London House Prices Bubble, Debt Slavery, Crimea 2.0 - Russia Ukraine Annexation

Housing-Market / UK Housing Apr 14, 2014 - 01:30 AM GMTBy: Nadeem_Walayat

Is London House Price Boom Sustainable? Regional UK House Prices Analysis

Is London House Price Boom Sustainable? Regional UK House Prices Analysis

Recent data released by the Nationwide illustrates that whilst UK average house prices are rising by near 10% per annum to stand at £180,264 and now just 3% away from their 2007 peak (-3%), meanwhile London has been in a raging bull market for well over a year with prices rising by 18% per annum putting the average at £362,699 which is more than 20% above London's 2007 peak.

The nationwide's regional table illustrates the extent to which the London housing bull market has out performed the rest of the UK and especially northern cities by typically 30%.

Many academic economists have for several years persistently claimed rising London house prices are unsustainable by mistakenly focusing on the traditional measures of affordability such as earnings, and thus often conclude that it is a bubble ready to burst whilst instead London's house prices have continued to accelerate.

The problem with academics is that they are very good at constructing thesis of what should happen and why, but in reality all that they have constructed is a faeces of what should happen and why because over 90% of academics don't trade / invest their own capital or in investing experience terms are NOOBS, instead their focus is on collecting letters after their names and to be regurgitated by the pseudo-economists (journalists) in the mainstream press.

Academics just do not understand what drives markets as I have covered at length in several ebook's and many articles including my latest on the housing market that can be downloaded for free by the end of this month (April 2014).

19 Aug 2013 - UK House Prices Bull Market Soaring Momentum, 10% Inflation by October?

In having immersed by myself in the markets for 30 years now, I know that what many academics tend to take for granted rarely matches reality. Whilst I covered many aspects of trading markets in my last ebook (Stocks Stealth Bull Market 2013 and Beyond - Free Download). However in terms of economic trends what academics will always fail to grasp is that markets are NOT driven by fundamentals but by SENTIMENT and it is SENTIMENT that CREATES the fundamentals! Which is why the academic economists rarely have any real clue as to what is going in the markets because they are nearly always looking in the WRONG direction i.e. they are looking at the CAUSE rather than the EFFECT, as in reality it is the EFFECT that makes itself manifest in the price charts long before the CAUSE appears in the economic data that academics focus upon, which is why the SAME economic data can and is used by economists and pseudo-economist (journalists) such as that which we see on TV news shows to explain EITHER price rises OR falls.

You can only know the markets IF you TRADE the markets! The pseudo and academics economists will never get you on the right side of trends years ahead of the herd, in fact most press media commentators will be some of the LAST people to jump onboard trends, usually just before they end!

Momentum Drives Housing Market Sentiment and Economic Growth

As house price rises continue to accelerate, many people sat on the sidelines waiting for prices to fall or even crash will realise that it is just not going to happen, and in their despair at the relentless accelerating trend of rising prices, in increasing numbers will feel no choice but to jump onboard the housing bull market as a they see the houses they have been viewing sold and asking prices trending ever higher.

As house prices rise, home owners see the value of their houses rise £x thousands per month, in many cases by more than their salaries, this will encourage many to borrow and spend more, and save less which will meet the governments primary objective for inflating the economy by means of the housing market. Everyone will be playing the game of how much has my house value increased by, a quick analysis of my own housing portfolio (based in Zoopla estimates) shows a 5.5% increase in housing wealth over just the past 6 months! Does this make me feel richer, more willing to spend? Well, being only human, YES it does!

Help to Buy Anniversary

It is now 12 months since the Coalition government's help to buy scheme started that initially targeted new builds but was extended to all properties which was brought forward to the 1st of October 2013 from its original start date of 1st of January 2014 that in my opinion sparked panic buying amongst many thousands of prospective home buyers who had been finding it near impossible to buildup deposits of 25% that mortgage lenders typically sought in terms of managing risk, however now the same mortgages can be secured with just 5% deposits as the government funds 20% of the deposit with an 5 year interest free loan which on the £600k valuation limit amounts to a huge difference between a previous cash deposit requirement of £150k against just £30k today under the help to buy guarantee scheme.

One year on over £2 billion has been committed under the help to buy scheme resulting in EXTRA demand of about 15,000 housing market transactions. Whilst academics may argue that the number of extra transactions is relatively small i.e. at about 2500 per month amidst a total of around 70,000 (3.5%). However, what the academics repeatedly fail to comprehend is that bull and bear markets are made at the margins, and then driven by sentiment. Therefore a marginal increase in demand of 3.5% per month is enough to generate strong positive sentiment that gains momentum each month resulting in a full blown house prices boom for 2014.

What Does this Mean for House Prices ?

Well, effectively injecting 20% of tax payers money into the value of homes implies that house prices should ultimately be inflated by an EXTRA 20% i.e. in addition to the preceding market trend and momentum, as I illustrated in an article ahead of the October help to buy expansion of what to expected in terms of the ramping up of the housing market towards igniting an election economic boom that at least targeted a trend trajectory of 10% per annum for 2014. Especially as the news of the day was also accompanied by another wave of out of control immigration that continues to play its part in fuelling housing market demand.

And another point that the mass media ivory tower academics and journalists who think they are economists fail to comprehend is that help to buy acts to LEVERAGE and INFLATE the WHOLE housing market and not just the marginal transactions because house prices are relative to one another i.e. each higher sale pulls ALL of the houses in the street / area up with it.

29 Sep 2013 - David Cameron Brings Forward Help to Buy Mortgages, Stoking House Prices Bubble, Election Boom

It's not rocket science, it's actually quite simple: Limited Supply + Quadruple Demand = House Prices Boom!

The strategy in bringing forward of the Help to Buy Scheme for all properties is clearly aimed at building on housing market sentiment towards a trend trajectory of average UK house prices rising at a rate of at least 10% per annum, which is precisely inline with my forecast momentum for UK house prices to be rising by 10% per annum as of October 2014 data, and all the way into Mid 2014.

Yours analyst waiting for the PANIC Buying headlines in the mainstream press. Forget under offers, it's offers OVER for an increasing number of areas of the country as I warned several weeks ago - Final Warning UK House Prices Boom Imminent!

The bottom line is to take this as your final warning for a UK house prices boom as those waiting on the sidelines have only a matter of weeks to act before housing market sentiment responds to a market that is rising at a rate of more than 10% per annum. The days of under offering for good houses in good locations is about to end

David Cameron prompted to respond to help to buy demand news and house price bubble fears replied - "Where we are today, house prices are still way below the peak they reached in 2007. Forecasters do not think they will get back to the level before the crash even in 2019. So there is no evidence of a problem."

Well, if the UK house prices trend pans out as I expect then average house prices will have reached their 2007 highs BEFORE the May 2015 general election and have soared far into the stratosphere by 2019.

UK Regional House Prices - London Boom

My analysis in the New UK Housing market ebook further elaborates on why London is out performing the regions as excerpted below:

The regional UK house prices graph illustrates that the UK is not one housing market but several markets that tend to differ in synchronicity to London depending on the distance from Britains property market trends epicentre.

The graph clearly illustrates that London looks set to be the first region of Britain to surpass its previous high probably by the middle of 2014 (Halifax NSA). A strong London housing market tends to ripple out in waves across Britain that tends to overcome negative local economic factors that suggest that regional house prices should stagnate. This is precisely what took place during the last housing bull market where after several years of London galloping ahead the ripples eventually ignited strong housing bull markets that also saw London-esk annual percentage house price gains and in some cases such as Northern Ireland far surpassed the pace of annual % gains.

The following table illustrates the current state of the regions In terms of the economic effect of momentum driven rising house prices (£'s rise over 1 year).

The key point is that house prices momentum is already igniting strong economic sentiment amongst many UK regions that won't be apparent in economic statistics for some time, so whilst the regions are unlikely to reach the level of the £40k annual gain of London, nevertheless in many respects are already exceeding 50% of the local average earnings and thus likely to result in an acceleration of these housing markets during 2014 that by the end of the year are likely to be exceeding London's annual percentage rate.

Of notable exception are Scotland and Northern Ireland, this is as consequence of the uncertainty that surrounds the outcome of the Scottish referendum which is already witnessing a flight of workers and capital out of Scotland as a Yes vote would open pandora's box that would destabilise bordering regions hence why the North appears to be lagging. The only anomaly appears to be Wales that is significantly outperforming the UK average when it should be near half the UK average which at this point I am putting down to erroneous halifax house prices data that may correct itself on release of 2014 Q1 data.

Therefore given that regional housing markets look set to replicate the London boom in terms of annual percentage increases then the greatest opportunities presented are in regions such as East Anglia, East Midlands and Yorkshire and Humber where average prices are less than HALF that of London. Whilst Scotland, Wales, Northern Ireland, North and the South West are pending the outcome of the Scottish Independence referendum, as a Yes vote will likely result in significant migration of skilled workers and businesses out of these areas and therefore act to depress local housing markets.

Why London House Prices are Rising

You want to know the real truth why London is galloping ahead of Britains other regions?

The truth in two words - MASS DELUSION!

Not just from the residents of London who are saddling themselves with unserviceable debt mountains on the assumption that house price inflation will in the long run solve their debt burden problems, just as long as they are able to cling onto their properties by their finger nails and meet the monthly interest payments. But the buy London properties mass hysteria is literally GLOBAL, and especially concentrated amongst the totalitarian states, such as Russia, China, the Gulf states and several others. Where it is not just the elites who see London through rose tinted glasses but the mania has gripped many more ordinary citizens for the fundamental fact that they FEAR their own criminal governments STEALING their hard earned / stolen wealth.

Yes, what Chinese with capital fear more than anything else is their 'COMMUNIST' government in the face of the next economic / financial crisis deciding to flip a switch and say now we really are communists and so all private property now belongs to the State - financial crisis solved as yesterdays bankrupt state is now flush with cash once more. Cannot happen ? It has already happened in China several times!

The same holds true for the Russian elite and citizens who fear Czar Putin doing to them what he has already done to several oligarchs and not forgetting the revolutions of past when all private property was stolen by the state.

Same holds true for the Arab states for there they have god on their side, all it would take is for the local Emir to reinterpret the holy book and declare private property is haram and thus for the good of his people to ensure that they will enter paradise he and his thousands of royal in-bred's must take custody of all private assets and property, so sorry but you will have to vacate your 6 bedroom villa and wait for the version in paradise that you are now virtually guaranteed!

That is what is driving London house prices beyond levels that academic economic theories and thesis or faeces can ever hope to comprehend and for which there is NO END IN SIGHT!

They will keep shoveling money into London and displacing British citizens as an ever greater percentage of the London property is lapped up by the in FEAR 1/2 billion plus new middle class's of totalitarian states and pseudo democracies such as India.

London property market equals wolf in sheep's clothing which is backed by a government that only continues to function by means of a £120 billion annual black hole full of election bribes that is effectively in large part being financed and supported by the new middle class of the world shoveling their wealth into London.

Those that have mistakenly looking for the London bubble to burst for several years refer to lack of affordability, however they also appear blind to the continuous ramping up of productivity in London as even the poorer areas of the city such as Brent are actively ejecting their benefits for life, cradle to grave, can work, won't work scroungers by means of the benefits cap out to surrounding areas and further afield to to places such as Birmingham and Luton which are increasingly becoming Benefits cities all to the continuing advantage of London that frees up space for more hard working people.

The future ?

Somehow, someway the London foreign investing fools will lose much of their money. My consistent view is that it will be by means of INFLATION i.e. the manifestation of fiat currencies in perpetual free fall against one another where the exchange rates only demonstrate volatility in the differing rates of free fall. However, the effect on London itself in terms of productivity will be minimal because the money will have been sucked in from abroad, therefore the losses will be felt far more in places such as Shanghai, Beijing, and Dubai than in London, because as long as the population of London continues to increase then so will there exist demand pressures.

So the London mega boom / minor bust cycle's will continue until we evolve beyond capitalism, and NO I don't mean to SOCIALISM!

Buying a House the Ultimate Means for Slavery

In my opinion, virtually all of us have been successfully brainwashed / conditioned to become slaves of the elite by means debt slavery, the primary mechanism for control preys on our natural instinct for a secure shelter / home that we can only achieve by means of saddling ourselves up with a mountain of debt.

Our current system of housing market debt slavery is by design for if successive governments had favoured independence and freedom then they would not have sold off 60% of the social housing stock.

Today the only people who are free are those who do not work in service of their debt masters because most of us remain convinced that we must borrow money to the maximum extent to be able to buy a house, for that is how we are controlled for the duration of our adult lives, from student debts, to consumption debts to housing debts, to retirement residency debts, for that is how the elite increases its wealth, where not even an economic depression halts the accumulation of wealth amongst the elite, instead the percentage of wages siphoned off by a myriad of methods such as inflation increases, hence the cost of living crisis.

The Circle of Slavery - Past, Present and Future

The reason why debt slavery is so seductive is because if offers instant gratification, flat screen tv, car, house in a near instance, because we all have at the back of our minds that our Time on Earth is LIMITED, we only have a short lease on life and so our natural state is highly conducive towards becoming debt slaves.

Debt slavery is another manifestation of the theft of our future, it is nothing new just the latest device to steal ones life because for eons humans have been successfully conditioned to give up control over their lives on the basis of ancient myths being utilised to make promises of how you will only really beginning to live AFTER they die in exchange for your PRESENT LIFE.

Debt slavery - Sell your future for an instant gratification in the present.

Religious slavery - Sell your future because you will only really begin to live after you die.

Instead, as I have written in countless articles (see archive) the answer is to focus on the PRESENT. For it is ones actions in the present that determine the future.

Debt Free Freedom?

The solution is not to BORROW MONEY!

I fully understand that is is very, very difficult for people who have been brainwashed to be able to consider this, but I assure you, not handing over approx 1/3rd of your earnings towards the elite's debt servicing will result in a far more prosperous and stress free life and all you need to do to overcome your programming is exert some self confidence in respect of the tendency towards instant gratification because usually working towards a goal is far more rewarding than actually achieving the goal and the worst thing people can do is to achieve goals without work, which is a recipe for personal disaster which is what debt slavery entails.

Labour, Liberal, Conservative, or SNP it does not matter they are ALL party to the debt slavery system that they operate from local councils right through to national governments. So the likes of the SNP propagandising the Scottish Referendum as a freedom movement is a red herring, as there is no freedom for the Scottish people but a means for the Scottish Bankster's and Elite to be able to implement more locally targeted mechanism to enslave the Scottish people by means of debt.

What the people of Britain need is an alternative system to the debt and tax slavery system that funnels wealth to the bankster elite, the starting point for such a system would have ZERO taxation and NO debt industry, which means that the unproductive bloated public sectors would not exist and the governments would not have the means to bribe voters with nor would the banking elite have the means of conjuring money out of thin air which they lend to debt slaves to work to service their whole lives, otherwise your children and grand children will continue to born into a debt and tax based slavery system.

In our society the worst place for ordinary people to be is in debt, for you risk ruining the rest of your lives as being in debt either by design or chance (parking fines etc) can soon spiral out of control. Therefore people need mechanisms to first avoid getting into debt and then the consequences of official charges, penalties and fees from spiraling out of control.

The bottom line is that one needs to work hard to achieve and maintain ones freedom in today's western debt based societies where the young adults are exposed to intense propaganda aimed at turning them into life-long debt slaves such as via the Universities which for approx 75% of students are in my opinion a SCAM because they will still end up flipping burgers or stacking shelves, only after the scamming universities have fleeced them out of approaching £50,000.

Labours Benefits Culture

Last Friday Channel 5 showed a documentary (available on demand) that illuminated the consequences of out of control eastern european mass immigration that has resulted in literally a flood of migrants whose primary focus is NOT to work hard but to maximise benefits by moving whole villages lock stock and barrel to many UK cities such as London, Sheffield and Rotherham which was the focus of the programme."Immigrants who come to the UK to milk the benefits system" - BBC Look North

Quoting the Roma participants of the Ch5 documentary -

"I know it's very, very easy to take benefit in England."

"She's give me home free, yeah. She's give me money free... she's give me everything."

"I'm gonna take benefits from England, yeah."

"We didn't have flats like this in Slovakia."

"We didn't have electricity or radiators."

"I get child benefit... tax credit... housing benefit. I got better life here than my country. I'm never gonna go back to Slovakia... never."

The response of the local community was also presented by Look North -

"We're going to protest against it, Us English"

"Yeah we are, it's going to kick off right innit, it's going to kick off right , I'll tell yer."

This illustrates a continuing legacy of the last Labour government that sought to encourage a benefits culture and benefits immigration as 90% of whom will tend to vote Labour. And STILL the voters of the peoples republic of South Yorkshire tend to vote Labour! Off course the reason being because most of the people of South Yorkshire who whilst highly critical of Roma benefits scroungers are themselves benefits for life cradle to grave scroungers!

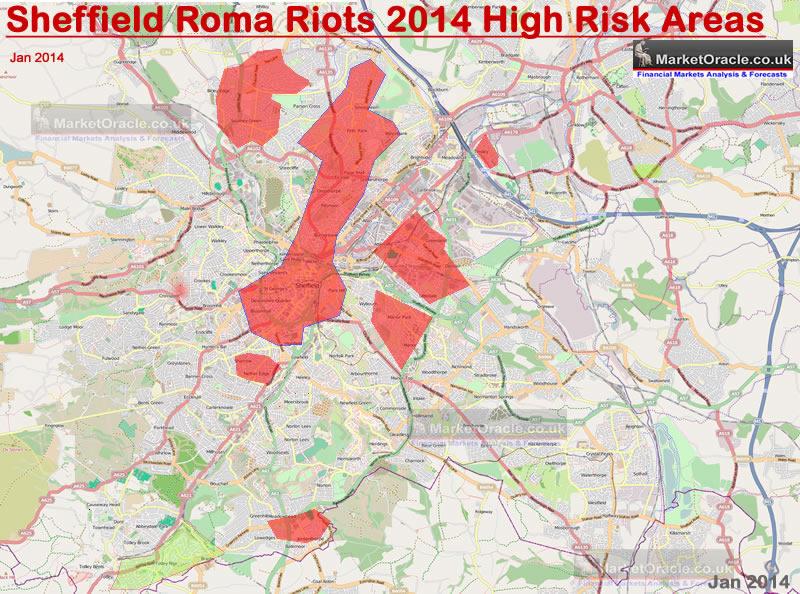

My article of Mid January 2014 warned of the consequences of Roma riots in many UK cities during Summer 2014 - 17 Jan 2014 - Sheffield Roma Riots 2014 Warns Labour MP David Blunkett - Immigration Cultural Catastrophe

It is not often that left wing normally pro-immigration Labour MP's can be found to be warning of the consequences of mass immigration, and not just any old back bencher but the former Labour Home Secretary David Blunkett was recently widely reported in the mainstream media warning of the consequences of immigration in the form of the ongoing influx of Roma communities from eastern europe into his home city of Sheffield where the Roma population has soared from less one hundred 8 years ago to well over 4,000 today, concentrated in pockets of the city such as Page Hall, that he warns could spill over into violence on the streets due to the clash of cultures between the indigenous / settled communities and the huge Roma influx underway as Czech, Slovak and Romanian Roma villages are literally moving lock stock and barrel to places such as Sheffield to draw on 15-20 times the financial value of benefits and social services that they are in receipt of in the likes of Romania.

BBC - David Blunkett riot fear over Roma migrant tensions

Tensions between local people and Roma migrants could escalate into rioting unless action is taken to improve integration, David Blunkett has warned.

The former home secretary fears a repeat of race riots that hit northern cities in 2001.

His concerns centre on the Page Hall area of Sheffield, where Roma migrants have set up home.

"We have got to change the behaviour and the culture of the incoming community, the Roma community, because there's going to be an explosion otherwise. We all know that."

"If everything exploded, if things went really wrong, the community would obviously be devastated. We saw this in Bradford, Burnley and Oldham all those years ago when I first became home secretary. We saw that the community itself were the losers."

He called on the Roma community in Page Hall to change aspects of their "behaviour", such as congregating on the streets on summer evenings and dumping litter, which he said was "aggravating" local people.

‘The Roma youngsters have come from a background even more different culturally, because they were living in the edge of woods, not going to school, not used to the norms of everyday life. We’ve got to change that.’

"We've got to be tough and robust in saying to people you are not in a downtrodden village or woodland, because many of them don't even live in areas where there are toilets or refuse collection facilities. You are not there any more, you are here - and you've got to adhere to our standards, and to our way of behaving, and if you do then you'll get a welcome and people will support you." - David Blunkett - Sheffield - Brightside MP, Former Labour Home Secretary

It is highly ironic that whilst in power David Blunkett did nothing to avert the unfolding immigration catastrophe, but now in opposition he has become a highly vocal critic of the Coalition governments immigration policies despite the fact that the immigration catastrophe is a direct consequence of the last catastrophic Labour government. But now David Blunkett has the urge to protect the people of his home city of Sheffield lest they in disgust vote him out at the next general election for mass immigration has always been a Labour tactic to retain power in cities such as Sheffield, for instance mass immigration enabled Labour to size power back from the Liberal Democrats in 2011 as over 90% of immigrants tend to vote Labour as the traditional party of immigration.

In fact mass immigration of the 2000's was a Labour government conspiracy that attempted to hide from the people of Britain their plan for the wholesale importation of new Labour voters to bolster their election winning chances, the result was that even an economy in a state of economic collapse failed to secure the Conservatives an election victory in 2010.

Where Sheffield is concerned the following map highlights the possible high risk riot hot spots as a consequence of out of control immigration and the cultural catastrophe that could reach its ultimate consequences during the Summer of 2014.

The bottom line is the greater the number of unproductive adults in an economy i.e benefits culture that now totals more than 6 million adults of working age then the greater will be the inflation, not only in housing but right across the economy.

Comments here - http://www.marketoracle.co.uk/Article45184.html#comment213617

Crimea 2.0 - Russia Ukraine Invasion and Annexation Before End of May 2014After several weeks of mainstream media near silence on the Ukraine crisis, the last few days have seen multiple instances of Czar Putin firmly putting his boot on Ukraine's throat, as events are fast accelerating towards Czar Putin's next phase for the dismemberment and annexation of Ukraine. Operation Crimea 2.0 is now well underway as highly organised and armed Russian infiltrators are busy sowing the seeds of chaos right across the southern and eastern cities of Ukraine manifesting their actions through organising road blocks, forceful occupation of government buildings and emboldening local extremist elements into action that is aimed at trapping the Ukrainian government into attempting to defend its territory so that resulting bloodshed can be used as an excuse to pour Russian military forces over the eastern border, as a pretext for invasion and annexation as I covered the time line of in an article early last week -

08 Apr 2014 - Donetsk Crimea 2.0 - Russia Ukraine Invasion and Annexation Before End of May 2014

Czar Putin having finished digesting Crimea being a mere entree of the main meal ahead that could ultimately seek to devour as much as 50% of Ukraine's original land mass, whilst the mainstream media's attention remains diverted by the likes of the irrelevant Oscar Pistorius court case, another expenses fiddling MP or the search for Flight MH370. However Putin's dark totalitarian forces have been quietly busy preparing the facts on the ground for a re-run of a Crimea style theft of territory enabling Russia to rip several more pounds of flesh off of Ukraine's body.

For over 2 months now Russian military forces totaling over 200,000 troops with heavy equipment have remained massed on Ukraine's eastern borders under the guise of military exercises that acts to keep a weak Ukrainian state in a perpetual state of fear of the consequences of engaging in any military engagements against the european regional super power that follows Czar Putin's evaluations of the lack of reactions to the annexation of Crimea following the bogus referendum.

The annexation of Crimea worked out far better than even the dictator of Russia expected it could have with virtually no reaction of any significance from the West nor any reaction on the ground in terms of armed resistance or spill over into Russia's own borders as the independence referendum engineered in Crimea has been repeatedly denied at the barrel of several thousand Russian tank turrets within the Russian federation that has seen hundreds of thousands killed in annexed nation states such as Chechnya.

My series of articles on what to first expect for Crimea and then much of South and East Ukraine of a programme for the systematic dismemberment of Ukraine which has at each stage been met by many skeptical in a state of denial comments as to what was probable -

21 Feb 2014 - Ukraine 2014, Britain 2016, Scottish Independence Could Trigger Balkanisation of UK

What was unimaginable a few weeks ago has now become a crisis situation of mounting deaths, where with each death Ukraine takes a further step towards leaping over the edge of and into the abyss of where the likes of Syria stands today, as the consequence of what happens when nations rip themselves apart.

Ukraine tearing itself apart has huge implications for european stability as the conflict risks sparking unrest in bordering states most of which have their own separatists movements, especially Russia which therefore looks set to intervene militarily.

My last article reiterated Czar Putin's intension's to annex much of Ukraine - 16 Mar 2014 - Crimea, Ukraine War, Czar Putin Tightening Grip Over Police State Russia for New Dynasty

What Will Happen Next?

Where Russia is concerned if Crimea can breakaway from Ukraine then so should Chechnya be allowed to breakaway from Russia, for Chechnya was independant following the breakup of the Soviet Union in 1991, having successfully beaten the Russian army during the 1994-1996 war until the second Chechen war starting in 1999 that flattened the Capital city Grozny and most of the the rest of Chechnya into submission, killing about 17% of the Chechen population. That is what it means to attempt to gain Independence from Putin's Russia.

Therefore Russia's actions in Chechnya will likely act as a blueprint for what lies in store for much of Ukraine, it's capital will likely come to resemble the Grozny rubble of 10 years ago. For the truth is that Putin and his secret police henchmen could not careless about sanctions for they are immune from their consequences as they could not care less if the Russian people suffer. The Russian people too will have suffered far greater hardships in past decades than which a few billion dollars of sanctions will achieve.

All that sanctions will achieve is for Putin's regime to consider that now it has nothing to lose so will seek to redraw most of Russia's western borders with former Soviet states such as the Baltic nations, any neighbouring states with significant number of ethnic Russian's or Russian speakers will be on the target list.

As things stand it does not look as though the West is going to do anything to stop Russia from annexing Crimea which WILL set in motion the annexation of many more bordering regions far beyond that of Ukraine.

Time-Line for Annexation of South Ukraine

The Donetsk russian rebels announcing an independence referendum to be held on 11th May sets a time-line for the deadline for the next annexation of Ukraine which will be with or without the consent of the local people i.e. the people of eastern Ukraine only have the choice of either a relatively bloodless annexation Crimea style or a bloody annexation following an estimated one hundred thousand Russian troops flooding over the border that will undoubtedly prompt at least limited resistance from Ukrainian military forces.

If anything the time line for invasion and annexation could be greatly accelerated as Russia attempts to repeat the Crimea blue print of a lightening land grab followed by bogus referendums of not just East Ukraine but the whole of the South Ukraine where the military occupation aspects could be completed within a matter of days. This is because in strategic terms to create a viable state from Moldavia Trans-Dniester in the west through Crimea in the middle, and all the way to the eastern border with Russia, then so would all of this area of Ukraine need to be physically connected hence why the land grab would include the whole of South Ukraine and not just the eastern bordering regions as I originally warned of in Mid February.

However, it is inconceivable that the theft of South Ukraine would be bloodless, as the latest news illustrates of attempts by the Ukrainian authorities to seize back buildings from separatists in East Ukraine.

The bottom line is that Czar Putin does not care about how many thousands of civilians or solider's would die, all he cares about is that would he be able to get away with it ? And the answer he got from Crimea 1.0 was YES.

The Great Miscalculation

The great miscalculation that virtually everyone including Obama and Putin are making today is that they are concluding that at worst europe could enter a new cold war, when instead a history of how market trends tend unfold suggests that the law of alternation is more probable than a repeat of what came before.

Therefore rather than a new cold war with Russia, we may be sleep walking towards a sequence of events that results in the shattering of over 60 years of peace in europe. Whilst a nuclear war in europe is completely unimaginable today, however once NATO forces start to engage Russian forces in a hot war then the risk of a nuclear nightmare becomes possible.

Scotland Independence Day Funeral

Similarly, this is what would soon happen to an Independant Scotland following a vote for Independence as Scotland would soon start to fragment as the bordering regions would reassert their separate identity that has far more in common with North England than Scotland, the MIDDLE-LAND! formerly known as Northumbria that stretches from Edinburgh in the north to Sheffield in the south.

Ensure you are subscribed to my always free newsletter to be in receipt of the new ebook on release containing many home value increasing guides and ongoing housing market analysis in your email in box.

Source and Comments: http://www.marketoracle.co.uk/Article45200.html

Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of four ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series.that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.