Banksters Market Rigging Manipulation Is 'Pedal To The Metal'

Stock-Markets / Market Manipulation May 07, 2014 - 03:58 PM GMTBy: Andrew_McKillop

Financial Companies Will Do Almost Anything

Financial Companies Will Do Almost Anything

Preet Bharara, the US Attorney for the financial Southern District of New York City recently said: “Companies, especially financial institutions, will do almost anything to avoid tough enforcement action and....have a natural and powerful incentive to make prosecutors believe that death or dire consequences await”.

The US FERC-Federal Energy Regulatory Commission formally charged JPMorgan with massive criminal manipulation of US energy markets, especially in California and the Midwest, specifically to obtain tens of millions of dollars in over-payments from power grid operators in the period between September 2010 and June 2011.

Gaming electric power markets, like the oil markets, the precious metals markets, and the non-energy commodity markets – in fact all markets - is a high-stake prize for the Robber Barons of Crony Capitalism. The simple result for all consumers and users of these basic inputs to the economy is that if regulators side with the criminals, prices in specific domains and sectors of key interest for the crony capitalists will stay rigged. For electricity and oil, they will remain high or very high, for gold and other PMs (precious metals) they will remain low. For other commodities they may be either low or high, depending on the whims and strategems of the crony capitalists, but in all cases prices will be artificial until there is a “mega reset” of the entire finance system.

In other words until there is a massive market crash at least equal to 2008-2009. At these times, nearly all commodities like nearly all traded financial assets will experience a price crash, but with the possibility that gold and other PMs may soar in price. It depends how the Robber Barons feel.

Doing something about this is very difficult, and becomes more so after each market reset.

And siding with the Robber Barons in no way has to be through collusion and corruption. A former chairman of the US CFTC (commodities trading regulatory agency) noted to me in person at a Chicago financial conference in 2008 that at best in his time in office, at any one time he had only six fully appraised and capable regulators available to handle all major affairs in the entire 48-state continental USA. Necessarily, prosecutions move slowly or very slowly and the army of well-paid lawyers lined up by the Robber Barons usually win.

Known and Proven

As a direct inevitable result, proven also in Europe and Asian markets, the Robber Barons can do what they like. Starting with energy and commodity prices, they presently want high oil and electricity prices, and at all times eying the potential for organizing “breakouts” in other major basic commodities, especially food commodities.

In some key commodities, like US natural gas and world coal, their whims direct them towards “price collapses” which enable them, when it pleases, to set up a later “surprise recovery”. Their naked and intense determination to push down gold and other PM prices for at least the last 3 years has almost daily impacts on price trends in these markets. Goldman Sachs and Morgan Stanley, among others repeatedly say the gold price, by end-year 2014 “will be $1075 per ounce or less”, even much less. Currently gold is above $1300 per ounce, making this specific market a spectacle we can call the Battle of the Titans in real time, where the crony capitalists take on everybody else – ignoring trifling details like the actual physical supply and demand for gold.

In the US, as of now, “test cases” are seeping into the media. One test being played out in New England concerns Energy Capital Partners, a hedge fund using tax-avoiding offshore investment techniques with deep ties to Goldman Sachs and JPMorgan. ECP paid $650 million last year to acquire three generating plant complexes, including the second largest electric power producer in New England, Brayton Point Power in Massachusetts.

Within 40 days of buying Brayton Point Power, ECP closed down all operations of this generator. No industrial or power market logic supported this decision. The pretexts used by ECP included its claim that Brayton had “old, outdated and failure-prone generating plant”, despite the fact that ECP had purchased the company after its “due diligence”.

The main goal was simple: create an artificial shortage of power in New England and gouge electricity prices. At times of peak demand like hot summer evenings and cold winter days, prices were able to be racked to extremes. The non-profit association Public Citizen and the financial journalists covering this “naked call on power prices” in New England, citing evidence lodged to the US FERC, estimate the market rigging cost consumers an additional $2.6 billion per year, but this estimate may be conservative.

The now very well known LIBOR-rigging scandal of manipulating interest rates and financial derivatives linked to interest rates, presently featuring the bank Barclays, has in fact spread its tentacles across the private bank sector of the Western world. For example, through UK-based RBS, its Japanese subsidiary RBS Securities Japan Ltd. in April pleaded guilty to wire fraud and accepted to pay around $50 million in fines as part of a settlement of more than $600 million, to date, with US and UK regulators over LIBOR rigging. US District Judge Michael Shea in New Haven in early May sentenced the Tokyo-based unit of RBS to pay the $50 million fine.

In total and to date, financial market regulators in different countries have sentenced banks including Barclays, RBS, UBS AG of Switzerland, Deutsche Bank and Holland's Rabobank Groep to a record total of 1.7 billion euros ($2.3 billion) for directly rigging interest rates linked to LIBOR. Related fines concern market rigging of Yen-Libor and Euribor rates, euro rates, and derivatives market-rigging related to this long-running market manipulation, which market specialists trace back to the early 1990s.

The Game Roars On

Global fines for LIBOR rate-rigging, plus the rigging of derivatives linked to LIBOR have reached $6 billion in the period June 2012 to end-April 2014. Regulators face the problem of finding out the extent of collusion of traders employed by the banks, with their criminal partners operating for leading brokers and other major market operators, such as the firm ICAP.

Due to interest rate and linked-derivatives rigging being very longstanding, and massive, at least $800 trillion in nominal value “financial assets” is either directly or indirectly affected. Overall, and again to date, the LIBOR-rigging industry rather than “scandal” is the largest-ever known, or more accurately partly-known scam in world financial history. Due to this specific case of market rigging revealing the key elements of huge spread across the entire financial sector, and well over 20 years of operation, the seemingly-impressive fines paid by identified wrongdoers are in fact “small change”. This is crony capitalism. For the banksters, it is like paying parking fines.

Collusion with the fraudsters and thieves who operate these scams on a permanent basis can be split into active and passive forms. Governments of course claim they are “alert to the problem”, but in the above example of the LIBOR scam have only acted seriously since 2009-2010. The financial industry operates on the basis that in specific domains and sectors – for example commodity and PM markets – these are de facto rigged and will stay that way.

Claims by some experts that we have to prosecute fraud and theft or else the economy will never really stabilize face the simple and basic problem of doing something about it.

As we know, since 2008 the “bankster clique” has claimed, whenever it suits, to be “on its deathbed” and subject to massive adverse trading conditions, loss of capital, under-capitalization, and so on. It therefore needs State bailouts and needs “government largesse” and support at a critical time. This “largesse” takes the quaint form of the big banks, when they successfully prosecuted, being able to settle prosecutions with no formal admission of guilt. They “agree to pay” the fines.

Gold and Oil – The Game Roars On

Gold market rigging can be demonstrated for at least the past 20 years.

In his book “The Gold Cartel,” analyst Dimitri Speck combines minute-by-minute data for the period Aug 1993 to Dec 2012 to show how gold prices moved on an average day. What happens is that New York morning fixings (about 10am EST) are frequently reset at a low price by the riggers, allowing the price to then be bumped up on overnight markets – when this is required by the riggers. Their basic goal is to ensure that “small players” are always wrongfooted, and always lose money, to push them out of the game. Currently, as we know, for reasons extending far outside the “simple” pleasure and profit of rigging gold prices, Goldman Sachs in particular has engaged a wall of financial propaganda, called “market forecasts”, for pushing gold prices as low as possible. Therefore abrupt and suspicious gold market price changes are certain and sure.

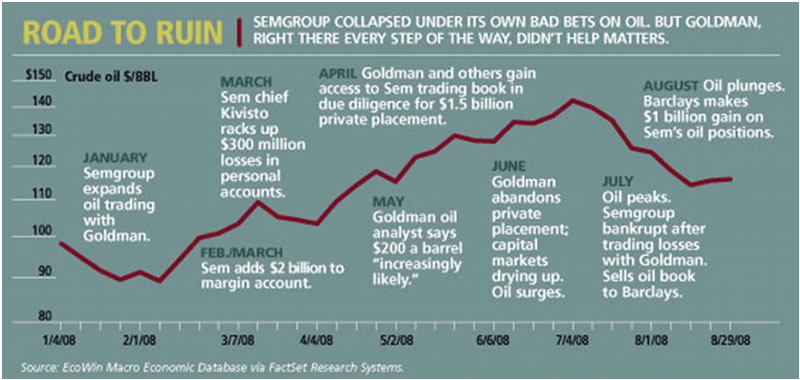

Oil market rigging – pushing the price upwards – also has a long track record. Probably the best-known and documented example of this, which of course needs a “?” added because no formal charges ever arose from the affair, was heavily researched by journalists working for 'Forbes' magazine. The key article is: http://www.forbes.com/forbes/2009/0413/096-sachs-semgroup-goldman-goose-oil.html

From this article, the key chart is reproduced, below. Nymex oil market rigging, with an instant spillover to all other major oil markets (ICE, Tocom, etc) appears most intense in the period of March-July 2008. After this, oil prices were heavily pushed downwards.

Oil market analysts recapping the period of 2005-2008 call it “a wild ride”, and many agree that in 2008 prices were at least $25 per barrel above any realistic demand-supply price. Taking world traded oil volumes as around 51 million barrels/day in 2008 (non-traded oil accounts for the rest), a “rigging surcharge” of $25/bbl represents a hit on all consumers and users of this traded oil of about $1.3 billion per day. For the 150 days of March-July 2008, we can calculate the total approximate value, to price manipulators, of their rigging.

No Guilt – No Shame

Ritual avoidance of guilt is a hallmark of crony capitalism, showing it always gets at least backdoor support from crony government for reasons that likely extend far beyond “simple” collusion and corruption of politicians, by the crony capitalists. As the banking and insurance crisis of 2008-2009 amply demonstrated, major private banks and insurers in several G7 countries made public threats of “closing down their business” unless governments provided them bailouts. Governments complied.

International action by the crony capitalists, using rigged FX-foreign exchange markets, has a long track record as a weapon used to weaken and destabilize selected enemy countries. This FX rigging activity, in these cases, is more than simple collusion of governments with the crony capitalists but the active use, by governments, of the market rigging “skills” of the crony capitalists to attack specific and selected enemy countries.

Making a check on how the Russian Ruble or RUB is performing against Western currencies since March 2014 will show this rather clearly.

The constant and massive manipulation of USD/JPY exchange rates is not “political” but what we can purely “market criminal”, designed to enable predictable and known-in-advance daily or weekly changes of share prices, and other asset prices, on world financial markets. The tipping point from government-approved “political” manipulation of currencies, to “market criminal” rigging, is however a fuzzy-edged domain. In the Japanese case, specifically, heavy manipulation of the Yen is already producing major blowback throughout the Japanese economy, setting a rising challenge to the political future of Shinzo Abe.

Blowback will also, and can also harm the crony capitalists themselves – not necessarily in the form of photoset prosecutions followed by an “agreed fine without guilt” set by crony government. A case in point featuring FX market rigging concerns the US dollar. At this time, in the “Western standoff with Russia” over the Ukraine, the dollar should be bolstered – but it is not. Longterm market rigging strategy by the banksters requires a constant decline in the dollar's world value. Blowback, in this case may result in the total abandonment of the “petrodollar system”, to the major disadvantage of the US.

The Bankster Strategy

Market rigging is so widespread, covering so many market domains, that investigative writers ask if there is some, of course secret, Master Strategy. Conjecture on this strategy can only be theoretical but key domestic-market rigging notably in home loans and mortgages, and their financial derivatives, is now a clear pernicious threat to the economy and society.

Transforming, that is mutating the whole real estate sector into a giant Ponzi scheme has more than only “blowback potential”. It is a threat to society, shown in a negative sense by governments being totally unwilling – they say “unable” - to control and defuze this threat. National or sovereign debt, which is another lever used by the crony capitalists to exercise unyielding and constant pressure on governments, through exchange and bond rate rigging, has plainly got out of hand since 2008.

In other words the banksters are the new masters. Clearly proven and documented since 2008, several major banks including Anglo-Chinese HSBC actively “launder” funds for world terrorist entities and organizations. The interconnection between the banksters and supposed “security providers” such as the US CIA and FBI is stronger than ever. For example, BoA-Bank of America funneled massive amounts of money to the later-collapsed BCCI, which in turn supplied funds to Osama bin Laden and others, according to the US Senate Foreign Relations Committee on Terrorism.

The banksters are therefore provenly able to finance, influence and possibly operate known terrorist organizations, providing them the capability of more than simply “blackmailing” their home governments with the threat of shutting down operations if they not given massive bailouts. Their constant financing of drugs and illegal weapons trades, worldwide, is also well documented.

Also since 2008, it is now abundantly clear that the banksters select and reward upper management – not “rogue individual traders” - on the basis of their ability to execute longterm strategies which require permanent rigging of financial and commodity markets. This strategy includes a clear retreat from so-called “high street banking” or retail banking. At the same time, for key members of the bakster fraternity, like JPMorgan in the US, RBS in the UK, Deutsche Bank in Germany, Soc Gen in France, the role of taxpayer subsidies in total revenues and profits has soared. Analyst estimates for JPMorgan suggest at least 75% of its 2013 net income was from this source.

Returning to the comment of Preet Bharara at the top of this article, the claim by banksters that they are “on their deathbed”, need legal largesse, and huge taxpayer fund inflows at the snap of their fingers, is an insane distortion of the true picture. The banksters are a threat to society.

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2014 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.