Gold, Silver and Stalling Economies

Commodities / Gold and Silver 2014 Apr 17, 2014 - 04:12 PM GMTBy: Alasdair_Macleod

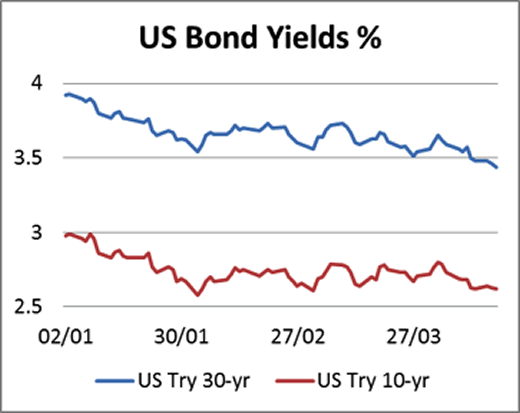

It wasn’t meant to be like this: six years of global money-printing should have guaranteed economic recovery. Until very recently, there was hope that finally the medicine was having some effect; but in the last few weeks investors have become noticeably more cautious. Is it Ukraine, or is it the slow-down in China? Whatever the story the truth is revealed in the chart of recent US bond prices shown below.

It wasn’t meant to be like this: six years of global money-printing should have guaranteed economic recovery. Until very recently, there was hope that finally the medicine was having some effect; but in the last few weeks investors have become noticeably more cautious. Is it Ukraine, or is it the slow-down in China? Whatever the story the truth is revealed in the chart of recent US bond prices shown below.

The Long Bond yield is leading the way downwards, having broken below the 3.5% level, and the 10-year bond seems set to follow its lead. Eurozone bond yields have also collapsed signalling either outright deflation or possibly, given its proximity to Ukraine, a flight from bank deposits.

This week the Ukrainian situation escalated with Russia’s Crimean strategy emerging in other eastern cities. Peace talks in Geneva today are not expected to improve things. Meanwhile Washington seems set to escalate financial tensions with Russia, potentially blacklisting businesses and even banks, as well as individual oligarchs. The financial consequences of any such action are bound to concern markets and could become destabilising, risking global economic prospects particularly with a Chinese slowdown.

Opinion is divided over the effects on the gold price. In western capital markets there is a widely-held view that a deteriorating economic outlook will provoke a run from commodities into cash, so those who regard gold as only a commodity are bearish but have almost certainly already sold. The four billion Asians who own most of the world’s gold take a different view having learned through experience that their currencies collapse instead.

This sums up the opposing forces behind the gold price. In futures markets the bets are in favour of shorting, while the Asians continue to buy physical. And this is why yet again, the London gold forward rate (GOFO) went sharply into backwardation last Friday when futures markets forced prices lower. It is even more negative this morning, signalling market strains are still increasing.

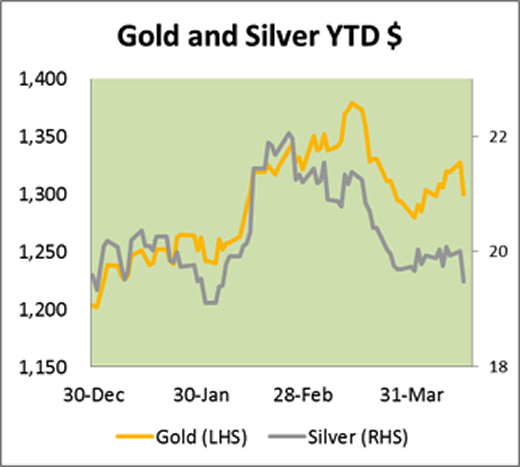

Prices for gold and silver sold off this week, with gold falling from a high of $1331 to a low of $1286 on Tuesday, and silver went as low as $19.22 at one point. The chart below shows how prices for gold and silver have progressed since the beginning of the year, and it can be seen that silver has been the outright loser.

However, as discussed last week, silver’s open interest on Comex has been building and is now close to all-time highs at over 164,000 contracts. When the tide turns, silver should be the star performer.

Next week

There is little doubt that the Ukrainian situation will dominate next week’s news. If it escalates, which seems likely, bullion may emerge as a safe-haven play.

Easter Monday is a holiday in many countries.

Monday. US: Leading Indicator.

Tuesday. Japan: Leading Indicator. Eurozone: Flash Consumer Sentiment. US: Existing Home Sales

Wednesday. Eurozone: Flash PMI. UK: BoE MPC minutes released, Public Borrowing. US: Flash Manufacturing PMI, New Home Sales.

Thursday.UK: CBI Distributive Trades Survey. US: Durable Goods Orders, Initial Claims. Japan: CPI.

Friday. Japan: All Industry Activity Index. UK: BBA Mortgage Approvals, Retail Sales.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.