Non-Farm Friday – America is Still Not Working, Stock Market BS Rally

Stock-Markets / Financial Markets 2014 Mar 07, 2014 - 05:20 PM GMTBy: PhilStockWorld

Sorry but this "rally" is just too much BS for me.

Sorry but this "rally" is just too much BS for me.

As you can see from Dave Fry's SPY chart, we're running up on ZERO volume in the Futures and then we sell off all day on very low volume (because there are no buyers and the Funds are exiting slowly) and then we have dip at the finish as the ETFs that HAVE to buy at MOC (Market on Close) pricing get shares jammed down their throats by the pumpers.

It's a complete and utter farce and completely ignored by the MSM, especially the Financial Media, who just play along as if none of this matters. While you may consider the manipulation of currency and metals markets to be news (both are under international investigation at the moment) – it doesn't rate a mention in the Financial Media, who's advertising revenue comes mainly from the companies that are being investigated for fraud and manipulation.

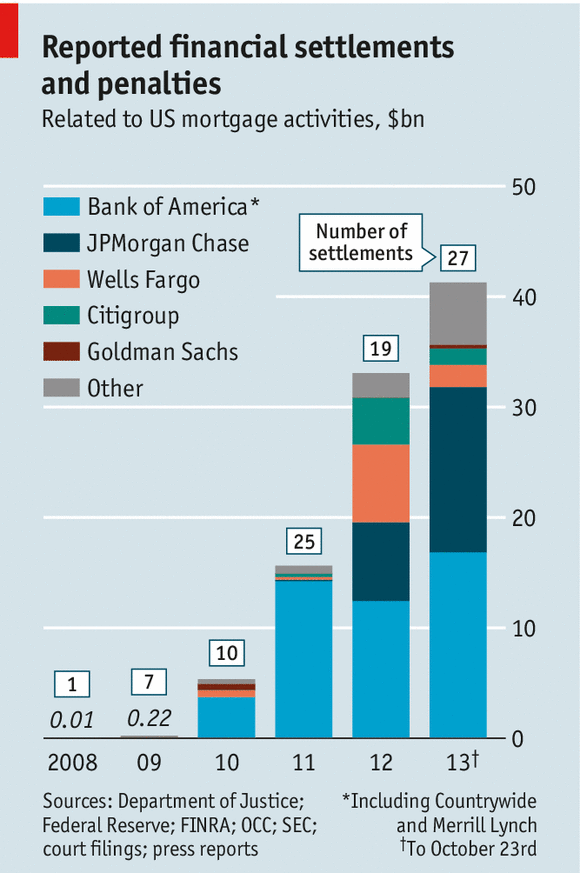

You know about the LIBOR scandal, you know Credit Suisse helped their top 1% clients evade taxes (duh!) and finally got caught, you know JP Morgan was fined the GDP of Jamaica for various wrongdoings, as were BAC and other Banksters – yet you still have your money in those banks, don't you? Fraud, manipulation, tax evasion, forging mortgage documents…. it's all just the business the Banksters are in, isn't it? And we accept it – even though we are the people they are committing all these crimes against. What the f*ck is wrong with us?

And these same criminal organizations, these same fraudulent operations – are the same ones who are telling us to put all our money into the stock market by endlessly upgrading the companies they have banking relationships with – like Morgan Stanley's very questionable pumping of TSLA last week, the day before their bond sale – which was underwritten by Morgan Stanley.

There's not even an investigation about that one – it's just business as usual on Wall Street. Normally I don't care, because we love a rigged game – as long as we can figure out how it's rigged and play along with the manipulators. But now we are getting to the point where this blatantly engineered stock market bubble is once again in danger of damaging the economy – just 5 years after the last crash (see the classic "Stock Market Crash – Year One Review" for historical perspective).

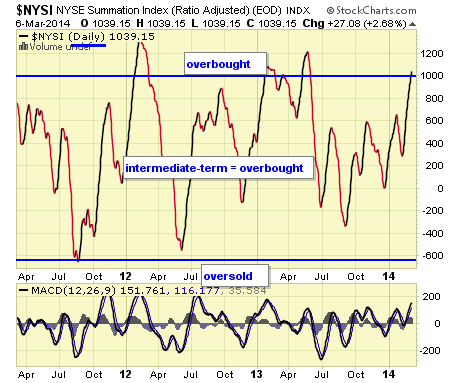

We've been keeping an eye on the NYSE Summation Index and, as you can see on the chart, it's getting EXTREMELY overbought.. This happens when the market isn't given a chance to correct and that is currently being caused by the constant flow of capital from the Fed (POMO) as well as the relentless pumping up of equities by the Banksters, aiming to drive as much retail capital as possible into the markets.

DESPITE all the "great" economic news (peppered with the weather excusing any negative), inflows to ETFs and Mutual Funds fell to $99M last week, down from $247M the week before. This didn't stop the markets from making new record highs but, at this point, those highs are beginning to look pretty thin – like the top layer on a very tall house of cards – ready to be knocked down by the slightest breeze.

I called for getting back to cash a week ago and so far, so wrong – I guess. Still, there's a certain value to being able to go to sleep at night without worrying about where the market will be in the morning and, hopefuly, we converted stocks to cash at near-record lows on the Dollar (80), so that currency bet may pay off as well (also not so far, with the Dollar at 79.50 this morning).

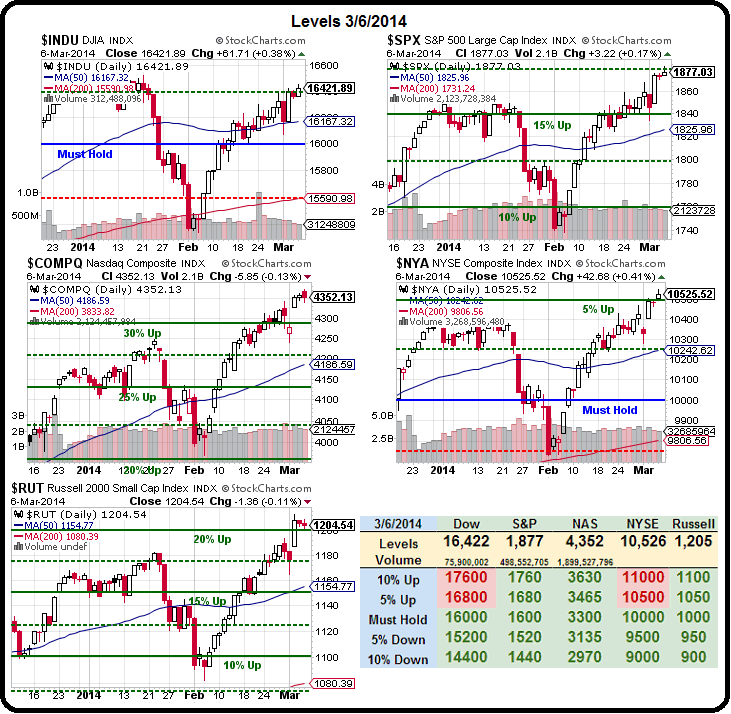

We finally got the NYSE over 10,500 and, if that holds up next week, we'll play for the Dow to catch up with something like the a UDOW (3x Ultra Bull on the Dow) Arpil $105/110 bull call spread at $3.50, selling DIA April $159 puts for $1.30 for net $2.20 on the $5 spread that's 100% in the money. If we keep a stop on the spread at $1, we don't lose any money unless the Dow drops 500 points vs a potential 100% gain if the Dow simply stays over 16,400 through April expirations.

See, it's not hard to make 100% per month with our sidelined cash in a bull market – let's just make sure we still have a bull market first!

8:30 Update: February Non-Farm Payrolls were up 175,000, which was the original expectation but now higher than the recently-lowered expectations. Long-term unemployment went UP 203,000 to 3.8M people and the Unemployment Rate stays at 6.7%. 285,000 additional people who were "marginally attached" (

wanted and were available for work, and had looked for a job sometime in the prior 12 months) dropped out as well – not a particualarly good sign.

On the whole (see chart in report) there are 145,266,000 people employed as of Feb 28th and there were 145,224,000 people employed as of Jan 31st – the rest is just statistical BS. How many people are working and what do they make – that's what drives the economy – no matter how much Fox "News" tries to convince you otherwise!

The average weekly earnings for our workforce was $831.40 or $43,232.80 per year, but that includes people like Ford's Alan Mulally, who got a $13.8M bonus yesterday, boosting the entire United States Workforce's earnings by 10 cents all by himself! Still, this number is an overall market positive and our Futures are popping back to their highs and NOW we can short oil at our target $102.50 (/CL) and the Russell at 1,212 (/TF) – something we've been waiting for all morning.

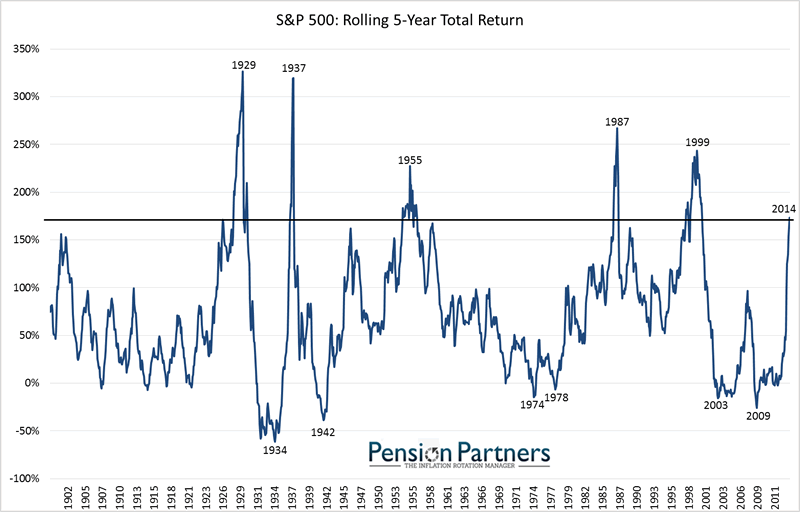

It's been a hell of a rally – one of the all-time greats – and perhaps it will keep going and, if it does, we are HAPPY to get more bullish but, as you can see from this nice chart from Pension Partners (thanks StJ), we're testing some very serious resistance at this level and there's no harm in CONFIRMING a move over the line (1,900 on the S&P, adjusting for the currently weak Dollar) before throwing our perfectly good money into the mix.

Even if "this time is different" – it's only the same as the times preceding 5 major market crashes!

Please, be careful out there.

Have a great weekend,

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.