U.S. Economy Death Cross - A Parasite Is Devouring The Heart Of America

Politics / US Economy May 07, 2014 - 05:34 PM GMTBy: Raul_I_Meijer

Tyler Durden runs a few lines by us from casino mogul Steve Wynn that paint a micro cosmos of everything that’s going wrong in our economies. Wynn calls the present conditions in which he conducts business “nirvana” because of prevailing artificially low interest rates and downward pressure on the dollar, but he also recognizes who pays for his nirvana. In very few words, he defines with precision how measures ostensibly intended to save the economy instead serve to destroy it, even as – and because -they make it – too – easy for him and his “class” to enrich themselves even further.

Tyler Durden runs a few lines by us from casino mogul Steve Wynn that paint a micro cosmos of everything that’s going wrong in our economies. Wynn calls the present conditions in which he conducts business “nirvana” because of prevailing artificially low interest rates and downward pressure on the dollar, but he also recognizes who pays for his nirvana. In very few words, he defines with precision how measures ostensibly intended to save the economy instead serve to destroy it, even as – and because -they make it – too – easy for him and his “class” to enrich themselves even further.

Steve Wynn Slams The Fed’s Ominous, Artificial Nirvana

… on one hand, as a businessman, I’m thrilled. Never dreamed that we would see anything so tasty and wonderful as that. On the other hand, it’s a reflection of questionable fiscal and monetary policy in the United States that is artificially depressed interest rates because of quantitative easing by the Fed, which is also sort of killing the value of the dollar and the living standard of the working people.

… if you’re a high-class borrower with good credit rating, this is one of the most tastiest seasons of all time for 2 reasons. You’re borrowing money at artificially depressed rates. And you’re most likely going to pay them back with 85-cent dollars. It’s a perfect storm for a businessperson unless you look at the truth of the matter and the impact it has on your customers and your employees. And that’s a much darker story. It doesn’t lend itself to a soundbite, but it’s — for every businessman in America and any economist that has their heads screwed on right, it’s an ominous situation.

Capital structure now is – these are mostly at the Venetian and the Wynn, things of beauty. They’re lovely, better than you could ever want. I mean, they’ve got everything, low interest rates, long maturities, low covenants. What else do you want? I mean, it’s great. If you look at it from our point of view. But look at it from a consumers’ point of view or a working person’s point of view, who’s paying for all this cheap money? Well, right now, the Fed is. I thought Bernie Madoff went to jail for that.”

This “policy” of creating the conditions for those who have a lot of money to make a lot more is having consequences that are going to be felt deep inside American society, and for a very long time. In the US housing markets, the only properties that are still selling well are the most expensive ones. In March, sales of homes that cost over $1 million rose 7.8%, while those under $250,000 fell 12%. Since the latter are the vast majority of the market, it’s not hard to see the fall-out for the mortgage industry, construction, home stores etc.

The S&P/Case-Shiller may claim that U.S. home prices climbed 12.9% in the year through February, but that’s just one end of the market. “On the low end, home sales are still making fresh lows every single month”, broker-dealer Newedge’s Robbert van Batenburg told his clients last month. And “The American Dream is dead for everybody but the happy few who have enjoyed the tailwinds of the appreciating stock market … ”

It is not difficult to see why: The Economic Policy Institute says that from 2009 to 2013, wages rose only for the top U.S. earners, but fell for the bottom 90%. Tyler Durden quotes data analyst CoreLogic as saying: “the real estate market is the ultimate reflection of confidence, wealth and income [..] the same factors driving the income stagnation in the middle are driving the income momentum at the top.” [..] That last bit is at the core of all this, as Steve Wynn also acknowledged, even though it’s both denied and ignored across the board: it’s the same factors that serve to both make the rich richer and the poor poorer. Those factors are better known as Fed policies.

This is all not some passing phase which will simply prepare all of America, and all US citizens, for better days ahead; it’s a deciding factor in the demise of the famed American entrepreneurial spirit and the small businesses and jobs that rely on it, a segment of society that’ll be extremely hard to revive once it’s gone. More from Durden:

The Death Cross Of American Business

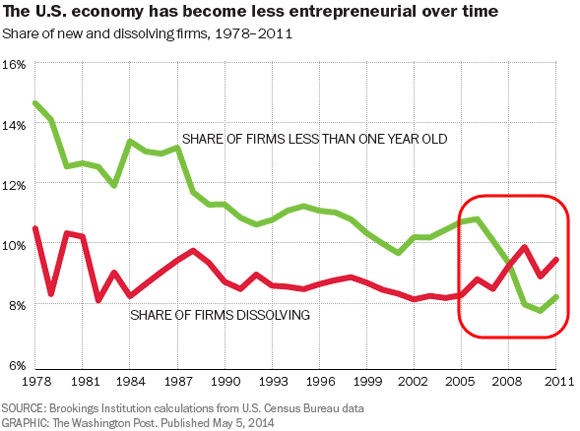

So much for the recovery… As WaPo reports, the American economy is less entrepreneurial now than at any point in the last three decades. A rather damning new Brookings Institution report shows that US businesses are being destroyed faster than they’re being created. As the authors of the report ominously explain: If the decline persists, “it implies a continuation of slow growth for the indefinite future,” as new business creation has been cut in half since 1978. This is the death cross of American Business!!

And the bottom line from Brooking’s Hathaway and Litan:

“Overall, the message here is clear. Business dynamism and entrepreneurship are experiencing a troubling secular decline in the United States. Existing research and a cursory review of broad data aggregates show that the decline in dynamism hasn’t been isolated to particular industrial sectors and firm sizes. Here we demonstrated that the decline in entrepreneurship and business dynamism has been nearly universal geographically the last three decades – reaching all fifty states and all but a few metropolitan areas.”

And no, nobody can prove that this is entirely the fault of Fed policies. But neither should anyone feel the need to try. Because it’s obvious that any policy aimed at facilitating the rich MUST make the poor poorer. It’s all just a transfer of money from one group to the other, a transfer hidden through mighty words of trickling growth that will lift everyone’s boat. Eternal hope and there’s always tomorrow. That’s the American dream. Well, say a prayer, because that dream has been dying for decades now, living an increasingly zombified existence fed by increasingly cheap credit that reached its zenith in lying subprime loans and the 7 million foreclosures they – so far – culminated in.

I wish I could say the American Dream has been on life support for decades, but few things are further from the truth. The Fed spent trillions of dollars, all of which use your labor as collateral, as Steve Wynn – again – rightly observes, but none of it went to re-establishing the heart of America as it once was: small business and the jobs it generates, which the US economy has always depended on, plus the home purchases those jobs made possible. Instead, Greenspan, Bernanke and now Yellen (and their made men) made sure to kill off that heart of America, for many years to come, by creating the ideal circumstances for Wynn et al to prosper even more.

That is, in the short term; Steve Wynn does seem to understand that this is all but certain to turn against him and his wealth medium and long term. Because it’s a one-on-one trade off: the Fed has not only done nothing at all to provide stimulus for the heart of America, it’s cut and dug a deadly hole in that heart in order to satisfy the bankrupt banks and bankers who are the greediest members of society. It could have, and should have, spent its stimulus in radically different ways. At least, if its goal would have been to bring recovery to America. Phoenix Capital:

The Fed Could Have Bought California & Texas With QE Money

… the Fed could have spent the $3.2 trillion to create 12.8 million jobs in 2009, each paying $50K per year, and still be making payroll for them today. Obviously, that’s an absurd notion, but then again, spending $3.2 trillion on anything without any evidence that your policies are really working is absurd (job growth remains anemic with the recovery being the worst in 80+ years). Indeed, QE failed to put a dent in Japan’s jobs picture over the last 20 years. It also failed to do much for the UK. Why would it somehow be different in the US?

And no, it’s not just the Fed, and it’s not just America. All major central banks act according to the same preferences: satisfy the appetite of the greediest parties. Where they should always first have restructured bank debts, they never did more than pay lip service to that sound economic principle, and put trillion dollar lipstick on unsound pigs so history’s biggest gamblers – and, lest we forget, biggest losers – could pay their debts and sit their fat asses back down at the crap table.

It’s a political at least as much as an economic issue. What’s best for a Wall Street banker will never be the same across the board as for a farmer in Alabama, and a German business executive’s interests will always be different from a Greek street vendor’s. In functioning democratic systems, “the people” should make sure that both get part of what they want and need. But in our present systems, not only does the less affluent party not get his “fair” part, he sees it being reduced so the already more affluent can take more. Even though, certainly in broad terms, it wasn’t the farmers and street vendors who were the cause of the crisis, but the bankers and executives.

If we don’t manage to solve that problem, and pretty soon, the US and EU won’t survive in their present shape and form, while Japan and China will be nations replete with street fighting men, armed with weapons a thousand times more efficient than history has ever witnessed. And that is truly scary. We’re not talking small problems here. Steve Wynn senses – part of – that, but he’s not sounding the big red flashing alarm he should. Here’s a metaphor: If American society were a human body, it would be under attack from a parasite, a flesh eating disease, that temporarily puts a red glow on its cheeks which makes people think it looks healthy. Flesh eating diseases kill their hosts. Consider yourselves such a host.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.