North England's New Mega-city - MANFIELD, Comprising Manchester, Leeds, Bradford, Sheffield, Rotherham...

Housing-Market / UK Housing Mar 26, 2014 - 03:35 PM GMTBy: Nadeem_Walayat

Investing in Future New Mega-Cities

Investing in Future New Mega-Cities

Whilst most house hunters will be viewing properties in terms of what would be a good investment over the next 10 years or so, I tend to gaze much further into the mists of time to try to ascertain what the mega-trends are and then attempt to leverage my wealth towards profiting from them, even if most of the payoff could come beyond my life-time and thus for future generations to profit from.

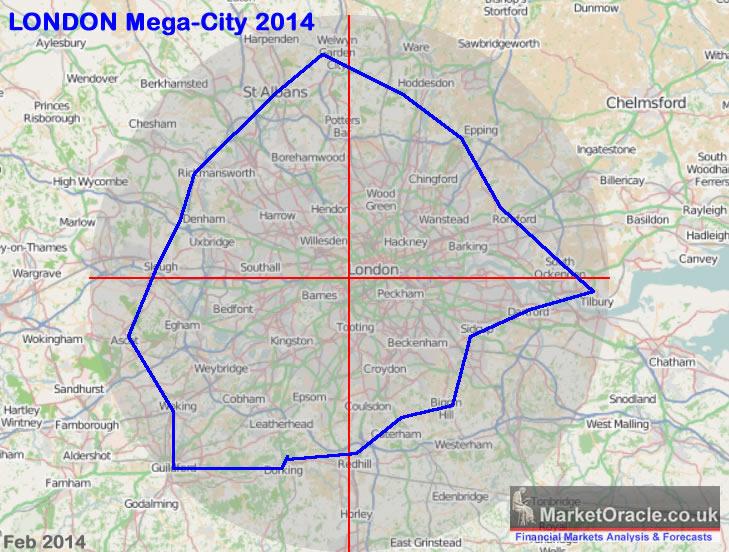

Whilst today it is obvious to all that London is Britain's only mega-city both in terms of area and population that is nudging above 10 million which far out paces any other UK city with Birmingham a distant 2nd at near 1/10th the population of just a 1.1 million. Therefore London benefits hugely by continuing to attract Britain's brightest and best as well as capital investment that is at least ten times that of other cities PER CAPITA, which puts ALL of Britain's other cities at a huge permanent disadvantage with a literally unbridgeable gap.

As my earlier population analysis illustrates that Britain's population looks set to continue grow strongly over the coming decades that at least extrapolates towards a 50% increase over the next hundred years to nudge 100 million by 2114. However it is inconceivable that most of this population increase will be concentrated in London which whilst probably doubling once more will still leave near 30 million people that are unlikely to be evenly spread out across Britain but rather concentrated in 2 or 3 new mega-cities.

If one searches Google for the experts opinion on which city is most likely to become Britain's next mega-city to rival London then you will find that the tendency is suggest that Britain's second and third largest cities namely centred around Birmingham and Manchester will take up that mantle.

However, perhaps because I live in Britain's fifth largest city (Sheffield 1/2mill), I don't see things playing out that way because the gap between London and either Birmingham and Manchester is so large that even if these cities doubled or even tripled in the size the gap would still persist that would perpetuate the permanent disadvantage as for these cities to have any chance of rivaling London then they would need to experience a more than ten fold increase in out from their city centre hubs, which is just going to happen.

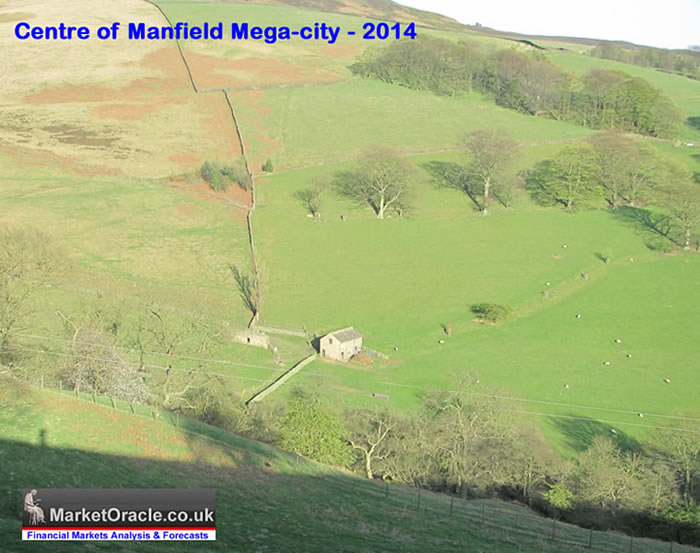

Instead, I see Birmingham and Manchester along with 20 or so of Britain's largest cities acting as spokes around NEW central hubs. The key being NEW, that completely deflects the long-term mega city investing trends away from existing city centres and towards into ultra cheaply priced literally in the wilderness areas (as far as Britain can have what could be termed as a wilderness).

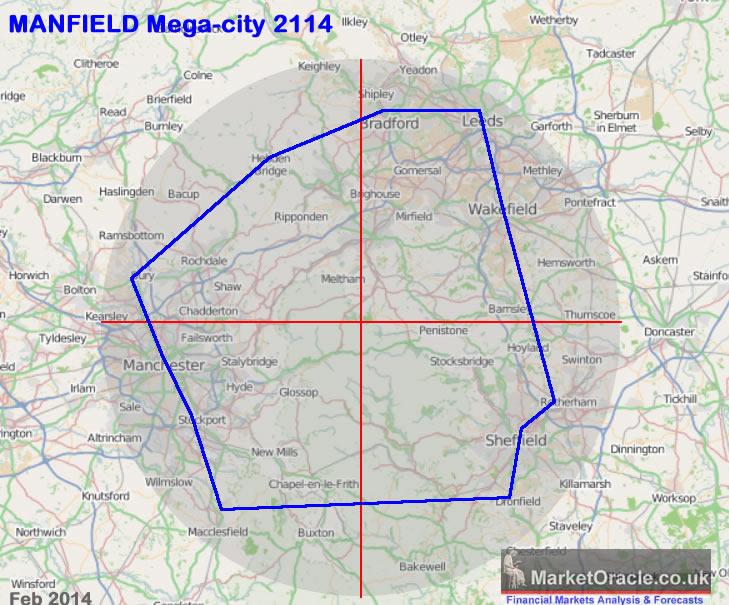

MANFIELD - Welcome to North's New Mega-city of 2114

Whilst it is beyond the scope of this ebook to analyse all of the potential new central hubs around which mega cities could form, however my analysis of the new yet to be named mega-city of the north, MANFIED illustrates what is likely to occur in at least 2 other such areas of Britain over the next 100 years or so.

The area of Manfield of equivalent size to present day London already has a population of over 3 million which gives it a real possibility of reaching an inter connected critical mass that will start to coalesce around its new central hub, so that instead of new mega cities expanding London-esk from out of existing city hubs over thousands of years, they are more likely to start to emerge around these NEW central hubs as that will represent the shortest and quickest route of travel between the merging spokes and hence drive concentration of people and infrastructure towards their centres that would have ample space to accommodate soaring demand.

Whilst many today may argue that this just cannot possible happen due to the mass of green belt land comprising much of its area, but that is also to its great advantage for all it would take is a bill in Parliament that would illicit far less local opposition than such a move would elsewhere given the long standing desire for a Northern mega city to rival that of London.

Furthermore, using the latest technologies and design techniques to mesh together transport, telecommunications, energy, and water links of all of the cities around the new central hub would ignite a decade long national construction led economic boom, creating hundreds of thousands of new jobs. The resulting boost to the British economy would be such that many would wonder why it had not been done several decades earlier and thus spark several more similar projects elsewhere, where perhaps 100 years from now Britain may well be on the path towards having built as many as 4 new technologically advanced mega cities of which some could even surpass London in terms of economic output.

The bottom line is that land and properties in the central hubs of the new mega cities such as Manfield are up for grabs at bargain basement prices, which whilst personally one may be unlikely to profit from their emergence during ones life time (barring a nano-tech solution to telomere shortening), however future generations will erect statues towards ones investment insight in future land and property investment planning.

New Housing Market Ebook - FREE DOWNLOAD

| Part 1: U.S. Housing Market Analysis, Forecast 2013-2016 | |

| Part 2: U.K. Housing Market Analysis, Forecast 2014-2018 | |

| Part 3: Housing Market Guides | |

| Home Buyers Guide | |

| Location, Location, Location | |

| Investing in Future New Mega-Cities | |

| Part 4: Historic Analysis 2007 to 2012 |

This article is excerpted from the new housing market Ebook "UK House Prices Mega-trend Forecast 2014-2018 - How to Capitalise on the Great UK Housing Bull Market with Home Buying, Selling and Improvement Guides" that is scheduled to be released for FREE download from the end of March 2014.

This article is excerpted from the new housing market Ebook "UK House Prices Mega-trend Forecast 2014-2018 - How to Capitalise on the Great UK Housing Bull Market with Home Buying, Selling and Improvement Guides" that is scheduled to be released for FREE download from the end of March 2014.

Ensure you are subscribed to my always free newsletter to be in receipt of the ebook on release and ongoing housing market analysis in your email in box.

Source and Comments: http://www.marketoracle.co.uk/Article44972.html

Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, stocks, housing market and interest rates. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.