Greece, Turkey, We're Shuffling The Cards on Our Europe Investing Play

Stock-Markets / European Stock Markets Apr 14, 2014 - 01:44 PM GMTBy: Frank_Holmes

Did you know that over the last year the Greek stock market is up roughly 45 percent? The country that many believed would never recover from a six-year recession is now making astounding strides, recently being added to the MSCI Emerging Markets Index at the end of 2013.

Did you know that over the last year the Greek stock market is up roughly 45 percent? The country that many believed would never recover from a six-year recession is now making astounding strides, recently being added to the MSCI Emerging Markets Index at the end of 2013.

As I've witnessed new strength from this "comeback country," along with a rise in foreign investment into emerging markets as a whole, our investment team is currently strategizing to adapt our game to new European plays. Here are the game changers we see:

Greece Wants Back in the Game

Last week, Greece returned to the international markets with a five-year bond sale, quickly topping $4 billion according to Bloomberg. The yield on these bonds is a little under 5 percent, an attractive number in comparison to other country's currency bonds. Greece has been shut out of the bond market for roughly four years now, but I believe the country's reentry last week is an imminent sign of recovery.

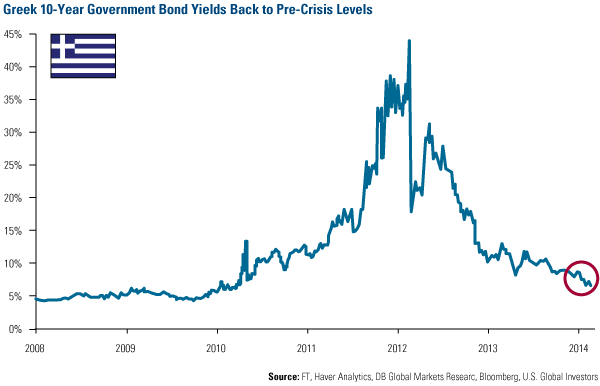

In the Investor Alert on March 28, we highlighted another indicator of Greece's recovery. The Greek 10-year bond yields are back down to 2010 levels and the country's economy is expected to grow by 1.1 percent this year. These conditions have boosted consumer confidence and allowed Greek banks to recapitalize, changing the lending landscape in a credit-starved nation.

A recent Reuters' article discussed the Greek bond sale stating that, "It would not only raise confidence in Greece's ability to fund itself and aid its recovery, but it also offers Europe the chance to claim its widely-criticized crisis medicine of tough cuts and austerity was necessary, and ultimately successful."

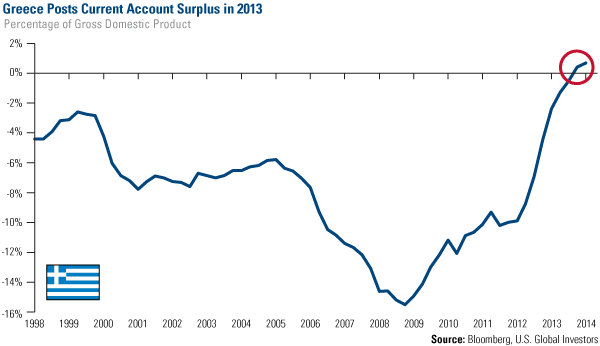

In fact, last October our Director of Research John Derrick expressed his confidence in the country during a time when most investors wouldn't offer Greece a second look. He said the country's current account situation could move from a deficit to a surplus in 2014. As it stands now, several strong economic signs are pointing to John's positivity on the country, including the fact that Greece hit a surplus before 2014 even began, as you can see in the chart below.

One way we are playing these powerful signs within our Emerging Europe Fund (EUROX), is through Greek banks such as Alpha and Piraeus. These banks recently recapitalized, and with the Greek banking industry now consolidated to only four major banks, these names are poised to benefit from the economic recovery.

The Cards Are Stacked Against the Russian Investment Case

I have always believed that government policies are a precursor to change, and witnessing the drama with Putin in the Russian corner of the globe, I think now is a perfect time to shuffle our investment deck and underweight our portfolio to the country. We noticed economic growth in Russia beginning to slow in 2013, with few identifiable, positive catalysts, but the recent geopolitical tension with Ukraine was the final indication of an undesirable shift.

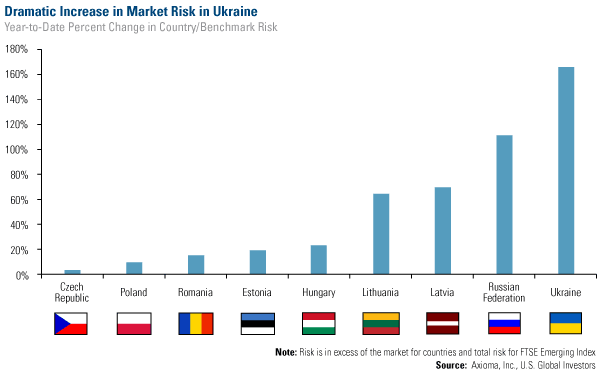

Since the breakout of conflict between Russia and Ukraine, investor confidence has dwindled in the area, and as you can see in the chart below, the two countries directly involved in the clash are the ones showing the highest market-risk impact.

Towards the end of 2013 I wrote that European equities had seen the longest streak of inflows in over 11 years, as investors began noticing this area of the globe as a spectacular investment opportunity. In addition to many strong areas in developed and emerging Europe, several of these equities were in Russia, and continue to be in Russia. Despite the disorder and our decreased exposure to Russia, we still see resilient stocks with growth opportunities. Two examples of strong Russian names include Norilsk Nickel, a nickel and palladium mining company, along with an Internet company, Mail.Ru.

When it comes to actively managing a portfolio, it's all about playing your cards right, and at U.S. Global Investors we seek to manage risk while pursuing opportunity for our shareholders.

Turkey's Turnaround

Greece isn't the only country returning to the Eurobond market. Last Wednesday, Turkey sold 1 billion euros of nine-year bonds for the first time this year. The bonds, which will mature in 2023, should help the country with financing needs for the remainder of 2014.

Investors showed particular interest in Turkey's bond issue, but have also started looking to the country as a prime tourist destination. Istanbul, the largest city in Turkey, recently jumped 11 spots to take this year's No. 1 position on TripAdvisor's Traveler's Choice list of global destinations, according to CNN.Besides traditional tourism, Turkey is one of the leading countries in terms of medical tourism, particularly chosen for its experienced surgeons and affordable hair transplant procedures.

Passenger growth in Turkish airports is taking off, seeing year-over-year growth of 15 percent in both international and domestic passengers. Additionally, Turkish Airlines flies to more countries around the world than any other airline! No wonder people love to visit this country. One way we capture this strength for our European fund is through a Turkish airport operator, TAV Airports.

In fact, I too will be participating in this outstanding growth when I travel to Turkey next month. U.S. Global is inviting all curious investors to take part in this exciting trip as well! I encourage you to read about the opportunities we will be exploring in Turkey straight from the experts.

So inspite of Turkey's underperformance last year, the country is up 10 percent year-to-date, and over the past decade Turkey's economy has more than tripled. Consumer confidence is back on track and the long-term, secular growth story remains intact.

Follow the Money

I believe the European recovery is a story worth telling, and within our Emerging Europe Fund (EUROX) we use our investment model to lead us not only to the strong and stable countries in this emerging market, but also to the strong sectors within each country. As Western Europe continues to recover, we believe companies with robust fundamentals in emerging Europe provide leverage to this growth. Explore this opportunity to invest in companies we believe are playing their cards right.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Emerging Europe Fund as a percentage of net assets as of 03/31/14: Alpha Bank AE 1.98%, Mail.Ru 0.00%, Norilsk Nickel 0.00%, Piraeus Bank SA 2.34%, TAV Havalimanlari Holdings Inc. 0.75%.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund's returns and share price may be more volatile than those of a less concentrated portfolio. The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund's performance more volatile.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.