Bear Stearns Rescue Reversed Gold Trend

Commodities / Gold & Silver May 01, 2008 - 10:42 AM GMT

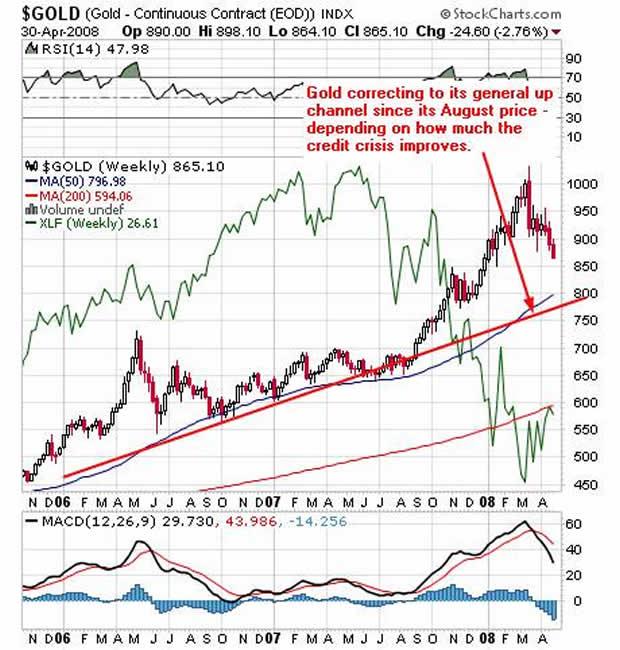

Gold rallied a great deal, way beyond anything in recent years, as the 07 credit crisis began and spread. Since the explosion of the credit crisis around August 07, gold exploded from the $670s to a $1020s peak mid March. The Fed/Morgan Bear Stearns bailout occurred at that time. Right after, the financials rallied (XLF Spider) and gold has been selling off since. Other commodities also are following. The credit crisis caused a gold and commodity bubble.

Gold rallied a great deal, way beyond anything in recent years, as the 07 credit crisis began and spread. Since the explosion of the credit crisis around August 07, gold exploded from the $670s to a $1020s peak mid March. The Fed/Morgan Bear Stearns bailout occurred at that time. Right after, the financials rallied (XLF Spider) and gold has been selling off since. Other commodities also are following. The credit crisis caused a gold and commodity bubble.

Central Bank bailouts, as credit crisis expands, drive gold and commodities

Several dynamics caused this gold correlation to the credit crisis. One was massive central bank bailout activity. Although few actual ‘bailouts' happened by name, we had the BoE bailout of Northern Rock, the ECB bailouts of several big banks, and the Fed bailout of Bear mid March.

There have been a lot of other central bank bailouts indirectly. The ECB and the Fed have both been offering longer term credit facilities to banks and financial institutions, to the tune of $1 trillion so far, depending on how you count it. They have added a cumulative $2 trillion to the credit markets since August of 07, depending on how you calculate it. And, most importantly, the ECB and the Fed have allowed banks to exchange their illiquid mortgage bonds/derivatives for borrowed capital, to the tune of hundreds of $billions each.

Obviously, as the Fed combated the credit crisis with interest rate cuts, the USD fell. Of course gold followed that by rising. The same can be said for what the ECB was doing, mainly from their massive bailouts, but not rate cuts.

Without all these measures, the western financial system would have totally collapsed. So far, at least, the worst case scenarios have been avoided. The credit system is still in big trouble, but it might be said the worst was avoided so far. As of now, there is some significant corporate bond issuance happening in the US finally, within the last several weeks. It is notable that gold has sold off heavily in the same time.

Gold and commodity bubble driven by funds

The second driver for gold and commodities since August was that investment funds of all types had to bail out of the financial sector, and also out of many stocks in general. That money cannot just sit there. So, a commodity and gold bubble ensued. So, gold rose to over $1000 in a few months. Oil and other commodities also followed suit rising dramatically.

Once it looked like the credit crisis might be abating after the Bear bailout (still a very dicey proposition) funds and others decided to switch back into other stocks and sectors, and take profits out of gold and commodities. Even oil appears ready for some of this profit taking.

The reason gold is down about $170 since its $1020 high appears to be due to a perceived improvement of the world credit crisis, since exactly when the Bear bailout occurred the middle of March 08.

The correlation of gold to a worsening credit crisis, and then gold's turn right after the Bear bailout is striking. Take a look at this chart:

We do not believe that gold is out of whack. What is happening is that gold is returning to its general up channel, as the world economy slows and central banks cut interest rates. Gold was way above its general up channel following the onset of the credit crisis. Gold will remain in a long term uptrend, once it returns to its general up trend channel established before August 07, if stagflation remains with us.

But for now, the mild improvement in the credit crisis after the Bear bailout has allowed funds to jump back into other investment sectors, and take profits in commodities and precious metals.

By Christopher Laird

PrudentSquirrel.com

Copyright © 2008 Christopher Laird

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.