half recovery" once again fails for the 6th year in a row, stock market cheerleaders will have to find a different excuse for the perennially-weak economy. But the Fed may stop its tapering just around the time it gets down to near zero on new asset purchases -- sometime before the end of this year. It then should actually increase its monthly allotment of QE shortly thereafter. If the Fed gets back in the money printing business it will shock investors -- especially those who are trafficking in the yen carry trade.

As the yen carry trade begins to unravel, stock prices will fall across the globe. This will feed on itself, as investors are forced to buy back yen at increasingly unfavorable exchange rates.

The bottom line is that there should be a temporary reversal in the yen carry trade in the very near future. Once the myth of an economic recovery in the U.S. is rejected by most investors, the Fed will be unable to raise interest rates and will be pressured to get back into the QE business In addition, the BOJ will feel compelled to stem the pace of the drop in the yen, especially because its 2% inflation goal now appears to be in sight.

A respite from the yen carry trade will cause a global stock market meltdown in the short term and a sharp drop in the value of the dollar. It will also be the start the next major leg upwards in the secular bull market for precious metals.

Michael Pento is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2014 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.