Aging Stocks Bull Market Is Igniting Commodity Sectors Rally

Commodities / Resources Investing Mar 17, 2014 - 12:49 PM GMTBy: Money_Morning

Peter Krauth writes: Markets clearly move in cycles, and commodities are no exception.

Peter Krauth writes: Markets clearly move in cycles, and commodities are no exception.

In fact, resources as an asset class are prone to the most extreme examples...

The good news is that recognizing and embracing these boom/bust cycles can make for huge profits.

And right now, a boom is clearly taking shape...

A number of commodities subsectors have already erupted on a dramatic surge upward...

And some equally dramatic indicators point to them heading much higher still...

The Signs Are Already Here

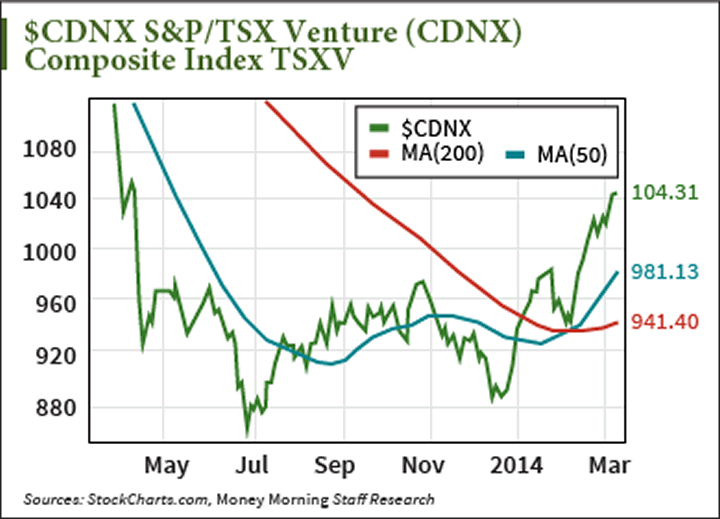

The TSX Venture Exchange is home to over 1,100 junior mining stocks. While not perfect, this exchange's index is widely used as a proxy for the health of junior mining, which comprises about half the index.

After peaking near 2,300 back in early 2011, the index has tanked over the past three years, losing about 63% of its value.

But more recent action has taken the index from 880 in late December to 1,043 more recently, for an impressive 19% gain in just two and a half months.

If we drill down into other subsectors, the action gets more enticing...

The Market Vectors Junior Gold Miners ETF (NYSE Arca: GDXJ) has done even better. After bottoming near $29 in late December, shares of this ETF have exploded higher, recently peaking near $43. That translates into a stunning 48% return in just two months on volume that was triple the norm.

But the strong commodities action doesn't end there...

Global Uncertainty Is Only Fueling This Surge

Despite several years of easy money central bank policies and excessive money printing, "official" inflation has remained tame. But the story's different down in the trenches.

Government statistics like the Consumer Price Index (CPI) might tell you inflation is mild at around 1.5%...

But that's only if you don't eat.

Food prices are up sharply. Corn has gained 13%, sugar is up 22%, wheat is up 20%, and coffee is up 79%, all in just the last seven weeks! And more is likely in store.

Two of the reasons are geopolitics and failed government policies. Venezuela has seen its fair share, with escalating violence and regular protests against crippling inflation and incessant food shortages.

Ukraine has long been considered the breadbasket of Europe. More than two-thirds of Ukraine is arable and highly fertile land, and 17% of agricultural exports go to Europe while 20% go to Russia. In the days of the Soviet Union, the Ukrainian Soviet Socialist Republic accounted for a full 25% of all Soviet agricultural output.

So it's no stretch to see that recent events between Europe, Ukraine, and Russia have compounded the effects on grain prices. There's no saying what might happen if tensions flare up further.

It's not just politics...

Brazil's a major agri-producer and exporter... big in coffee, sugar, oranges, cocoa, cotton, and soybeans. But unusual droughts in (normally rainy) January and February have been an important catalyst for higher agricultural commodity prices.

Since the Fed began quantitative easing late in 2008, the impact on various asset classes has been dramatic. Stocks as measured by the S&P 500 are up 100%. The yield on 10-Year Treasuries fell from 3.7% to 1.5% by April 2013 (which meant significant bond-buying).

Healthcare, biotech, banking, consumer staples, consumer discretionary, and even housing... virtually all these sectors have benefited from easy-money policies.

But for a few exceptions, commodities have been left out of this rising tide... until now.

The cyclical bull in general stocks that started back in 2009 is already 5 years old. And yet the Fed is likely to maintain sustained low interest rates for another year and a half to two years. So the bull may be getting long in the tooth, but it's premature to call its end.

One thing we do know is that commodities tend to perform best in the latter part of a cyclical bull market. And that's where I think we are right now. It's certainly what the indicators appear to be saying.

Make Money as Food Prices Spike

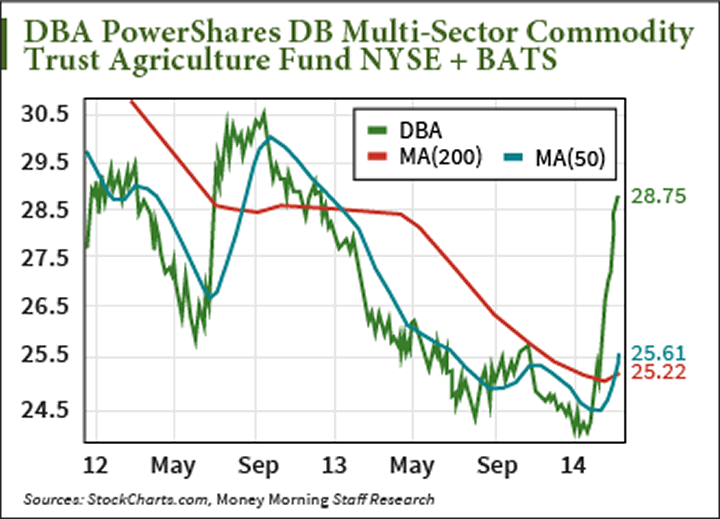

One way to participate in rising food prices is through the PowerShares DB Agriculture ETF (NYSE Arca: DBA). Essentially, this ETF is a basket of 17 agricultural commodities futures contracts, which gives investors exposure to sugar, live cattle, corn, soybeans, cocoa, coffee, lean hogs, and wheat, among others.

So far this year, DBA has gained nearly 19%. On a technical basis, the chart looks way overextended and ripe for a pullback. Look for a drop perhaps down to the $26 level, which is close to the 50-day moving average and could act as new support.

Readers of Real Asset Returns have been participating in the rising agricultural sector since July. Our leading South American farmland play, whose shares are already ahead by 20%, still looks primed for more gains ahead.

Remember, this cyclical bull market is maturing but still has legs left. And China, despite some recent weak economic news, is a major consumer of raw materials whose appetite seems boundless.

Commodities typically participate late in such cycles and have started acting like they are joining this party. With the picks above, you'll arrive just in time to profit...

Source : http://moneymorning.com/2014/03/17/aging-bull-igniting-sector-rally/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.