A Stampede Of Elephants In The China Shop - The Chinese Shadow Banking System

Economics / China Credit Crisis May 04, 2014 - 03:24 PM GMTBy: Raul_I_Meijer

I’m going to take a number of different sources to paint a portrait of China. I’ll take a great series of numbers from Ambrose Evans-Pritchard, whose analysis we can all do without, and leave the analysis up to David Stockman, who goes a long way but, in my proverbial humble view, seems to be stumbling a bit towards the end. That is to say, as I’ve written before, when I look at China these days, I see a bare and basic battle for raw power, economic as well as political power, between the Chinese government and the shadow banking system it has allowed, if not encouraged, to establish and flourish, and which now has grown into a threat to the central state control that is the only model Beijing has ever either understood or been willing to apply.

I’m going to take a number of different sources to paint a portrait of China. I’ll take a great series of numbers from Ambrose Evans-Pritchard, whose analysis we can all do without, and leave the analysis up to David Stockman, who goes a long way but, in my proverbial humble view, seems to be stumbling a bit towards the end. That is to say, as I’ve written before, when I look at China these days, I see a bare and basic battle for raw power, economic as well as political power, between the Chinese government and the shadow banking system it has allowed, if not encouraged, to establish and flourish, and which now has grown into a threat to the central state control that is the only model Beijing has ever either understood or been willing to apply.

The Chinese shadow banking system, which you need to understand is exceedingly fluid and has more arms and branches than a cross between an octopus and a centipede, has become a state within the state. That this should happen, in my view, was baked into the cake from the start. Either the Communists could have maintained their strict hold on all facets of power and allow economic growth only in small increments, or it could, as it has chosen to do, push full steam ahead with dazzling growth numbers, but that would always have meant not just the risk, but the certainty, of relinquishing parts of their power and control.

As someone mentioned a while back, if you want to have an economic system based on what we call capitalist free market ideas (leaving aside all questions that surround them for a moment), the players in that system need to have a range of – individual – freedom that will of necessity be in a direct head-on collision with – full – central control. We bear witness to that very battle for power between Beijing and the ”shadows”, right now, as we see the most often highly leveraged shadow capital change shape and identity whenever the political leadership tries to get a handle on it through banning particular forms of borrowing, lending and financing.

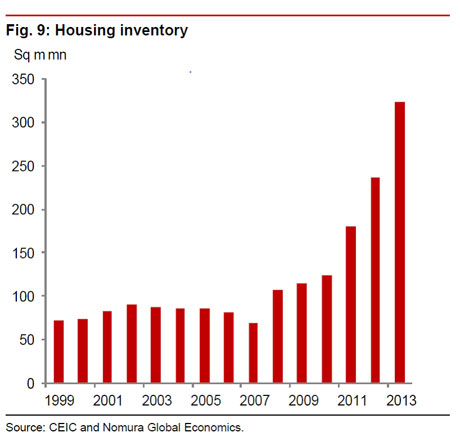

There can’t be much doubt that the cheap credit tsunami unleashed in the Middle Kingdom has turned into an extremely damaging phenomenon, as characterized by massive overbuilding, pollution, but the government and central bank have far less power to rein it in than people seem to assume. The shadow system has made so much money financing empty highrises and bridges to nowhere that it will try to continue as long as there’s a last yuan that can be squeezed from doing just that. And when that aspect stops, it will retreat back to where it came from, the shadows, leaving the Xi’s and Li’s presently in charge with the people’s anger to deal with.

Increasingly over the past two decades, China has had two economies. That’s not an accident, it’s what has allowed it to expand at the rate it has. But that expansion is as doomed to failure as any credit boom, and given its sheer size, it’s bound to come crashing down much harder than anything we’ve seen so far in the “once rich” part of the world we ourselves live in. The odds of a soft landing are very slim, and one, but certainly not the only, reason for that is that Beijing has traded in control for faster growth. And that now the negative aspects of the growth process become obvious, it no longer has sufficient control to foster a soft landing.

On the way up, the interests of Beijing and the shadows were very much aligned for obvious reasons; going down, that is no longer true. Li and Xi will be held responsible for the downturn, the men behind the shadows won’t, because no-one will be able to find them. There’ll be middle men hanging from lampposts, but the big players will be retreating to London, New York, Monaco.

But I was going to let others do the talking today. Here are Ambrose’s numbers:

Chinese Anatomy Of A Property Boom On Its Last Legs (AEP)

So now we know what China’s biggest property developer really thinks about the Chinese housing boom. A leaked recording of a dinner speech by Vanke Group’s vice-chairman Mao Daqing more or less confirms what the bears have been saying for months.

It is a dangerous bubble, and already deflating. Prices in Beijing and Shanghai have reached the same extremes seen in Tokyo just before the Nikkei boom turned to bust, when the (quite small) Imperial Palace grounds were in theory worth more than California, and the British Embassy grounds (legacy of a good bet in the 19th Century) were worth as much as Wales.

“In 1990, Tokyo’s total land value accounts for 63.3% of US GDP, while Hong Kong reached 66.3% in 1997. Now, the total land value in Beijing is 61.6% of US GDP, a dangerous level,” said Mr Mao. “Overall, I believe that China has reached its capacity limit for new construction of residential projects”.

• China’s house production per 1,000 head of population reached 35 in 2011. The figure is below 12 in most developed economies “even when the housing market is hot; no country has a figure of greater than 14”.

• “By 2011, housing production per 1000 people reached 30 in Tier 2 cities, excluding the construction of affordable houses.

• “Many owners are trying to get rid of high-priced houses as soon as possible, even at the cost of deep discounts.

• “In China’s 27 key cities, transaction volume dropped 13%, 21%, 30% year-on-year in January, February, and March respectively.

David Stockman points out what may be the biggest bull in the China shop: because of the massive debt expansion it’s undergone, its economy is inherently unstable. And it’s nonsense to presume that Beijing can, in Stockman’s nicely puts it, “walk the bubble back to stable ground”. This is in part due to the sense of entitlement government policies have instilled in the population, and in part to the rise of the shadow banking system that the Communist party not only has far less control over than it likes to make us believe, but that it fights an active economic war with over control of the economy. Unfortunately Stockman’s analysis, good as it is, glazes over that last point.

Beijings Tepid Efforts To Slow The Credit Boom Are Springing Giant Leaks

China is a case of bastardized socialism on credit steroids. At the turn of century it had $1 trillion of credit market debt outstanding – a figure which has now soared to $25 trillion. The plain fact is that no economic system can remain stable and sustainable after undergoing a 25X debt expansion in a mere 14 years. But that axiom is true in spades for a jerry-built command and control system where there is no free market discipline, meaningful contract law, honest economic information or even primitive understanding that asset values do not grow to the sky.

Nor is there any grasp of the fact that the pell-mell infrastructure building spree of recent years is a one-time event that will leave the economy drowning in excess capacity to produce concrete, steel, coal, copper, chemicals and all manner of fabrications and machinery, such as backhoes and cranes, which go into roads, rails and high rises.

At bottom the fatal error among China bulls is the failure to recognize that the colossal boom and bust cycle that China is undergoing is not symmetrical. The much admired alacrity by which the state guided the export boom after 1994 and the infrastructure boom after 2008 is not evidence of a superior model of governance; its only proof that when credit, favors, subsidies, franchises and speculative windfall opportunities are being passed out freely and to everyone, when there are all winners and no losers (e.g. China’s bankruptcy rate has been infinitesimal), a statist regime can appear to walk on water.

But what it can’t do is walk the bubble back to stable ground. The boom phase unleashes a buzzing, blooming crescendo of enterprising, investing, borrowing and speculating throughout the population that cannot be throttled back without resort to the mailed fist of state power. But the comrades in Beijing have been in the boom-time Santa Claus modality for so long that they are reluctant to unleash the economic gendarmerie.

That’s partly because their arrogance blinds them to the great house of cards which is China today, and partly because they undoubtedly understand that the party’s popularity, legitimacy and even viability would be severely jeopardized if they actually removed the punch bowl. [..]

In short, the Chinese population “can’t handle the truth” in Jack Nicholson’s memorable line. They by now believe they are entitled to a permanent feast and have every expectation that their party and state apparatus will continue to deliver it. As a result, Beijing has resorted to a strategy of tip-toeing around the tulips in a series of start and stop maneuvers to rein-in the credit and building mania. But these tepid initiatives have pushed the credit bubble deeper into the opaque underside of China’s red capitalist regime, meaning that its inherent instability and unsustainability is being massively compounded.

There’s no-one debating that Beijing walks a very tight line between growing its economy and bringing that growth back to earth. That would have been a severe challenge no matter what. But its biggest problem now is that there are many buttons and switches and levers in the economy that it effectively no longer even has access to. The shadow state within the state will, as long as there’s a profit in it, behave like water in the sense that you can build a dam at one place but it will find another route to flow down through. This Wall Street Journal article provides a nice example of the how and why of that process:

Entrusted Lending Raises Risks In Chinese Finance

With credit tight in China, companies in industries beset by overcapacity are turning to an unconventional source for cash – other companies – in a new rising risk for the country’s financial system. These company-to-company loans, known as entrusted lending, have emerged as the fastest-growing part of China’s shadow-banking system, which provides credit outside of formal banking channels. Net outstanding entrusted loans increased by 715.3 billion yuan ($115.4 billion) in the first three months of 2014 from a year earlier, according to the most recent data from China’s central bank.

The increase in entrusted loans last year was equivalent to nearly 30% of local-currency loans issued by banks – almost double the portion in 2012. The jump is all the more pronounced since China’s total social financing, a broad measure of overall new credit, shrank 561.2 billion yuan over the same period, largely because other forms of shadow credit declined as Beijing sought to rein in runaway debt growth. [..]

Officials at the People’s Bank of China, the central bank, have warned that much of the intercompany lending is flowing to sectors where the regulators have urged banks to reduce lending: the property market, infrastructure and other areas burdened by excess capacity. In central Shanxi province, 56% of entrusted loans in the past few years have gone to power producers, coking companies and steelmakers, among others, according to a recent paper by Yan Jingwen, an economist at the PBOC. Access to entrusted loans allows struggling companies to hang on longer than they otherwise could, delaying the consolidation that the government and some economists say is needed in a swath of industries.

Big publicly traded companies with access to credit – such as the shipbuilder Sainty Marine and specialty-chemicals producer Zhejiang Longsheng – are among the most active providers of entrusted loans. These companies, instead of investing in their core businesses, lend funds at hand to cash-strapped businesses at several times the official interest rate.

In an analysis for The Wall Street Journal, ChinaScope Financial, a data provider partly owned by Moody’s Corp., found that 10 publicly traded Chinese banks disclosed that the value of entrusted loans facilitated by them reached 3.7 trillion yuan last year, up 46% from the previous year. Compared with 2011, the amount was more than two-thirds higher.

It’s only a matter of time before the Communist party tries to assert control over, and ban, theses entrusted loans. But the people who initiated them will simply move on to other forms of shadow lending, ones that they probably already have waiting in the wings. There are many thousands of party officials and heads of state enterprises who are many miles deep into leveraged debt and will grasp onto any opportunity to double down on their wages in order not to be exposed as gamblers, to hold on to their positions, and to avoid the tar and feathered noose. Beijing will let them, lest the Forbidden City itself fill up with tarred feathers, and try to deflate the balloon puff by puff. As the shadows simultaneously re-inflate it just as fast, if not more.

Still, once it’s clear that you’ve greatly overbuilt, overborrowed and overleveraged, the only way forward is down. The “water always seeks the least resistance” analogy holds up there as well. At some point, in economics like in physics, gravity takes over. And this time around the China avalanche as it moves down its slope has a good chance of burying the rest of the world in a layer of dirt and bricks and mud and mayhem too. So we might as well try to understand this for real, not quit halfway down.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.